[ad_1]

Despite positive developments like the launch of futures-based Ether ETFs and a UAE Dirham-based stablecoin driving digital asset adoption, Bitcoin (BTC), the world’s most valuable cryptocurrency, failed to stop its losing streak and is currently trading below the $28,000 mark.

The cryptocurrency market is currently worth $1.08 trillion. However, it experienced a 0.90% loss within the last 24 hours. Bitcoin recently faced rejection at $28,600 and has been under pressure.

The current bearish trend can be attributed to two key factors: the increasing US bond yields and overbought signals.

On October 3, the yield of the US. 10-year Treasury note surged to 4.75%, marking a sixteen-year high. This resulted from statements from Federal Reserve officials, indicating that interest rates would not be reduced in 2023 and 2024.

Potential Impact of Recent Bitcoin Developments

Last week, Solana stood out by attracting $5 million in investments. Bitcoin continued to lead the way with a substantial inflow of $20.4 million. On the other hand, Ether had a tough week, facing outflows of $1.5 million for the seventh consecutive week.

According to analysts at CoinShares, these trends can be attributed to factors such as strong price momentum and concerns about US government debt. They believe these factors are driving investments in digital assets.

Senate leaders passed a stopgap measure to secure U.S. government funding until November 17th, but the future beyond this date remains uncertain.

Germany, Canada, and Switzerland saw significant inflows of $17.7 million, $17.2 million, and $7.4 million, respectively, while the United States saw a notable outflow of $18.5 million.

Bitcoin’s momentum may have contributed to positive investor sentiment, resulting in increased interest in digital assets and a potential upward trend in Bitcoin’s price.

Osmosis and Partners Introduce nBTC

Osmosis, a leading decentralized exchange, has integrated Bitcoin into the Cosmos network through the Nomic bridge. This allows users to transfer Bitcoin to the Cosmos network with a low transaction fee of only 1.5% and receive nBTC tokens in exchange.

These tokens can be used for various purposes within Osmosis and across more than 50 Cosmos-linked app chains.

Sunny Aggarwal, one of the co-founders of Osmosis, believes that the upcoming nBTC Interchain Upgrade will have a significant impact on integrating Bitcoin with the DeFi ecosystem. The upgrade is scheduled to be released on October 27 and activated on October 30.

In addition, the partnership with Kujira allows users to maintain self-custody of their nBTC and use it as collateral for lending and borrowing activities. This development has the potential to positively impact the adoption and utility of Bitcoin in the cryptocurrency space.

Bitcoin Blackmail Scams: Risks to Reputation and Value

Bitcoin blackmail scams have surged, with scammers swindling almost $1.7 million in the first half of 2023. Despite attempts to prevent illegal crypto activities, scammers earned a shocking $55.04 billion in 2021, causing both financial and emotional harm.

These scams exploit human vulnerabilities and often threaten to expose personal data unless victims pay in cryptocurrency.

Scammers have been evolving, with ransomware and giveaway scams featuring fake celebrity endorsements becoming more common.

Hence, rising Bitcoin blackmail scams may harm its reputation, discourage investors, increase risk awareness, and impact demand and price.

Bitcoin Price Prediction

On a 4-hour chart timeframe, Bitcoin price shows significant price points to consider. The pivot point for the asset stands at $27,267. As for resistance levels, we have the immediate resistance at $28,427, followed by subsequent resistances at $29,222 and $29,997.

On the downside, the immediate support is marked at $26,775, with the following supports at $25,900 and $25,000, respectively.

- Delving into technical indicators, the Relative Strength Index (RSI) currently stands at 59. This value suggests a bullish sentiment as the RSI is above 50.

- On the other hand, the 50-day Exponential Moving Average (EMA) is recorded at $27,260. Given that the price hovers above this EMA, it indicates a short-term bullish trend.

- An observed chart pattern indicates that the 50-day EMA underpins at $27,300, leading to speculation: is it an opportune moment to buy above this level?

In cryptocurrency trading, analysts often study specific chart patterns, such as the symmetrical triangle or upward channel. However, in this scenario, the support from the 50-day EMA at $27,300 is particularly noteworthy.

If Bitcoin manages to stay above this level, it could indicate a bullish momentum in the market.

In the short term, considering the current trends and resistances, it is likely that Bitcoin will test the resistance level.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

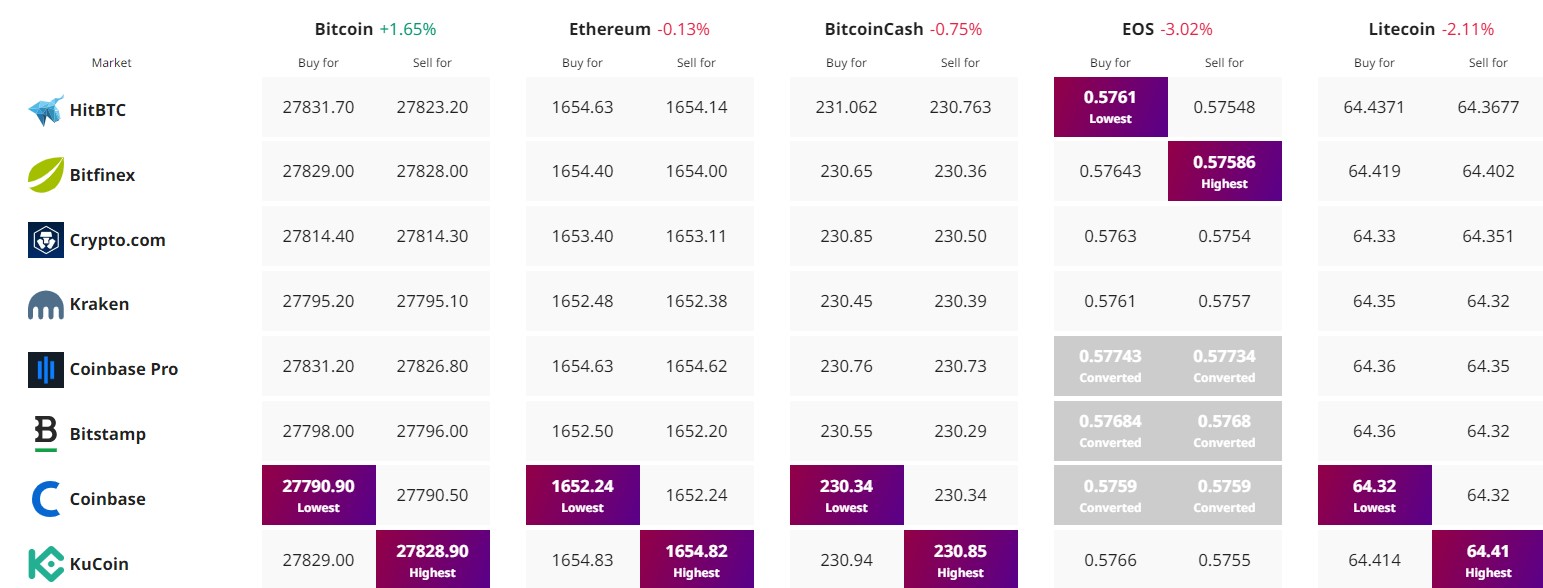

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

[ad_2]

cryptonews.com