[ad_1]

Bitcoin, the world’s most popular cryptocurrency, has recently seen a significant increase in price, rising up by 2%. As a result, investors and traders are eagerly anticipating the next potential target for BTC. The price of Bitcoin has decreased over the course of the day, which is believed to be a result of the FOMC (Federal Open Market Committee) minutes release.

This information has caused market uncertainty and may have contributed to the drop in BTC prices.

Bitcoin in the Balance: How Interest Rate Hikes Impact BTC Prices

On February 22, the US Federal Reserve released the minutes of its Federal Open Market Committee (FOMC). The FOMC minutes revealed that the Fed intends to raise interest rates for longer than many investors anticipated following the January Consumer Price Index (CPI) report, which showed inflation to be higher than expected, with a 0.5% increase.

As a result, the Federal Reserve increased the benchmark fed funds rate by 25 basis points. Investors are closely analyzing the minutes of the Federal Reserve as market volatility has increased.

The crypto market is experiencing a downturn today, with BTC/USD and other cryptocurrencies correcting following the release of the FOMC minutes, which suggests that further interest rate increases may be on the horizon if inflation continues to be strong.

Rising US Dollar Index Keeping BTC Under Pressure

The minutes from the US Federal Reserve meeting revealed that officials are committed to using a more gradual pace of interest rate hikes to address the issue of increasing inflation, which has caused the value of the dollar to rise.

The DXY index, which is a measure of the value of the US dollar relative to a basket of other major currencies, is currently hovering near 104.50 and is moving towards its weekly high.

There is a strong historical correlation between the movements of the DXY index and cryptocurrency prices. Typically, when the DXY rises, the value of Bitcoin tends to decline.

Bitcoin Beach Festival Makes Waves in Brazil with Crypto Education and Carnival Fun

The inaugural Bitcoin Beach event was recently held in Jericoacoara, Brazil, where the need for effective alternatives to traditional finance is more pressing than ever due to financial insecurity.

The event spanned three days, from February 18 to February 21, 2023, and featured six distinguished speakers, as well as a carnival performance with a Bitcoin theme. The event aimed to educate the country’s youth about Bitcoin and its potential benefits.

Events that promote Bitcoin education can help to increase financial literacy and accelerate the adoption of cryptocurrencies by the general population.

Furthermore, recent data suggests that the demand for Bitcoin payments is higher in South America, and the Brazilian government is taking steps to integrate cryptocurrencies into the daily lives of its citizens.

US Fourth Quarter GDP Growth Revised Down to 2.7%

The US Commerce Department has revised the country’s economic growth in the fourth quarter of 2022 downwards due to a decrease in consumer spending and an increase in the Federal Reserve’s preferred inflation metrics.

The new figures show that the inflation-adjusted gross domestic product (GDP), which represents the total value of all goods and services produced in the US, grew at an annualized rate of 2.7% during the period. This is lower than the previously reported growth of 2.9%.

In the fourth quarter of 2022, the US economy expanded at an annualized pace of 2.7% quarter on quarter, which was slightly less than the advance estimate of 2.9%. Consumer spending increased by 1.4%, the smallest increase since Q1 2022 and lower than the advance projection of 2.1%.

Generally, when the US economy is strong, Bitcoin prices tend to increase as investors seek alternative assets. However, other factors such as global economic conditions, government regulations, and investor sentiment also influence Bitcoin prices. It is essential to keep track of these factors and the overall market conditions to predict the direction of Bitcoin prices accurately.

Bitcoin Price

As of now, the live price of Bitcoin stands at $24,050, with a trading volume of $31 billion over the last 24 hours. It currently holds the top spot on CoinMarketCap, with a live market capitalization of $464 billion.

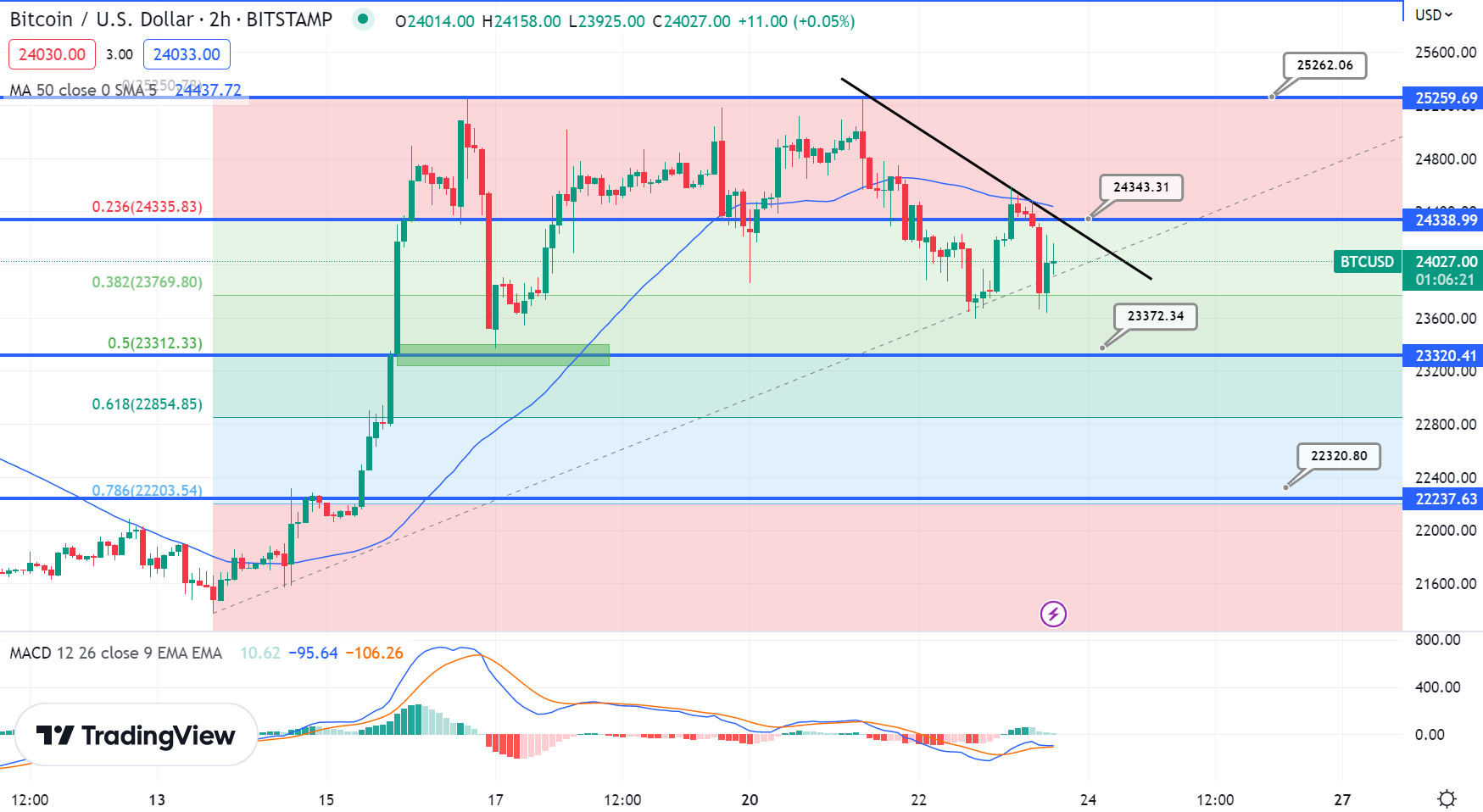

On the 2-hour timeframe, Bitcoin is exhibiting an ascending triangle pattern with an upward trendline providing support around the $24,000 level. In case the price of Bitcoin falls below this level, the next support level is expected to be at around $23,400. Moreover, the RSI and MACD indicators are both in the selling zone, exerting additional selling pressure on Bitcoin.

Bitcoin’s resistance level stands at $24,500. A surge in buying pressure could drive the price above this level and potentially trigger a breakout, paving the way for BTC to test the next resistance level at $25,200.

Buy BTC Now

Bitcoin Alternatives

CryptoNews has released an in-depth analysis of the top 15 cryptocurrencies that investors may want to consider for 2023. The report provides valuable insights to help investors make well-informed investment decisions.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

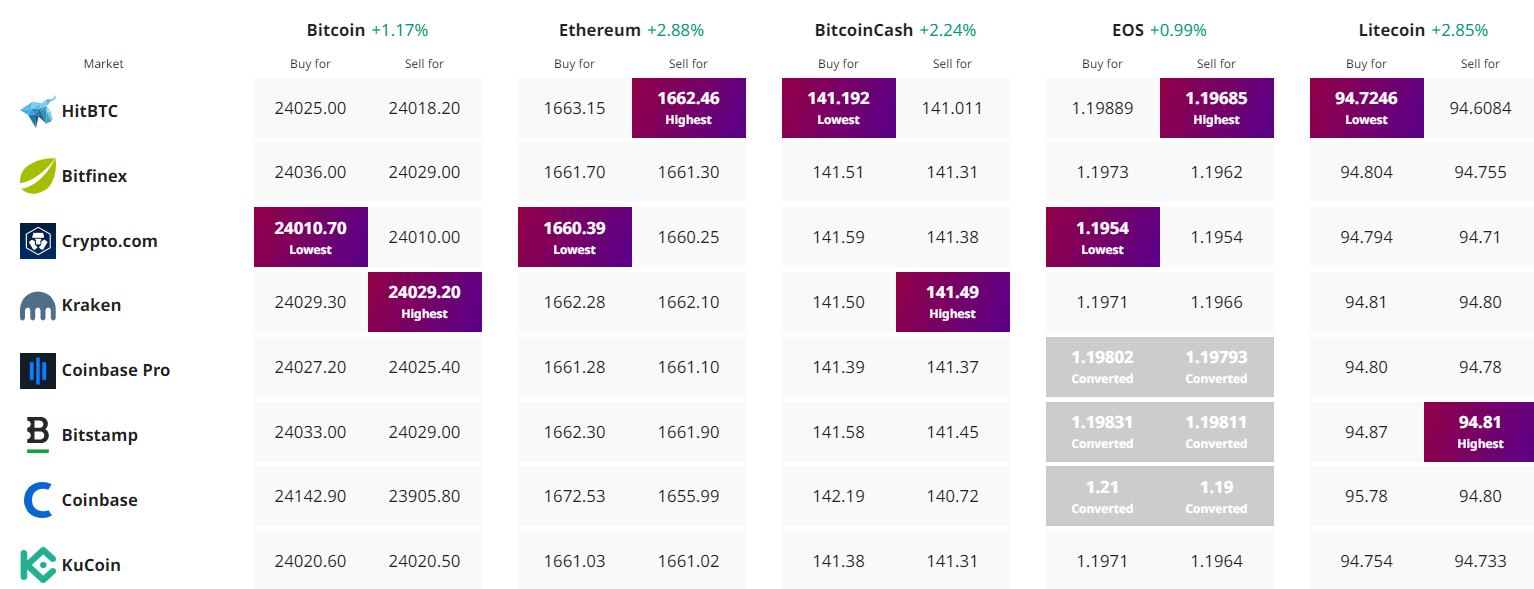

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com