[ad_1]

On November 29, the Bitcoin price prediction remained bearish under the $16,650 resistance level as the “Risk-off” sentiment continued to dominate the global financial markets. BlockFi is the latest victim of the FTX collapse, and it’s a lender in the troubled cryptocurrency space that has filed for bankruptcy.

BlockFi and eight affiliates filed for Chapter 11 bankruptcy in a US bankruptcy court in New Jersey on November 28. The filling will enable the firm to stabilize its operations and finalize a comprehensive restructuring agreement that maximizes value for all clients and other stakeholders.

BlockFi Bankruptcy – Quick Review

BlockFi, a New Jersey-based company, stated that it owed money to over 100,000 creditors. As its second-largest creditor, it listed FTX, a cryptocurrency exchange, owing $275 million.

Early in 2022, BlockFi encountered difficulties as a result of a sharp drop in cryptocurrency prices, which resulted in customer withdrawals and the liquidation of assets from the struggling Singapore-based Three Arrows Capital.

Over the summer, the company received a $400 million credit line from FTX, which allowed the lending company to avoid bankruptcy. On November 11, however, FTX declared bankruptcy.

In the United States, a company can file for Chapter 11 bankruptcy to restructure its debts while operating under court supervision. The news that cryptocurrency lender BlockFi had filed for bankruptcy led to a drop in the value of BTC/USD.

Singapore Banks’ Bitcoin Exposure is “Insignificant” but Subject to Highest Risk Weight

Singapore’s senior minister, Tharman Shanmugaratnam, stated on November 28 that banks in the country must hold $125 in capital for every $100 exposure to risky crypto assets such as Bitcoin (BTC) and Ethereum (ETH).

In a written response to Singapore’s parliament, Shanmugaratnam claimed that Singaporean banks have “insignificant” exposure to cryptocurrencies. According to the Monetary Authority of Singapore (MAS) minister, the exposure was “less than 0.05% of their total risk-weighted assets.”

Shanmugaratnam revealed Singapore’s active participation in the Basel Committee on Banking Supervision’s (BCBS) framework for banks’ cryptocurrency exposure. The group is expected to deliver its final framework by the end of the year, he added.

Bitcoin’s exposure will grow if Singapore attracts more crypto players, which will benefit the price of BTC/USD.

Binance’s PoR Audit Process

According to Binance CEO Changpeng “CZ” Zhao, the company is shifting massive amounts of bitcoin as part of its proof-of-reserve (PoR) audits. According to a Whale Alert report, Binance deposited 127,351 Bitcoin totaling more than $2 billion to an unidentified wallet on November 28.

The massive Bitcoin transaction quickly sparked FUD, or fear, uncertainty, and doubt, throughout the community, with many pointing out that Binance transferred a fortune’s worth of BTC in a single transaction.

CZ later announced on Twitter on November 28 that the significant transaction was part of Binance’s PoR auditing process. He also urged the community to remain calm and to disregard the rumors.

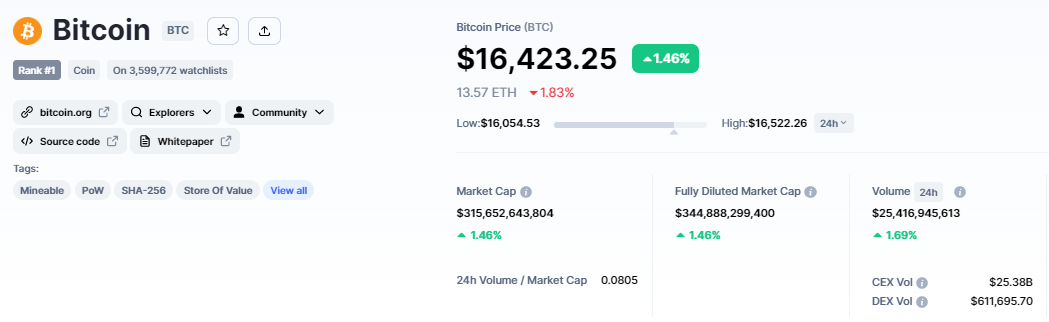

Bitcoin Price

The current Bitcoin price is $16,420 and the 24-hour trading volume is $25 billion. During the last 24 hours, the BTC/USD pair has surged over 1.5%, while CoinMarketCap currently ranks first with a live market cap of $315 billion, up from $344 billion during the Asian session. It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,218,643 BTC coins.

During the UK session, the BTC/USD traded slightly bullish, after gaining support at the $16,000 psychological trading level. In the 4-hour timeframe, an upward trendline is extending support around the $16,000 level, and the closing of candles above this level has triggered a bullish recovery in Bitcoin.

On the upside, the immediate resistance for Bitcoin is at $16,650, which is supported by a downward trendline. Bitcoin has also formed a double top level at $16,650, and a break above this level could send BTC as high as $17,250.

Leading technical indicators such as the RSI and MACD have entered the buying zone, signaling the beginning of a buying trend. Bitcoin has recently surpassed the 50-day moving average of $16,250, indicating the start of yet another bullish trend.

If Bitcoin breaks the lower symmetrical triangle pattern and closes the candle below $16,000, it will be vulnerable to the $15,650 support zone.

Cryptocurrency Pre-Sale With Massive Profit

Despite market slowdowns, a few coins have enormous upside potential. Let us examine them more closely.

Dash 2 Trade (D2T)

Dash 2 Trade is a trading intelligence platform that offers real-time analytics and social trading data to investors, allowing them to make more informed trading decisions.

The sale of its native D2T token, which is set to launch in the first quarter of 2023, has already raised more than $7.4 million. It has also announced BitMart and LBANK Exchange listings for early next year, giving early investors a good chance to make some decent returns.

Visit Dash 2 Trade Now

RobotEra (TARO)

RobotEra (TARO) is a Sandbox-style Metaverse that will launch its alpha version in the first quarter of 2023.

Gamers will be able to play as robots and contribute to the creation of its virtual world, which will include NFT-based land, buildings, and other in-game items, on its Ethereum-based platform.

1 TARO is currently being sold for 0.020 USDT (it can be purchased with either USDT or ETH), but this price will rise to $0.025 during the second stage of its presale, which will begin soon.

Visit RobotEra Now

Calvaria (RIA)

Calvaria (RIA) is a blockchain-based card-trading game in which players battle with NFT-based cards to earn rewards. One of its most intriguing features is that it allows gamers to play it without having any cryptocurrency, which may help it gain traction over other crypto-based titles.

The presale for the token has raised $2.1 million and is currently in its fourth stage, during which 40 RIA can be bought with 1 USDT.

Visit Calvaria Now

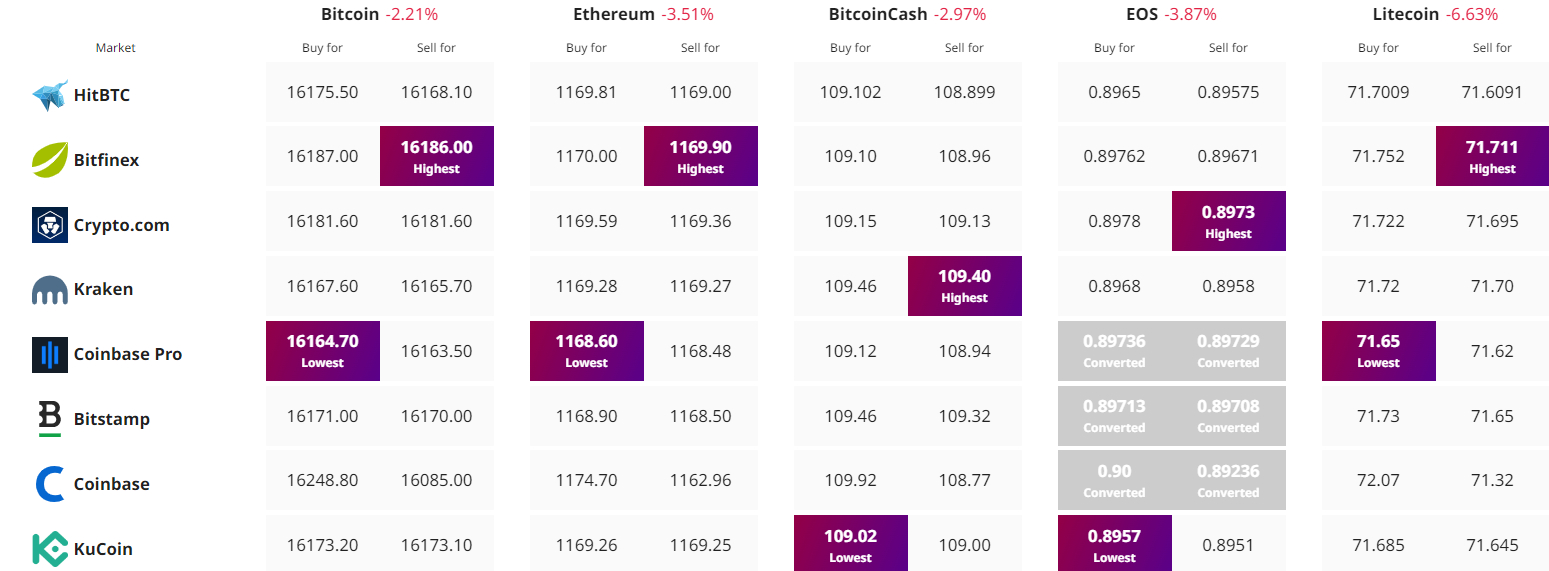

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com