[ad_1]

Bitcoin, the world’s largest cryptocurrency by market capitalization, has been making headlines recently as it broke through the $27,000 barrier for the first time. This surge in price has reignited speculation about where Bitcoin is headed next, with many analysts and investors offering their predictions.

Similarly, Ethereum also drew strong buying interest, with its value increasing by 24.75% to reach the $1,794 mark. However, the reason for this upward rally can be attributed to the impact of inflation in the United States, rather than hyperinflation.

This indicates that the value of the US dollar is decreasing, which is expected to encourage investors to seek out alternative forms of currency to safeguard their assets.

As a result, Bitcoin, which is decentralized and not connected to any government, could be viewed as a more stable investment option, thereby increasing demand and driving the price up even further.

In addition, the bullish prediction by former Coinbase chief technology officer Balaji Srinivasan, stating that Bitcoin’s value will reach $1 million in the next 90 days, was perceived as a significant factor driving the cryptocurrency’s price.

This optimistic comment is expected to motivate more investors to purchase Bitcoin, driving up demand and causing the price to climb even higher.

Risk-On Wave In Cryptocurrency Market Amid US Financial Crisis

The global cryptocurrency market has continued to display a bullish sentiment and is still on the rise, reaching above the $1.16 trillion mark. However, the ongoing financial crisis in the United States, particularly the upheaval in the banking industry, has prompted investors to turn to cryptocurrency as an alternative.

It’s worth noting that the recent bankruptcy of Silvergate, a financial services provider for cryptocurrency companies, along with the government’s acquisition of insolvent banks like Silicon Valley Bank and Signature Bank, has created challenges for banking enterprises associated with cryptocurrency.

Therefore, these crises have highlighted the effectiveness of cryptocurrencies, which have emerged as a safe haven during the ongoing financial crisis in the United States.

It’s important to note that investors are looking for alternative options to safeguard their funds, and Bitcoin, being decentralized and not subject to any government, appears to fulfill these criteria and is regarded as a more trustworthy investment option.

As a result, the crypto market has been on an upward trend, with Bitcoin and other cryptocurrencies reaching new multi-month highs.

Bitcoin Continues to Surge, Analysis Suggests Potential for Further Growth

Since Wednesday, the price of Bitcoin has continued to rise, recently surpassing $27,000, resulting in an increase in profitable transactions on the BTC network compared to unprofitable ones.

Furthermore, a new research report from CryptoQuant author and analyst Ankur Banerjee, using the Elliott Waves analysis approach, indicates that Bitcoin, the world’s largest cryptocurrency, has the potential for further value growth.

This optimistic forecast is likely to increase demand for Bitcoin and drive up its price, as investors may see it as a potentially profitable investment option.

Ex Coinbase CTO Places $2 Million Bet on Bitcoin Reaching $1 Million

Balaji Srinivasan has placed a $2 million bet on Bitcoin’s price hitting $1 million by June 17. Balaji S. Srinivasan is a businessman and investor from the United States. He was the former Chief Technical Officer of Coinbase and a co-founder of Counsyl.

Balaji Srinivasan has placed a $2 million bet on Bitcoin reaching $1 million in value, citing his belief that hyperinflation in the United States will make BTC more appealing. If Bitcoin fails to reach the $1 million mark, Srinivasan will lose the bet and must pay 1 BTC and $1 million in USDC to the person who placed the bet.

However, if Bitcoin’s price hits $1 million, Srinivasan will receive 1 BTC and $1 million in USDC, potentially attracting more investors to the cryptocurrency.

Bitcoin Price

Bitcoin is currently trading at $27,200 with a 24-hour trading volume of $32.3 billion. Bitcoin has dropped by 0.64% in the last 24 hours. On the technical front, the BTC/USD pair is trading with a bullish bias, facing an immediate resistance at the $27,740 level.

On the upside, if there is a bullish breakout of the $27,740 level, it could potentially propel BTC’s price toward the $29,000 or $30,700 mark. Meanwhile, support levels are holding steady at around $26,600 and $25,200.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Industry Talk has curated a list of the top 15 cryptocurrencies to keep an eye on in 2023, with insights from the experts at Cryptonews. Whether you are a seasoned crypto investor or new to the market, this list provides valuable information on promising altcoins that could potentially make a significant impact on the industry.

Stay updated with new ICO projects and altcoins by checking back regularly.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

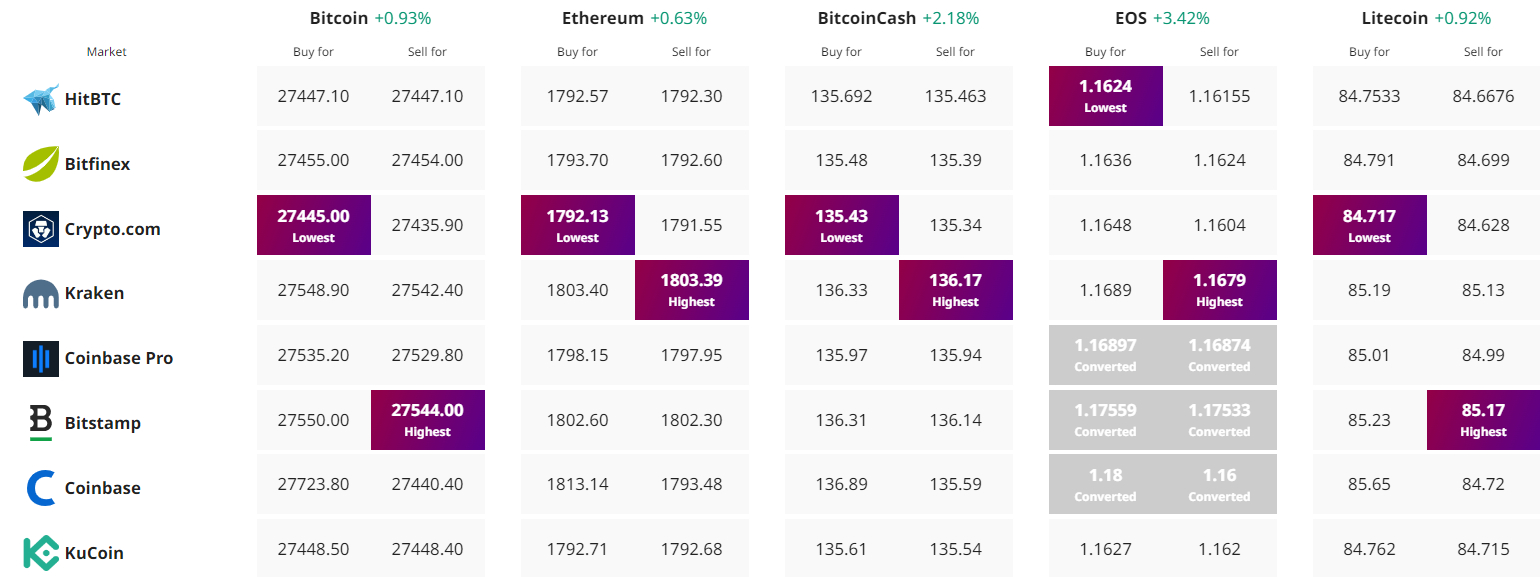

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com