[ad_1]

Bitcoin is currently experiencing a surge in prices, with its value reaching a new high after almost 6 months. This has led to speculation that a new bull market may be starting.

On February 2nd, the BTC/USD opened trading at $23,723. In the last 24 hours, it has gained 3.50%, and is currently trading at $23,796.00.

The BTC/USD has fluctuated between a high of $24,239.00 and a low of $23,668.00, and its value has increased by more than 3% in the past week.

How The Fed’s Interest Rate Hike Is Affecting Your Money

On February 2nd, the Federal Reserve hiked interest rates by 25 basis points (0.25 percentage points) to a range of 4.5%-4.75%, meeting the expectations of market participants.

Moreover, Jerome Powell, the head of the Federal Reserve, held a press conference and stated that the deflationary process in the economy had begun. Powell confirmed this by saying it is too soon to declare victory over inflation.

Jerome Powell also noted that he does not anticipate the Federal Reserve to lower interest rates this year, contrary to what several prominent analysts predict. Additionally, Powell stated that he was “not concerned” with the bond market’s suggestion of one more rate drop before a pause, as some market players anticipate inflation to decline more quickly than the Fed expects.

The market has responded favorably to Jerome Powell’s remarks, even though the markets had anticipated the rate rise and he had mentioned further increases. BTC/USD increased as the market reacted to the Federal Reserve’s interest rate hike.

FASB Approves Crypto Asset Accounting Standard: What It Means For You

On February 1, the FASB agreed to put forth a proposed regulation on the accounting and disclosure of cryptocurrencies. This new regulation will provide guidelines to companies who own digital assets and offer investors more clarity in terms of relevant information.

The Financial Accounting Standards Board (FASB) recently proposed new regulations for organizations dealing with cryptocurrencies. These regulations require cryptocurrency exchanges and businesses to abide by a predetermined set of accounting principles and procedures in order to ensure compliance.

To ensure better accounting and disclosure of crypto assets in the US, it is proposed that companies should segregate digital currencies from other intangible assets (such as patents and trademarks) in their financial statements, both for private and public enterprises. Businesses need to adjust their net income by taking into account the profits and losses they have made from crypto assets.

The proposed regulation would only affect a select number of businesses. The inquiry put forward by the Board has not yet had any input from huge companies such as Block and Tesla. However, MicroStrategy, a cryptocurrency organization, is one of the few that have expressed their support for the move.

If the suggested regulations are accepted, it could potentially lead to an improvement in public trust in digital currency. This is a very positive development for BTC/USD as it will likely bring greater stability and potential growth.

Feds Step In To Block Addresses Linked To Russian Black Market Dealer

On February 1, the Office of Foreign Assets Control (OFAC) of the US Department of the Treasury announced that it had added two cryptocurrency wallets, reportedly linked to a Russian network that evades sanctions, to its list of Specially Designated Nationals. The OFAC claimed it blacklisted the Bitcoin and Ethereum addresses used by Jonatan Zimenkov, the son of Igor Vladimirovich Zimenkov.

According to the Office of Foreign Assets Control (OFAC), father and son Igor and Jonatan Zimenkov joined forces to establish a sanctions evasion network that transferred “high-technology devices” to a Russian corporation during the invasion of Ukraine last year.

Furthermore, blockchain data reveals that neither of the two sanctioned Bitcoin or Ethereum addresses holds any assets. It appears that the Treasury is making more of an effort to integrate cryptocurrency wallets into its sanctions initiative, which could increase its transparency and the value of the leading coin, BTC/USD.

Bitcoin Price

The present cost of one Bitcoin is $23,565 with a 24-hour trading volume amounting to $30 billion. The rate of Bitcoin has increased by 2.50% in the past week. Furthermore, it presently holds the top spot on CoinMarketCap with a live market capitalization of $454 billion.

Recently, the graph of BTC/USD exchange rate for the past 4 hours has been unable to break through $24,000. Subsequently, it decreased and tested the $23,000 support level.

The 50-day moving average for the 4-hour timeframe has placed Bitcoin’s support level at $23,000. If it falls below this value, it could dip to either $22,600 or $22,350. This might also lead to a bullish reversal in the BTC/USD pair.

Purchasing Bitcoin with a value of greater than $23,000 and setting targets of $23,550 or $24,000 could be profitable. If the cost drops to the under the support zone of $23,000 though, selling positions would likely be more profitable.

Buy BTC Now

Bitcoin Alternatives

CryptoNews recently featured a list of the most promising crypto investments that could offer great returns by 2023. Therefore, before you decide to invest your money, it is essential to do thorough research and look for other investments with higher returns.

Cryptocurrency enthusiasts are constantly monitoring the latest trends and information in the crypto space, allowing them to explore potential investments. Cryptocurrency investors monitor altcoins and ICOs to stay ahead of the market.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

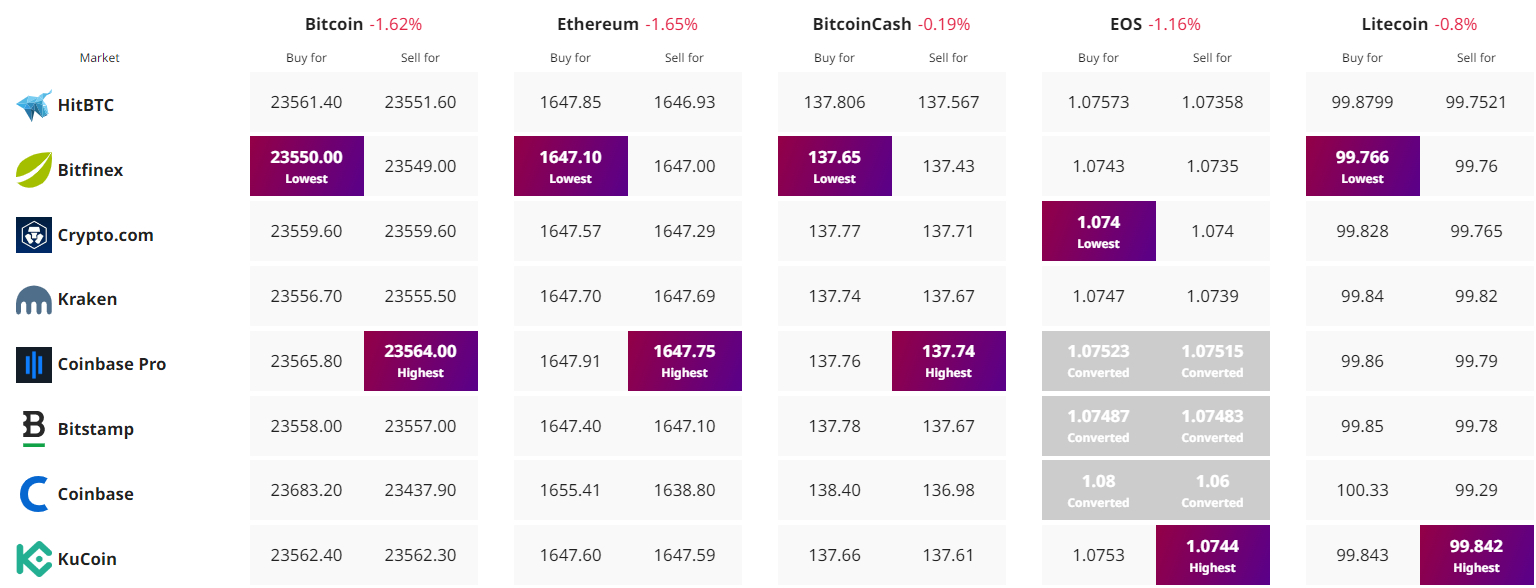

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com