[ad_1]

Bitcoin, the world’s top cryptocurrency, has undergone a significant drop, reaching its lowest value in two months. Ether, the second most valuable cryptocurrency, followed a similar path and also experienced a decrease in value.

On March 10th, Bitcoin briefly fell below $20,000 for the first time in almost two months, hitting a low of $19,918.

The decline in cryptocurrency prices can be attributed to a variety of factors, including remarks from US Fed Chair Jerome Powell, Joe Biden’s budget proposal, and the recent closure of Silvergate Bank.

As a result, the dip in cryptocurrency prices is causing concern among investors and the industry as a whole. Furthermore, the fact that the total market capitalization of all cryptocurrencies has fallen below $1 trillion is a clear indication that the overall market is in for a challenging period.

The Collapse of Silvergate Bank and Its Impact on the Crypto Industry

The recent closure of Silvergate Bank is considered one of the main reasons behind the decrease in cryptocurrency values. The bank played a crucial role in providing services to crypto enterprises in the United States. Therefore, its closure could have a significant negative impact on the crypto sector.

Indeed, Silvergate Bank’s closure could hinder the development of the cryptocurrency industry, as it provided critical banking services to these enterprises.

The bank’s suite of services, such as custody, wire transfers, and fiat deposits, was essential for many cryptocurrency firms. Without such support, it could be challenging for these companies to find other banking partners offering similar services, which could ultimately impede the growth of the sector.

US Crypto Miners Could Be Subject to 30% Tax on Electricity Costs

The release of a supplementary budget explainer paper on March 9th was another contributing factor to the decline in Bitcoin’s price. The paper revealed that under a Biden budget proposal that aims to “reduce mining activity,” United States crypto miners could eventually be subject to a 30% tax on electricity costs.

If implemented, this proposal may have a significant impact on the crypto-mining industry, as it relies heavily on low electricity costs. A reduction in mining activity in the US could have negative implications for the entire crypto market.

Crypto Market Cap Dips Below $1 Trillion

The substantial drop in Bitcoin’s price significantly affected the entire crypto market, resulting in the global crypto market cap falling below $1 trillion once again.

Other widely-used altcoins, such as Ethereum, Dogecoin, and Litecoin, also witnessed substantial losses across the board.

This indicates that the cryptocurrency market remains volatile and subject to unpredictable fluctuations, as demonstrated by the current challenging times for overall crypto values.

Impact of US Fed Chair’s Comments

Jerome Powell’s statements about inflation and interest rates have had a significant impact on the cryptocurrency market. His recent announcement that the central bank may begin raising interest rates sooner than expected has caused concern among investors about the potential impact on the economy and cryptocurrencies, leading to a decrease in cryptocurrency prices.

Powell’s remarks have continued to negatively impact the cryptocurrency market for the second consecutive day, adding to the pre-existing concerns and anxieties about the regulatory environment and the future of cryptocurrencies.

Bitcoin Price

The current live price of Bitcoin is $19,938, with a 24-hour trading volume of $43 billion. Over the last 24 hours, Bitcoin has decreased by 8.50%. It is currently ranked #1 on CoinMarketCap, with a live market cap of $385 billion.

Bitcoin’s technical analysis indicates a strong bearish trend for the BTC/USD pair, as it has breached the double-bottom support level of $20,350. Bitcoin’s immediate support level is at $18,430. A breach below this level may intensify selling pressure, leading to a further drop toward the $16,400 level.

Conversely, the initial resistance level is at $20,300, with a breakout above it likely to trigger buying pressure and push Bitcoin’s price towards the $21,400 level. If there is additional bullish momentum, the BTC price may reach the $25,000 mark.

Buy BTC Now

Top Cryptocurrencies to Watch in 2023

Check out Cryptonews’ Industry Talk team’s selection of the top 15 altcoins to watch in 2023, regularly updated with new ICO projects and altcoins. Stay up-to-date with the latest developments by visiting the list often.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

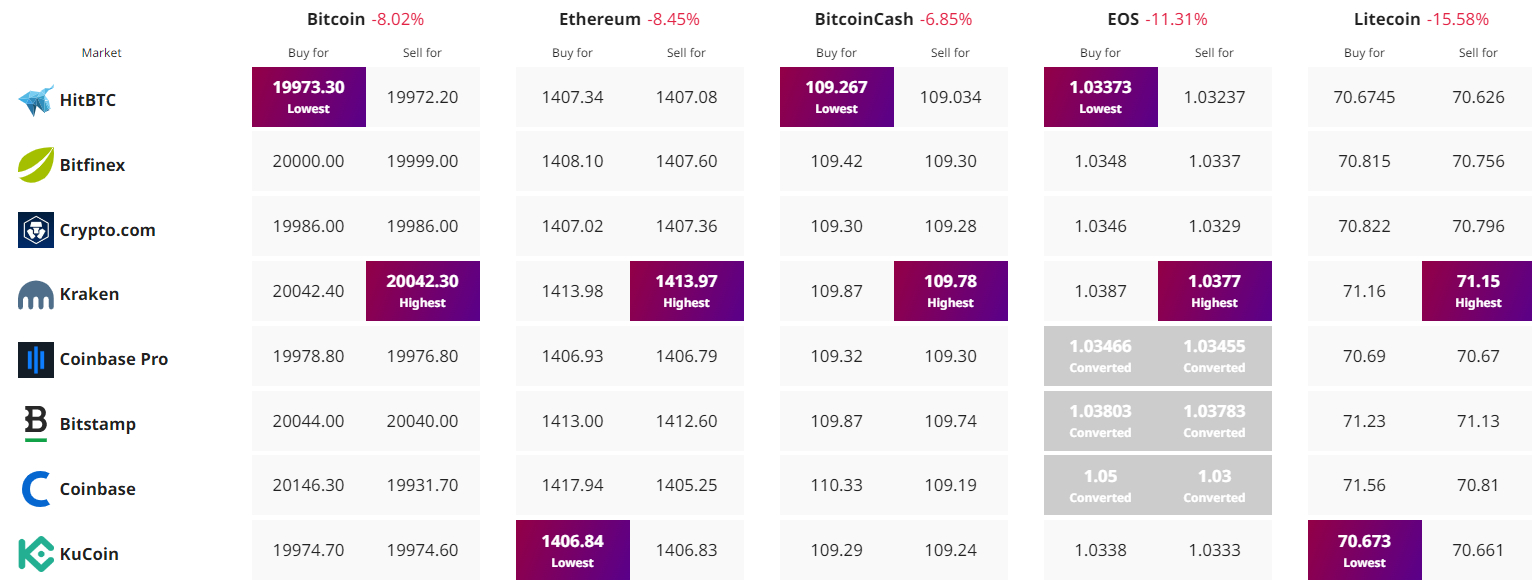

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com