[ad_1]

In recent news, billionaire Michael Saylor has made headlines by purchasing a staggering $150 million worth of Bitcoin, further solidifying his position as a prominent advocate for the world’s leading cryptocurrency.

This significant investment has stirred up discussions around the future trajectory of Bitcoin’s price and its implications for both investors and the market at large.

As more high-profile figures like Saylor place their bets on the digital currency, it becomes increasingly important to examine the factors that could influence Bitcoin’s value and explore the potential outcomes of this growing trend.

Surge in Crypto Popularity Amid Financial Uncertainty

The worldwide cryptocurrency market has witnessed a remarkable surge in popularity, particularly as the recent US financial crisis has led to diminishing trust in conventional banking institutions. Bitcoin (BTC), the most prominent digital currency, has seen considerable value appreciation within the past month.

Nonetheless, the US banking crisis has been a major catalyst in steering clients towards cryptocurrency trading, as they search for secure assets such as Bitcoin to protect their investments.

This is demonstrated by the growing number of US investors, encompassing institutional ones, who are acquiring substantial amounts of Bitcoin with the anticipation that it may ultimately supplant the US dollar as the global reserve currency.

In addition, recent developments have shown Chinese banks exhibiting openness to accommodating Hong Kong-based cryptocurrency companies, reflecting a favorable attitude towards the crypto sector.

This is considered another significant factor that could potentially boost Bitcoin’s value even further.

Bitcoin Price

The current live price of Bitcoin stands at $27,044, accompanied by a 24-hour trading volume of $18.3 billion. Over the past day, Bitcoin has seen a 3% decrease in value. As per CoinMarketCap, it holds the #1 ranking, boasting a live market capitalization of $522.7 billion.

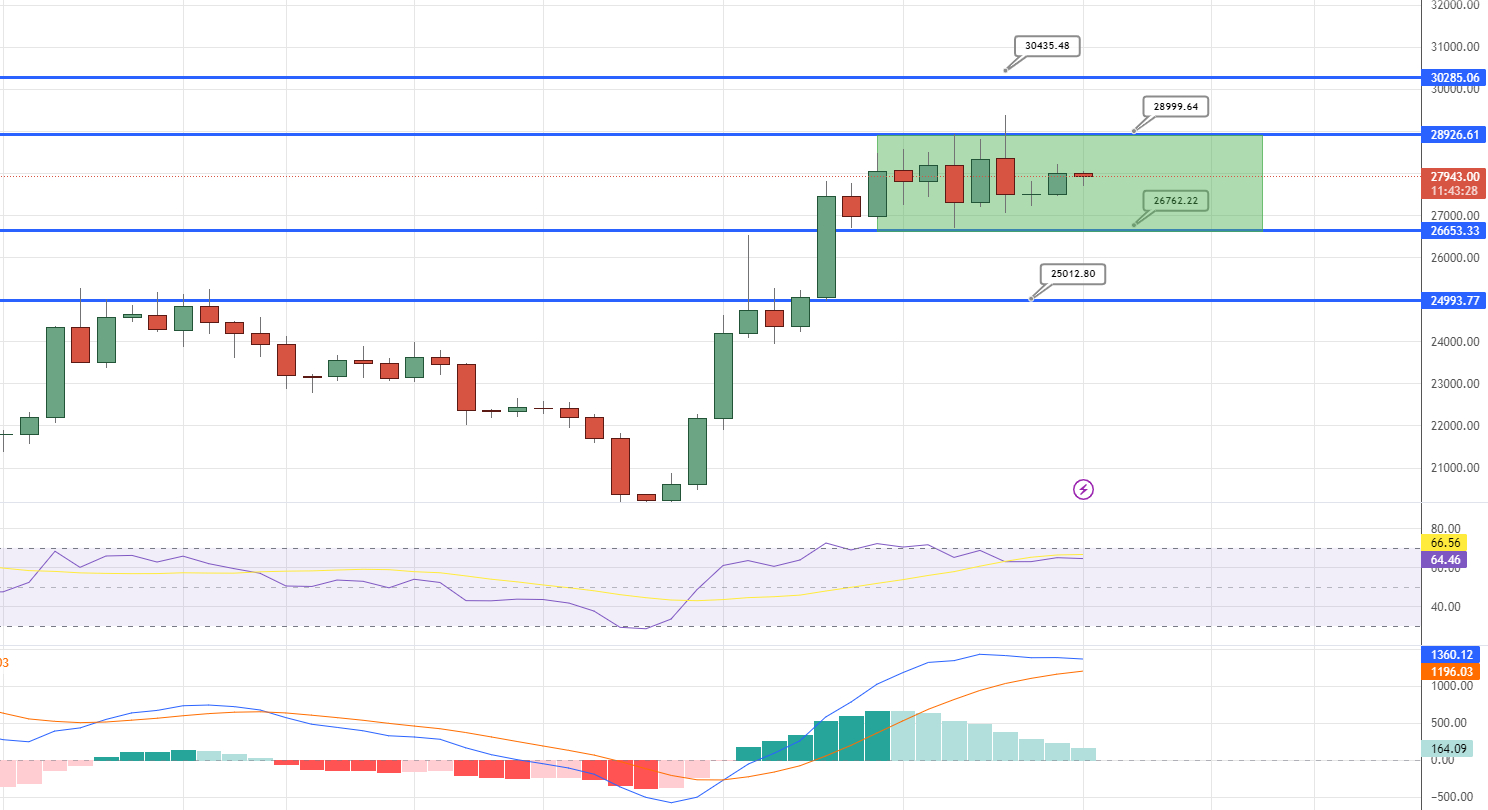

According to technical analysis, the BTC/USD pair is displaying a volatile pattern at present, with the possibility of encountering resistance around the $28,900 level. So far, the technical perspective remains relatively unchanged, as Bitcoin continues to hover near the $27,900 price point.

Should the BTC/USD pair succeed in breaking through the resistance level at $28,950, it could lead to an increase in Bitcoin’s value, with the possibility of the price climbing to $29,200 or even $30,700.

On the other hand, if a downward trend emerges, Bitcoin’s price is anticipated to encounter robust support levels at approximately $26,600 and $25,200.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

In order to remain current with the newest ICO projects and altcoins, it is recommended to frequently refer to the expert-curated list of the top 15 cryptocurrencies to watch in 2023.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

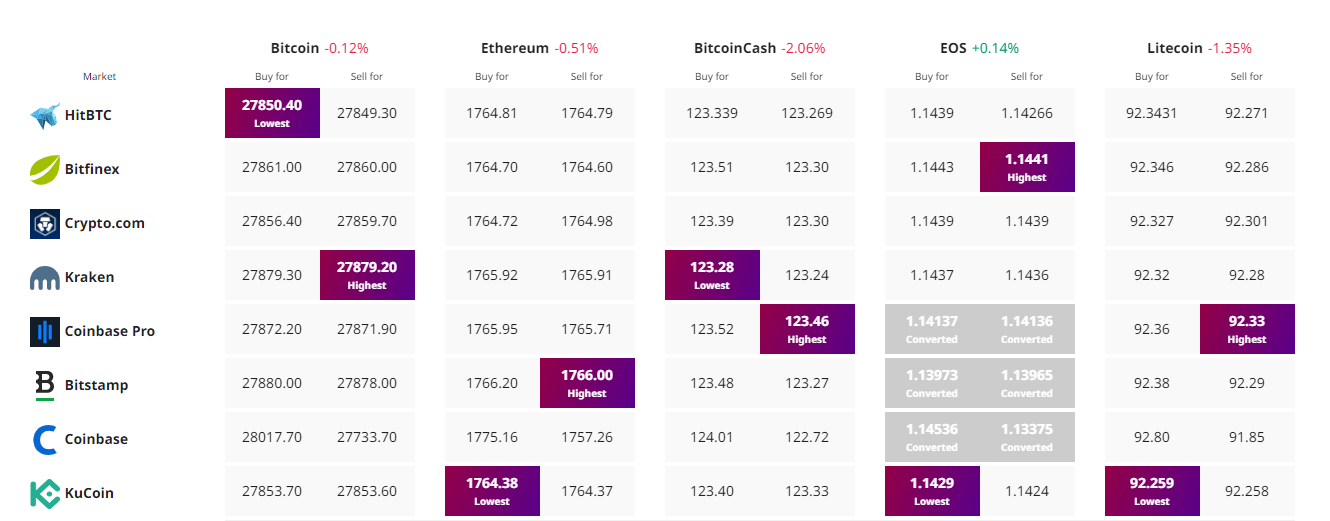

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com