[ad_1]

As Bitcoin (BTC) remains stable around the $28,000 mark, the cryptocurrency community is eagerly watching to see if it will continue to climb upward or if it will fall below its current support level.

Despite regulatory concerns and an interest rate hike by the US Federal Reserve, Bitcoin has managed to rebound with a 3.8% boost in the past 24 hours. This has resulted in an overall increasing trend in the cryptocurrency market, with other altcoins also experiencing a surge in value.

In this article, we will explore the factors that are currently impacting Bitcoin’s price and analyze where it might be heading next.

Former Coinbase CTO Bets $1M on Bitcoin Reaching $1M by June 2023

Balaji Srinivasan, former CTO of Coinbase, has garnered attention by betting $1 million on Bitcoin’s future, with a belief that it will reach $1 million by June 17, 2023.

Srinivasan asserts that the continuous devaluation of the US dollar will ultimately lead to “hyperbitcoinization,” with Bitcoin taking the place of the global economy’s digital gold standard.

Srinivasan’s positive projection has sparked enthusiasm within the cryptocurrency industry and is seen as one of the major factors behind the recent surge in BTC prices. Given his stature in the crypto world, his prediction carries significant weight.

Moreover, his $1 million bet has caught the attention of influential investors, including Cathie Wood of Ark Invest. This bullish forecast is expected to drive more interest and demand for BTC from investors, leading to a rise in its value.

Several experts have criticized Srinivasan’s optimistic projection, stating that it is based on an unrealistic expectations in a difficult macroeconomic situation. Some even believe that he is trying to manipulate the BTC price or seeking attention for himself and the cryptocurrency.

Despite this, Srinivasan’s bullish prediction has reignited hope and excitement in the crypto market after a tough year in 2022. The effect on BTC’s price is still uncertain, but it has certainly sparked lively discussions and interest within the industry.

Boost in Bitcoin Prices from Cryptocurrency Derivatives Trading Attracts New Investors

The rising demand for cryptocurrency derivatives trading is contributing to the surge in BTC prices. The increase in Bitcoin options contracts and open interest is seen as a positive indication for potential new investors.

The Deribit derivatives trading platform has observed a surge in interest, likely influenced by the instability of traditional financial institutions. This development is anticipated to have a favorable effect on Bitcoin prices, which have already gone up by 22% in the last month and over 65% since the start of the year.

The ongoing upward trend in the cryptocurrency market is expected to attract new investors.

Bitcoin Price

The current Bitcoin price is $28,690, with a 24-hour trading volume of $32.3 billion, and a 0.02% increase in value in the last 24 hours. According to CoinMarketCap, it holds the top spot with a live market capitalization of $554 billion.

Based on technical analysis, the BTC/USD pair is currently exhibiting a bullish trend, but it could face resistance at the $28,950 level.

Breaking through the resistance level of $28,950 could potentially boost Bitcoin’s value to reach $29,200 or $30,700.

Conversely, if there is a bearish trend, the support levels of approximately $26,600 and $25,200 are anticipated to provide significant backing.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the latest ICO projects and altcoins by regularly checking out the curated list of the top 15 cryptocurrencies to watch in 2023 by the experts at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

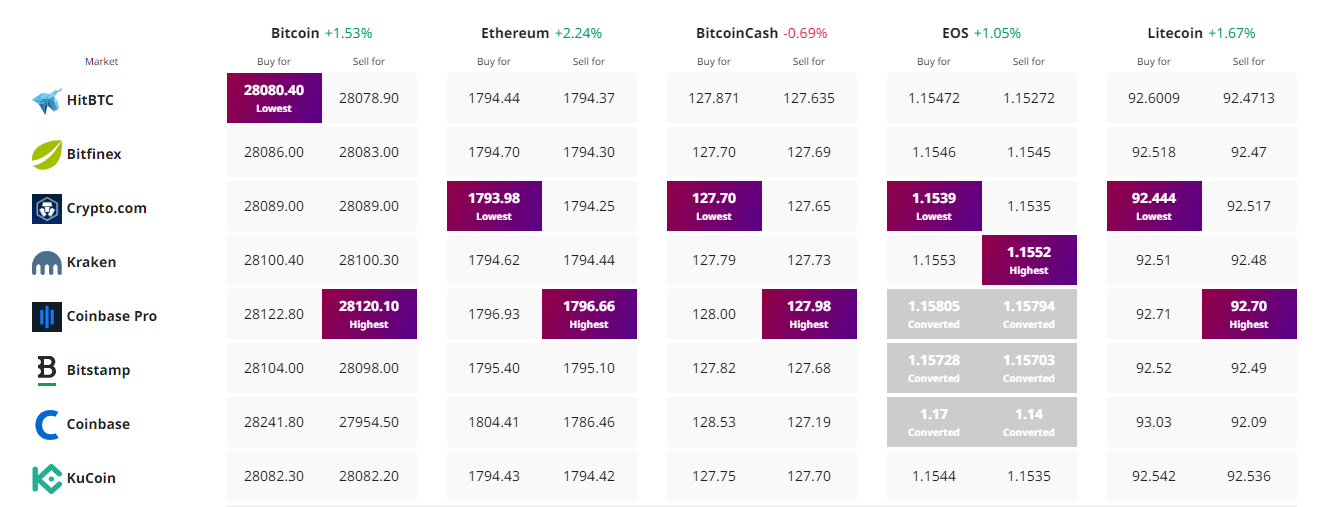

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com