[ad_1]

On December 10, the BTC/USD pair continued to consolidate in a narrow range of $16,000 to 17,350. Stronger-than-expected US PPI figures from the Bureau of Labor Statistics have kept Bitcoin’s uptrend limited.

US PPI Accelerated Unexpectedly in November

The producer price index rose 0.3% from October to November, exceeding the 0.2% estimate, while the October figure was revised up to 0.3% from 0.2%. The unstable price of food and energy exacerbated the situation; without those two components, the producer price index’s “core” increased by 0.4%, the most since June.

The cryptocurrency market reacted negatively to the report, which was interpreted as making it more difficult for the Federal Reserve to pause and eventually stop raising interest rates this year. BTC/USD is also falling as a result of the announcement.

Binance and Crypto.com Publish Proof-of-Reserve Audits

This week, two cryptocurrency exchanges made proof-of-reserves available to demonstrate that their trading platforms support customer assets 1:1. Binance published a report on December 7 that included information on the audit’s global auditor, Mazars Group.

On December 9, Crypto.com revealed proof-of-reserves documents, which were also verified by Mazars. Since the demise of FTX in November, the cryptocurrency community has been keeping a close eye on centralized exchanges. Following the promises made by exchange officials following the FTX incident, crypto exchanges issued proof-of-reserves (POR) evidence.

Binance has made a detailed analysis of the assets held on the Bitcoin, Ethereum, Binance Smart Chain, and BTCB networks, including BTC, BTCB, and BBTC, available on the Mazars Group website. Throughout the process, “Binance was 101% collateralized,” according to Mazars.

Following the fallout from FTX, Crypto.com temporarily suspended withdrawals on the Solana network. It positioned the exchange in the midst of the crisis.

The Crypto.com team stated that it intends to demonstrate its responsibility as a cryptocurrency custodian by disclosing its proof of reserves. It also demonstrated that customers’ funds could be trusted to handle any withdrawals. The news is good for crypto assets because it demonstrates the transparency of centralized exchanges. It is also advantageous to the BTC/USD.

US Lawmakers Propose Cryptocurrency Mining Environmental Monitoring Legislation

The Environmental Protection Agency (EPA) has been required to provide data on the energy requirements and environmental effects of cryptocurrency mining under a bill proposed by US lawmakers. On December 8, Massachusetts Senator Ed Markey and California Representative Jared Huffman claimed that Bitcoin miners consumed approximately 1.4% of the country’s electricity.

Furthermore, they stated that they were “sounding the alarm” about the energy consumption associated with cryptocurrency mining in the country. Senator Jeff Merkley co-sponsored the Crypto-Asset Environmental Transparency Act (EPA).

The Environmental Protection Agency would be directed to monitor crypto mining activity that consumes more than five megawatts. The bill includes allegations of miner-caused “noise and water pollution.” Concerns about climate change were cited by Markey and Huffman as one of the reasons for moving quickly to regulate the crypto industry.

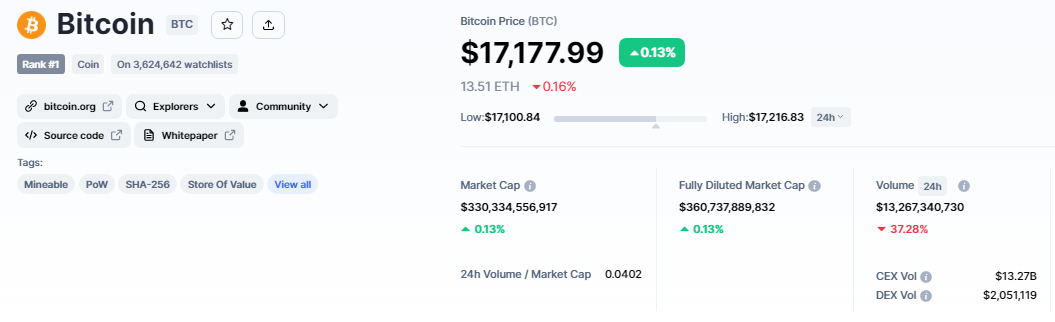

Bitcoin Price

Bitcoin’s current price is $17,177, and the 24-hour trading volume is $23 billion. The BTC price is has gained over 0.5% since yesterday.

The BTC/USD pair is trading with a positive bias after breaking above the $16,750 barrier. Bitcoin has formed an upward channel on the 4-hour timescale, which is supporting the bullish trend. BTC may encounter resistance near $17,400.

A bullish breakout above $17,400 could take Bitcoin to $17,650, and a bullish crossover above this level could take Bitcoin to $18,150. A bearish crossover below $17,000, a level stretched by the 50-day simple moving average, can initiate a selling trend that could extend all the way to $16,650.

Coins with Massive Upside Potential

Despite the bearish price action, the coins below are going from strength to strength, catching the attention of crypto whales.

IMPT (IMPT) – Only 1 day left in presale

IMPT is a carbon-credit marketplace that will reward customers for shopping with environmentally friendly businesses. It will issue carbon offsets as NFTs on the Ethereum blockchain when it launches next year, with users able to purchase such NFT-based offsets using the IMPT tokens they receive as a reward for shopping on the platform.

Since its initial public offering in October, IMPT has raised more than $17.8 million, with 1 IMPT currently trading at $0.023. The sale is set to end in less than two days, with listings on Uniswap, LBANK Exchange, and Changelly Pro following shortly after.

Visit IMPT Now

Dash 2 Trade (D2T) – Presale in the final stage

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides investors with real-time analytics and social trading data in order for them to make better trading decisions. It will go live in early 2023, with its D2T token being used to pay for monthly platform subscription fees (there are two subscription tiers).

Dash 2 Trade’s presale, which is now in its fourth and final stage, has already raised more than $9.3 million. It has also announced early next year listings on Uniswap, BitMart, and LBANK Exchange, implying that early investors will soon be able to lock in some profits.

Visit Dash 2 Trade Now

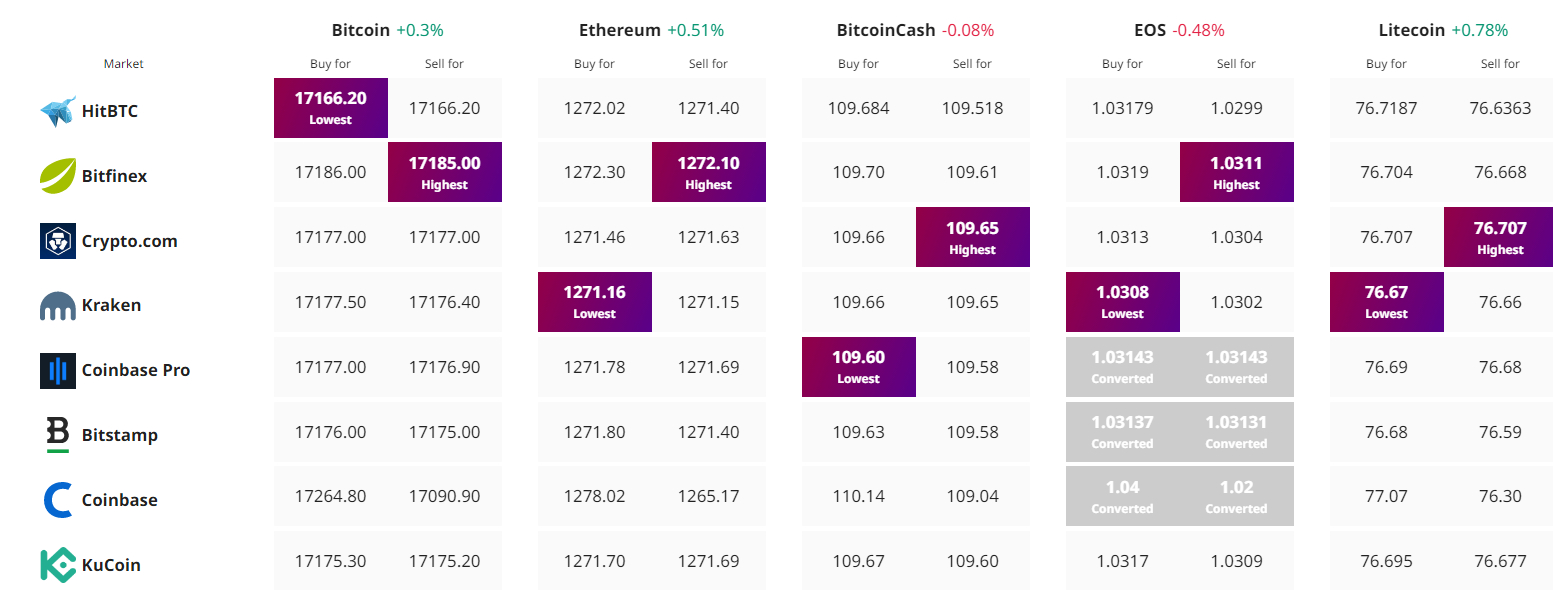

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com