[ad_1]

During the US trading session, there is a bullish outlook for Bitcoin’s price prediction as BTC has rebounded from the support level of $23,300. Bitcoin’s price has been on a rollercoaster ride over the past few days, with significant price surges followed by steep drops.

Binance CEO Refutes Claims of USDC Delisting Amid SEC’s Regulatory Actions

Binance, which has the most trades of any cryptocurrency exchange, is reportedly thinking about breaking ties with its US business partners. According to a recent report from Bloomberg, Binance is contemplating delisting tokens from any firms based in the United States due to the Securities Exchange Commission’s (SEC) recent regulatory crackdown.

Since the SEC is paying more attention to the crypto industry, Binance is one of several exchanges reviewing its policies and procedures to ensure they meet regulatory requirements.

After the Securities and Exchange Commission (SEC) said that BUSD, a stablecoin tied to the US dollar, is a security and then sued crypto firm Paxos, the relationship between exchanges and the US regulatory body has become more tense and uncertain.

In light of these developments, Binance is reportedly re-evaluating its investments in the United States. While Binance is not licensed to operate in the US, it has been conducting business in the country through its subsidiary, Binance.US.

However, with regulatory pressures mounting, Binance is just one of many crypto exchanges that are now reviewing their operations and considering changes to their business models in order to remain compliant with US regulations.

Binance CEO Reacts Quickly to Accusations

In response to the allegations, Binance’s CEO, Changpeng Zhao (CZ), took to Twitter to deny the claims. CZ responded to a comment on the social media platform, stating:

Binance’s CEO, Changpeng Zhao, has recently been involved in controversy. A Reuters report revealed that Binance transferred $400 million from a “secret” account associated with its subsidiary, Binance.US, to a trading firm owned by CZ called Merit Peak.

The firm, which was incorporated in the British Virgin Islands in 2019, had previously invested over $1 million in Binance’s U.S. subsidiary. The transaction was facilitated through Silvergate Bank, a crypto-friendly financial institution.

SEC Alleges Terraform Labs CEO Transferred 10K+ Bitcoin After Collapse

The SEC has sued Terraform Labs and founder Do Kwon for allegedly transferring millions of dollars worth of Bitcoin to a Swiss bank account after the company’s collapse in May. The lawsuit includes charges of the sale of unregistered securities.

The defendants are said to have moved over 10,000 Bitcoin from Terraform and Luna Foundation Guard accounts to an un-hosted wallet outside of exchange platforms.

Since then, Terraform and Kwon allegedly transferred Bitcoin to a Swiss financial institution and converted it to cash, resulting in over $100 million in withdrawals since June 2022.

The collapse of Kwon’s enterprise erased more than $40 billion in combined market value. FINMA, the Swiss financial regulator, declined to comment on the case.

Binance Reviews US Investments in Light of Regulatory Crackdown

As regulatory scrutiny of Binance continues, the world’s largest cryptocurrency exchange is reportedly considering ending its partnerships with US firms. Bloomberg reports that Binance’s CEO, Changpeng Zhao, is reviewing the exchange’s venture capital investments in the US and is considering severing ties with US banks and service providers.

Binance is also reportedly considering delisting tokens from U.S.-based projects, including Circle’s USDC stablecoin.

The SEC, CFTC, DOJ, and IRS have been investigating Binance, which services US customers through Binance.US. Despite the investigation, Binance.US claims to operate independently and has no plans to exit the U.S. market.

Bitcoin Price

As of today, the live Bitcoin price is $24,323, and its 24-hour trading volume is $40 billion. In the past 24 hours, Bitcoin has experienced a 2.5% decline. Bitcoin has a current CoinMarketCap ranking of #1, with a live market capitalization of $469 billion. The circulating supply of Bitcoin is 19,293,956 BTC coins, with a maximum supply of 21,000,000 BTC coins.

Bitcoin has rebounded after finding support around the $23,325 50% Fibonacci retracement level. The upward trend was initiated by candles closing above this level, which led to a buying trend in Bitcoin.

Moving forward, Bitcoin’s next resistance level is $24,350. If a bullish crossover occurs above this level, the BTC price could potentially increase to $25,300. Additionally, on the 4-hour timeframe, a “three white soldiers” pattern may indicate an upcoming uptrend in BTC.

The 50-day moving average is also contributing to the likelihood of a continued uptrend in Bitcoin. Investors may want to monitor the $23,700 level to take a buy position and do the opposite if the price falls below this level.

Buy BTC Now

Bitcoin Alternatives

CryptoNews has released a comprehensive review of the top 15 cryptocurrencies that investors should consider for 2023. The report aims to assist investors in making informed investment decisions.

Along with cryptocurrencies, there are other investment options with the potential for high returns that investors may want to explore.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

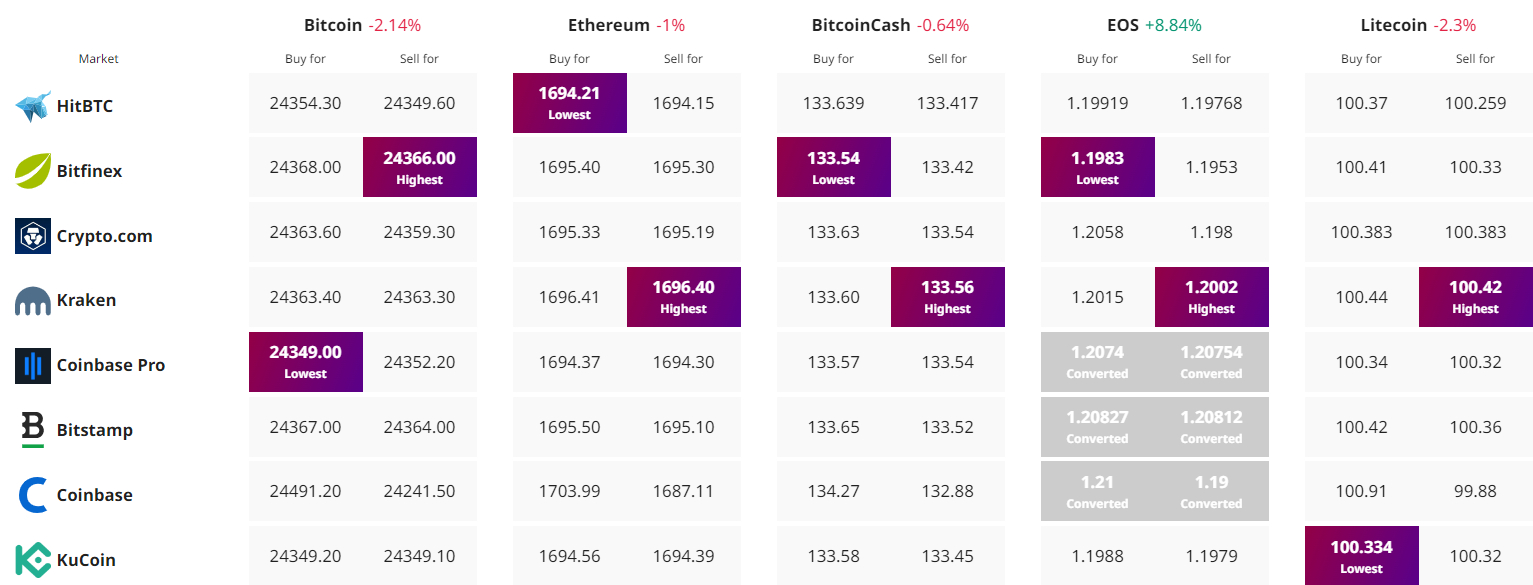

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com