[ad_1]

Bitcoin failed to maintain its upward trend on November 24 and fell below $16,650 despite the release of dovish FOMC meeting minutes. Members of the Federal Open Market Committee (FOMC) voted in early November to raise interest rates by 75 basis points, or 0.75 percentage points. It was the fourth such rate increase in a row.

However, Fed Chair Jerome Powell stated in a press conference following the decision that a slower rate would be appropriate soon.

On November 24, the Federal Reserve tweeted about the minutes of the FOMC meeting held on November 1-2, 2022. The minutes contain information on future interest rate trends, which is critical for determining the value of risky assets such as stocks and cryptocurrencies.

According to the FOMC minutes, a “Substantial Majority” of Fed members anticipate a “soon” slowdown in rate increases. The minutes also indicated that Chairman Jerome Powell’s post-meeting call for “higher rates for longer” was contentious, causing the US currency and Treasury yields to fall while stocks rose.

However, put-call variables for bitcoin and ether, which measure the cost of bullish calls versus bearish puts, remain in the negative range, indicating a bias in favor of options.

Furthermore, the majority of respondents in the Open Market Desk survey predicted that the December meeting would result in a 50-basis-point increase in the federal funds rate target range. The price of BTC/USD increased after the information became public.

Mt. Gox Bitcoin Awakened

The 2014 Mt. Gox breach made headlines when 65 BTC were transferred to the exchange HitBTC. On November 22, a Bitcoin wallet linked to the BTC-e exchange began trading. Since August 2017, the 2014 Mt. Gox hack-related wallet has completed its massive transaction.

A total of 10,000 BTC, worth approximately $167 million, were sent to two unidentified recipients. The sender split the transactions and transferred $3,500 BTC to other wallets. The remaining 6,500 BTC were sent to a single address.

Ki Young Ju, the creator of CryptoQuant, tweeted about the observed Bitcoin transfers on November 24. He clarified that it was not a government auction or anything of the sort because HitBTC was recently paid 65 BTC. He then suggested that the exchange suspend the account due to suspicious activity.

Holders are unable to use KYC because it has been corrupted during multiple transactions. Furthermore, Ki Young Ju stated that old Bitcoin was created during a time of lawlessness. As a result, its movement was negative for BTC/USD.

New York Passed Legislation that Bans Bitcoin Mining Operations

Earlier this week, New York Governor Kathy Hochul signed legislation prohibiting the use of carbon-based energy in some bitcoin mining operations. For the next two years, a proof-of-work mining company will be unable to expand, renew permits, or allow new competitors to begin operations unless it uses entirely renewable energy.

In the proof-of-work (PoW) mechanism that underpins Bitcoin, miners compete to process new transactions. The law seeks to assess and mitigate the negative environmental consequences of the industry.

The price of BTC/USD began to rise after Hochul signed legislation prohibiting some bitcoin mining operations from using carbon-based energy sources.

Bitcoin Price

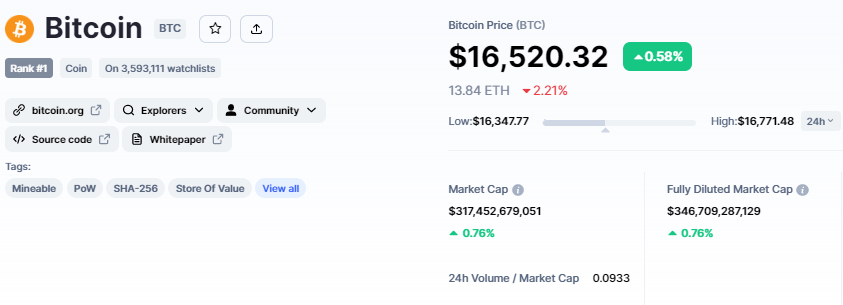

The current Bitcoin price is $16,509, and the 24-hour trading volume is $29 billion. Bitcoin has gained by less than 0.5% in the last 24 hours. CoinMarketCap now ranks first, with a live market cap of $346 billion. It has a total quantity of 21,000,000 BTC coins and a circulating supply of 19,215,887 BTC coins.

Bitcoin is currently gaining traction toward the $16,600 level. Candles that close above this level signal a bullish turnaround. A bullish engulfing slicing through and closing over the $16,350 barrier shows that the bullish trend may continue.

As a result, continued positive pressure might push the price up to the $17,180 resistance level. If the $17,180 level is broken again, there may be more buying opportunities till the $18,650 level, which is extended by the 38.2% Fibonacci retracement level.

We may expect the rise to continue because the RSI and MACD are both in a buying zone. If the $17,000 milestone is breached, BTC may fall to $17,600.

On the downside, Bitcoin’s support level is at $16,000, and a breach of this level may send the currency as low as $15,670.

Cryptocurrency Pre-Sale With Massive Profit

Despite the market’s slump, a few coins have enormous upside potential. Let us check them more closely.

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that gives traders of all skill levels real-time statistics and social data, helping them to make better-educated decisions.

D2T, established by the Learn 2 Trade service, provides investors with market-driven insights, trading signals, and prediction services. Customers will be given enough information to make informed judgments, according to the cryptocurrency effort.

D2T began selling tokens three weeks ago and has raised more than $6.9 million. Following the presale, D2T will be listed on LBank and BitMart, with a large increase in asset price expected.

The present value of 1 D2T is 0.0513 USDT, but this is predicted to climb to $0.0533 in the following stage of sales and $0.0662 in the final stage.

Visit Dash 2 Trade now

Calvaria (RIA)

Calvaria is an exciting new cryptocurrency gaming project that has the potential to dominate the play-to-earn market. Two major barriers to widespread Web3 gaming adoption have been identified by Calvaria developers. While investors see the potential of Web3 games, users do not.

Calvaria’s presale, which is already in stage 4 of 10 and close to $1.9 million, is gaining traction. Investors are flocking to the fast-growing GameFi project as the price of the native RIA token climbs considerably at each presale stage.

Tokens cost $0.025 each in stage 4, but by stage 5, the price had climbed to $0.03, and tokens cost $0.055 in stage 10.

Visit Calvaria Presale Now

RobotEra (TARO)

For investors who appreciate the metaverse, TARO is one digital asset to keep an eye on. The asset is the native token for RobotEra, a world-building metaverse platform that allows players to access its system through avatars.

Every user can buy land and properties, as well as contribute to the overall appearance of the virtual world. There are also community metaverses in RobotEra where users can engage in communal activities such as sports and games, as well as conversions.

Because all things are Non-Fungible Tokens (NFTs), players own whatever they purchase. TARO is a new market presale that is currently in its early phases. Regardless, this is a valuable asset with significant upside potential.

Buy TARO on Presale Now.

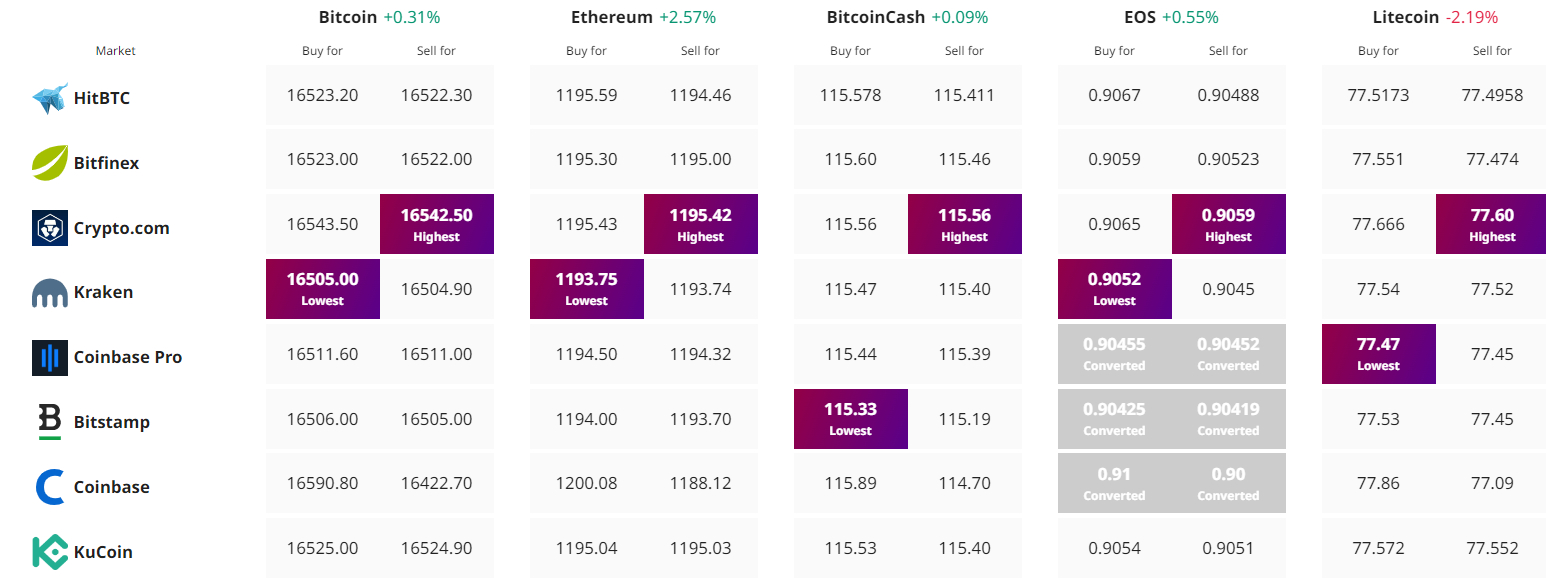

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com