[ad_1]

With Bitcoin’s price currently hovering around $23,000, there is uncertainty among traders and investors about the direction of its next move. As the market undergoes a period of consolidation, analysts and experts are making predictions about the future of Bitcoin’s price.

In this article, we will delve deeper into the current state of the market and examine several factors that could have an impact on the movement of Bitcoin’s price in the near future. We will explore various scenarios and provide insights on what traders and investors can expect in the coming days and weeks.

Bitcoin Bearish Market Slowing – What Does This Mean For BTC Prices?

A few days ago, Bitcoin (BTC) appeared to be in a price-RSI divergence pattern, which was a sign of relative trend weakness for the bears and would lead to a retracement. The retracement has now been completed, but the bears are also showing signs of weakness.

While Bitcoin exchange flows have been leaning toward the bears for the last few days, the selling pressure has been steadily decreasing. According to Glassnode alerts tracking daily on-chain flows, Bitcoin’s net flows on February 24 totaled -$29.5 million. While there has been a return of overall sell pressure, it has slowed around the time of publication.

The majority of purchasing power for Bitcoin comes from addresses owning 1,000 – 10,000 BTC, which were accumulating at press time. This is significant, as this address category controls the majority of the BTC in circulation. However, a bullish trend has yet to begin because addresses holding more than 10,000 BTC have been contributing to selling pressure.

It will be interesting to see whether the bulls are prepared to take over in the coming days and weeks. The current value of 1, 10, and 100 BTCs can be found using a Bitcoin Profit Calculator. Additionally, it is worth noting that Open Interest has been dropping in recent days, and a major shift in derivatives demand could be on the horizon.

The IMF Is Warning Investors About The Potential Risks Of Cryptocurrencies

The International Monetary Fund’s (IMF) executive board considers the use of crypto assets to be a threat to the global monetary system, with potential implications for monetary policy, capital flow management, and budgetary concerns.

In light of this, the IMF recommends that member countries take necessary measures to address the growing popularity of cryptocurrencies. The board advises against the use of digital coins as official tender by governments, pointing to recent examples of El Salvador and the Central African Republic’s adoption of Bitcoin.

The IMF’s concerns about the use of crypto assets reflect broader debates about the role of digital currencies in the global economy. As cryptocurrencies continue to gain mainstream acceptance, it will be important for governments and international organizations to consider their impact on the monetary system and to develop appropriate policies to mitigate potential risks.

It is essential to have strong macroeconomic policies, credible institutions, and sound monetary policy frameworks. The International Monetary Fund (IMF) recognizes the importance of these factors and will continue to provide guidance and advice in these areas.

However, the IMF has issued a warning that the growing use of cryptocurrencies poses a significant risk to the global monetary system. The use of digital assets has the potential to undermine monetary policy, bypass capital flow management, and raise fiscal concerns.

The IMF advises against governments declaring cryptocurrencies as legal tender, despite recent examples of El Salvador and the Central African Republic adopting Bitcoin as an official currency. The IMF’s cautious stance on cryptocurrency may lead to greater scrutiny and regulation, which could impact the adoption and value of Bitcoin and other digital currencies.

Block’s Q4 Bitcoin Revenue Down But Share Prices Jump 7%: The Story Behind It

Block, a multinational digital conglomerate founded by Jack Dorsey and previously known as Square, has reported $1.83 billion in bitcoin income from its Cash App payment service in Q4 2022. This is a decrease from the approximately $2 billion reported in the previous year’s fourth quarter, which the company attributed to the crypto market slump.

Despite the decline in bitcoin revenue, Block’s stock rose by approximately 7% after reporting positive overall financial results. In Q4 2021, when BTC reached an all-time high of nearly $70,000, the total amount of bitcoin sold to clients was higher at $1.76 billion.

Cash App, Block’s peer-to-peer payment software, generated over $7 billion in BTC revenue and $156 million in BTC gross profit in 2022, a 29% and 28% year-over-year decrease, respectively. The bitcoin gross profit in Q4 2022 was $35 million, a 25% decrease from the previous quarter.

Block explained that the year-over-year revenue fall was due to a decrease in the total dollar amount of bitcoin sold to clients, which is recognized as bitcoin revenue. The bitcoin gross margin in the quarter was 2% of bitcoin revenue.

The decline in bitcoin revenue is attributed to the crypto market crisis last year, as Bitcoin began trading at around $47,000 in 2022 and finished at around $16,500, representing a 65% decline.

Potential Impact: The decrease in bitcoin revenue reported by Block (previously known as Square) can have an impact on the value of Bitcoin. This news may indicate to investors that the demand for Bitcoin is decreasing, which could cause a decline in its price. Additionally, since Block is a major player in the cryptocurrency industry, its financial results may influence market sentiment and investor confidence in Bitcoin and other digital currencies.

Bitcoin Price

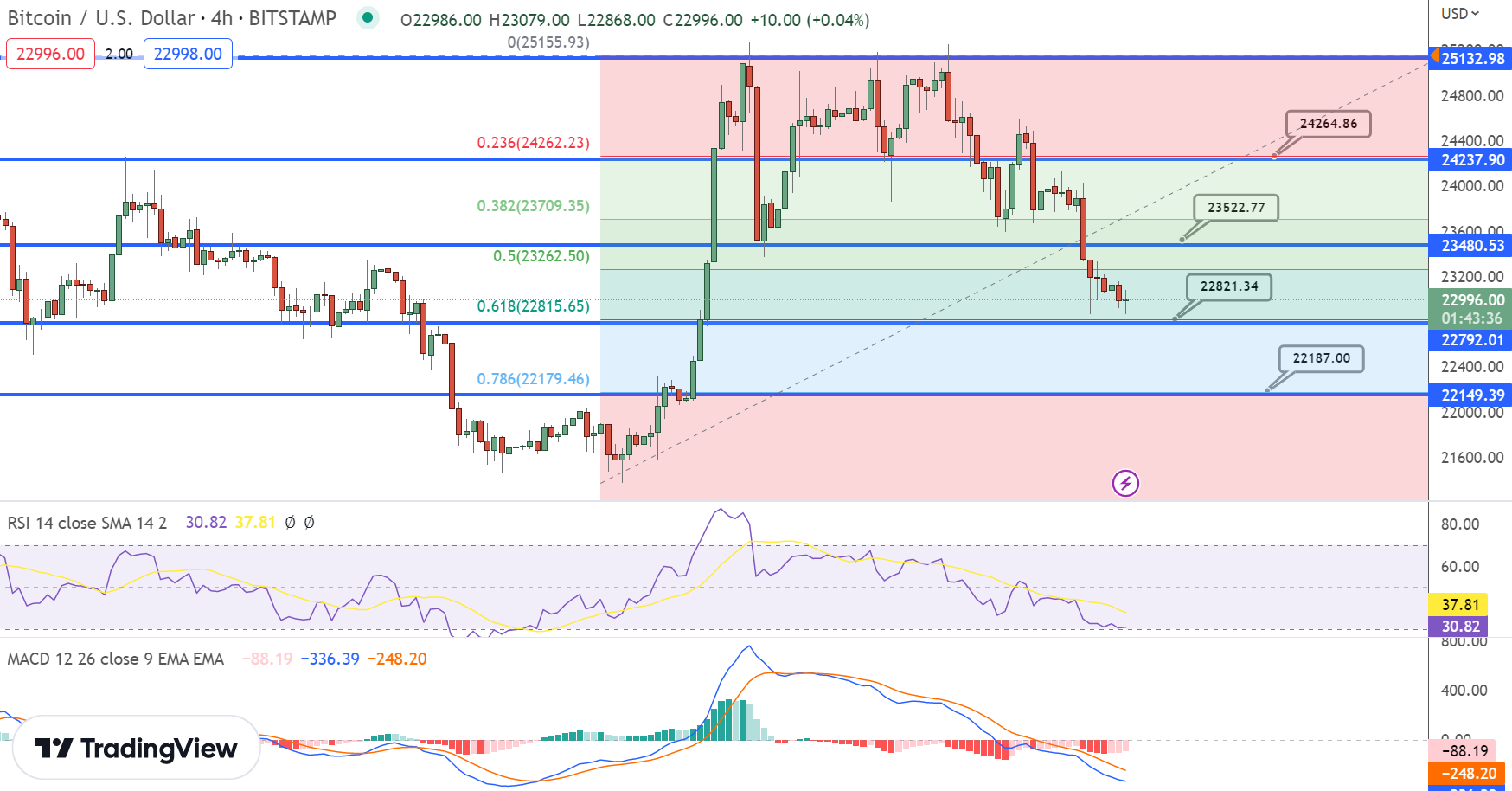

Bitcoin is currently trading at approximately $23,000, with a 24-hour trading volume of $18 billion and a 0.50% increase in the past day. The immediate support level for Bitcoin is at $22,800, and if the BTC/USD pair breaks below this level, it could potentially expose the price of BTC to the next support area at the $22,150 level.

Bitcoin Price Chart – Source: Tradingview

The resistance level for Bitcoin remains at around $23,500. However, since the BTC/USD pair has entered the oversold zone, there is a possibility that BTC may bounce off and break through the resistance level at $23,500, potentially leading to a price of $24,250.

Buy BTC Now

Bitcoin Alternatives

Investors looking to buy into Bitcoin may want to consider alternatives with more room for growth in the short term. Cryptonews has released an in-depth analysis of the top 15 cryptocurrencies that investors may want to consider for 2023. Click below to find out more.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

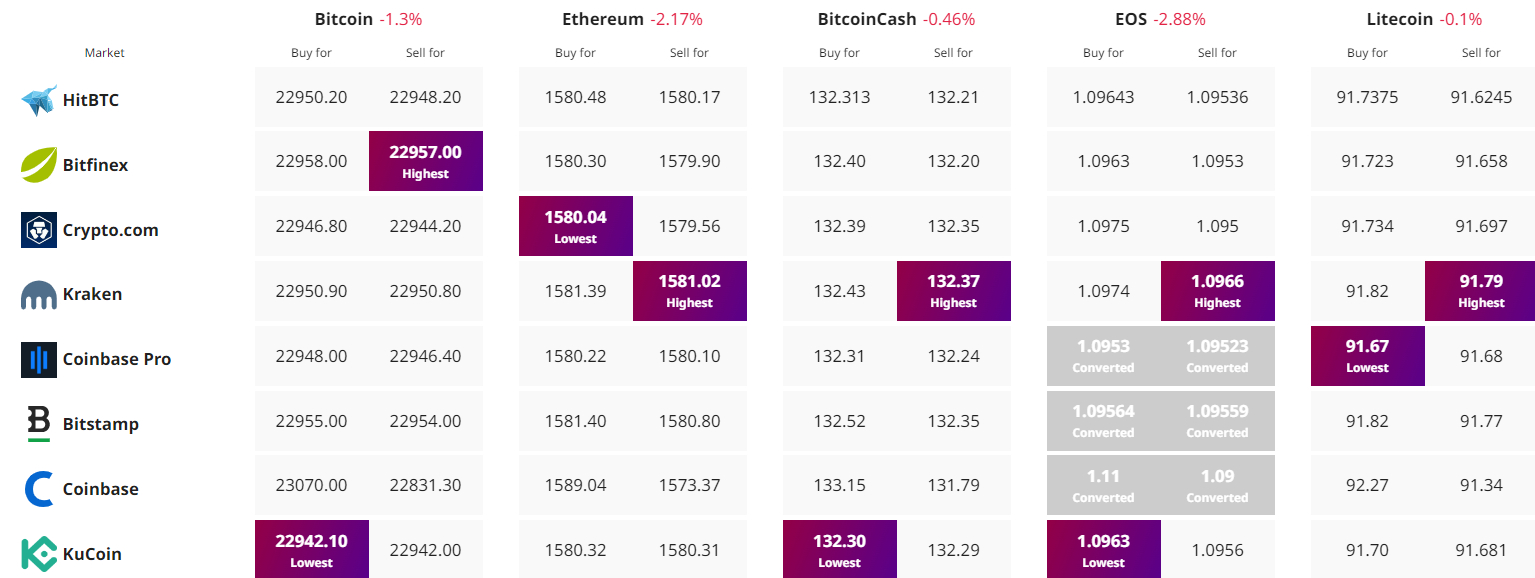

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com