[ad_1]

Bitcoin’s price has been consolidating at around $23,800, leaving traders and investors wondering where it is headed next. As the market continues to stabilize, analysts and experts are making predictions about what the future holds for Bitcoin’s price.

Bitcoin’s price has been consolidating at around $23,800, leaving traders and investors wondering where it is headed next. As the market continues to stabilize, analysts and experts are making predictions about what the future holds for Bitcoin’s price.

In this article, we will take a closer look at the current state of the market and explore various factors that could potentially impact Bitcoin’s price movement in the coming days and weeks.

IMF Directors Warn of Crypto Risks

The IMF’s executive board considers the use of crypto assets a threat to the global monetary system. They warned of potential consequences for monetary policy, capital flow management measures, and fiscal concerns.

The IMF recommends that member countries take appropriate measures to address the growing popularity of cryptocurrencies. The board discourages governments from adopting digital coins as legal tender, as seen with El Salvador and the Central African Republic’s recent embrace of Bitcoin.

Strong macroeconomic policies and credible institutions and monetary policy frameworks are crucial, and the Fund will continue to offer advice in these areas. The International Monetary Fund (IMF) has warned that the increasing use of cryptocurrencies poses a risk to the global monetary system, with the potential to undermine monetary policy, evade capital flow management, and raise fiscal concerns.

The IMF also discourages governments from declaring cryptocurrencies legal tender, despite some countries such as El Salvador and the Central African Republic embracing Bitcoin as an official currency. The IMF’s cautionary stance on cryptocurrency may lead to increased scrutiny and regulation, which could impact the adoption and value of Bitcoin and other cryptocurrencies.

Bitcoin Dips as US PCE Inflation Data Prompts Anticipation of Interest Rate Hike

Bitcoin (BTC) dropped back to $23,000 on Friday, shortly after the release of the Personal Consumption Expenditure (PCE) price index showing a 5.4% YoY and 0.6% MoM increase in January. The higher-than-expected figure means that the Federal Reserve’s battle against rising inflation is likely to continue.

BTC started Friday at around $24,000 and remained above $23,800 until the release of the January PCE statistic at around 13:30 UST. Following the release, the value plummeted, falling as low as $23,000 in just 30 minutes. As of writing, it is worth $23,217.

Bitcoin’s drop is accompanied by a 3.3% fall in Ethereum (ETH), a 4.6% drop in Cardano (ADA), and a 7.1% drop in Polkadot (DOT). Meanwhile, the NASDAQ and S&P 500 are down 1.81% and 1.25%, respectively.

According to Coinglass data, the crypto market drop has resulted in over $110 million in liquidations in the last four hours alone, including $44 million in Bitcoin and $22 million in ETH liquidations. The largest single liquidation was on BitMEX for $7.52 million on an XBTUSD deal.

The PCE, instead of the Consumer Price Index, is the Fed’s preferred measure of inflation (CPI). The former distinguishes itself by tracking how customers’ purchasing patterns evolve over time, and the central bank considers it to be the best predictor of where inflation is headed in the future.

Bitcoin Price

As of now, the live price of Bitcoin stands at $24,050, with a trading volume of $31 billion over the last 24 hours. It currently holds the top spot on CoinMarketCap, with a live market capitalization of $464 billion.

At present, Bitcoin’s price is $23,873, with a trading volume of $28.6 billion over the past 24 hours. The price of Bitcoin has decreased by nearly 2% in the same timeframe.

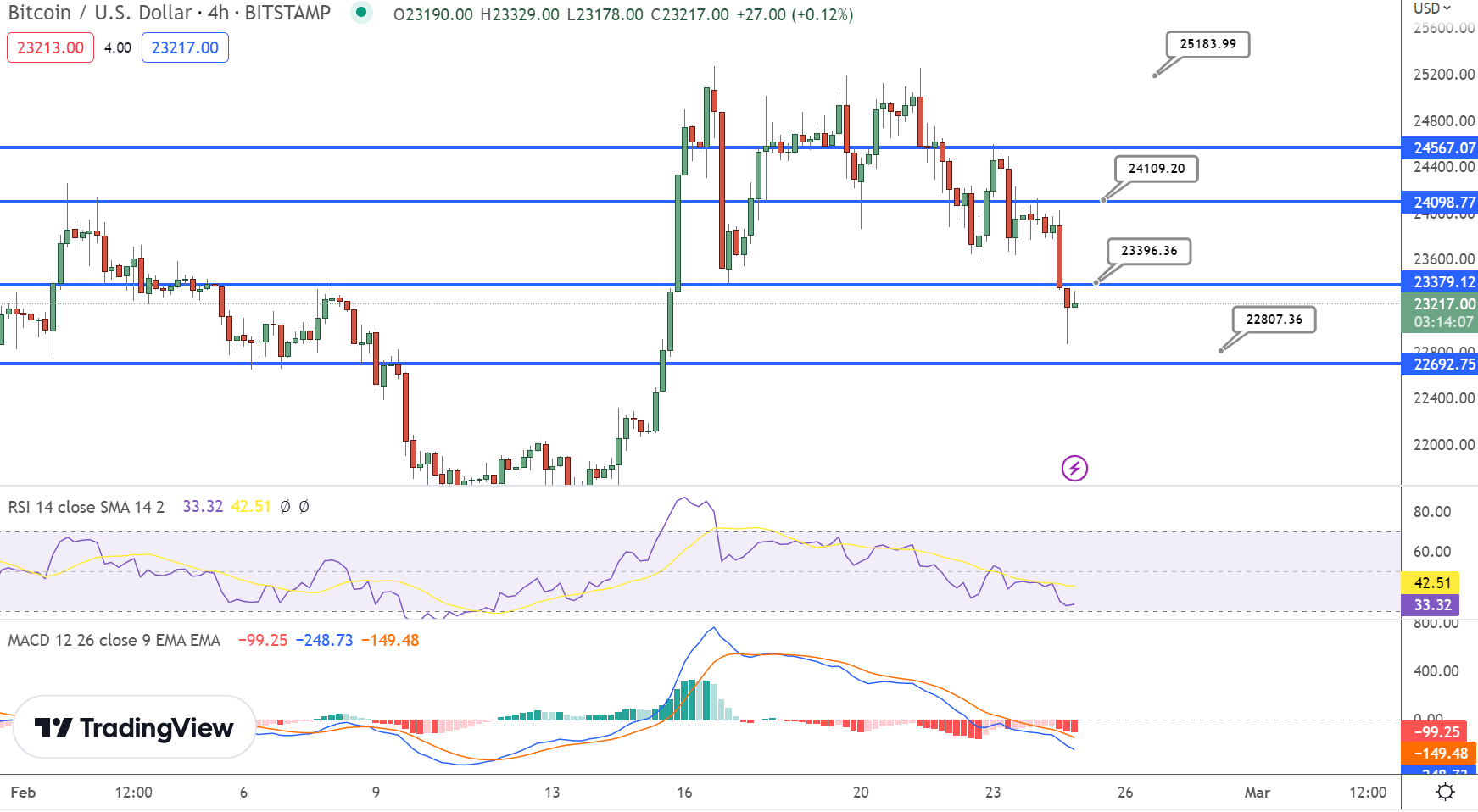

From a technical standpoint, Bitcoin is projected to receive immediate support around the $23,600 level, and breaking below this may expose the BTC price to the $23,375 level.

Bitcoin Price Chart – Source: Tradingview

On the bullish front, if Bitcoin successfully breaks out above the $24,100 level, it could potentially reach the $24,500 or $25,200 mark. However, the RSI and MACD indicators are still in the selling zone, so it is important to keep a close eye on the $23,600 to $23,350 range. If the price closes above this range, there may be potential buying opportunities.

The current price of Bitcoin is $23,873, with a 24-hour trading volume of $28.6 billion. It has experienced a drop of almost 2% in the past 24 hours. From a technical standpoint, Bitcoin is expected to receive immediate support around the $23,600 level. If it falls below this level, it could potentially expose the BTC price to the $23,375 level. The Bitcoin price chart source is Tradingview.

Buy BTC Now

Bitcoin Alternatives

Investors looking to buy into Bitcoin may want to consider alternatives with more room for growth in the short term. Cryptonews has released an in-depth analysis of the top 15 cryptocurrencies that investors may want to consider for 2023. Click below to find out more.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

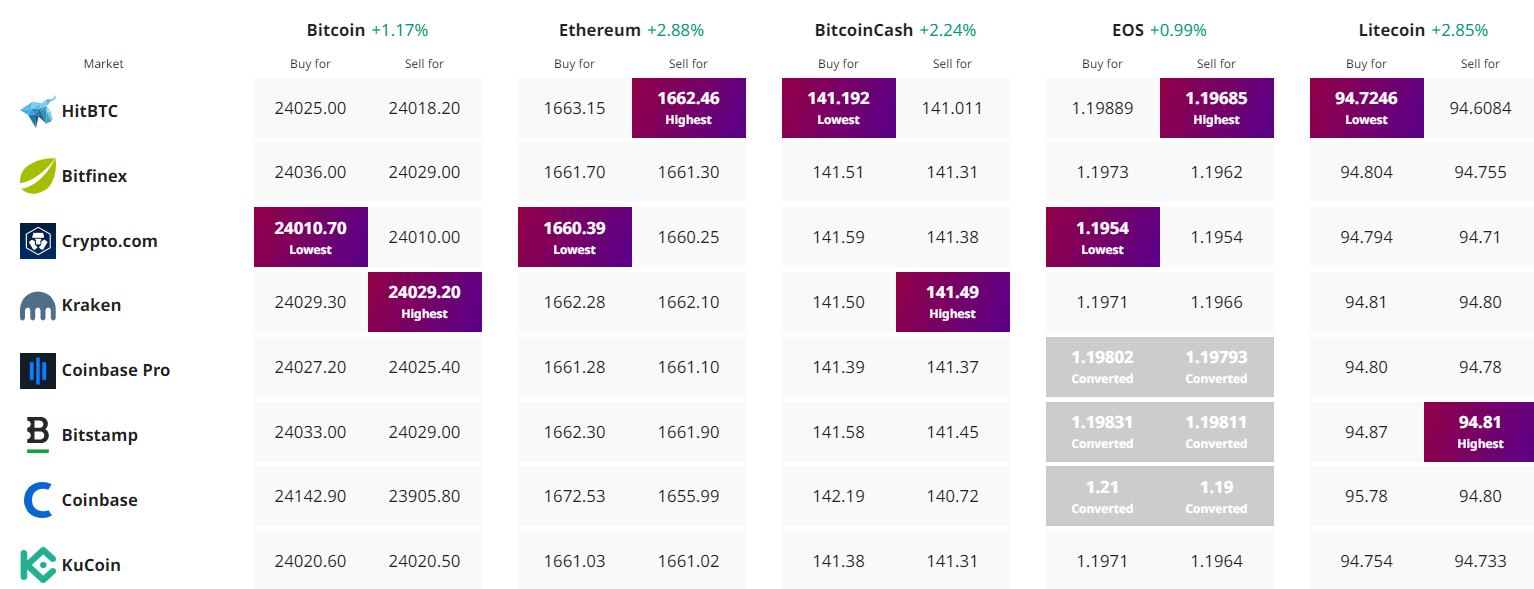

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com