[ad_1]

On January 29, Bitcoin price has surged over 2.5%, with the leading cryptocurrency reaching a price of over $23,500. The surge in bitcoin’s price has been fueled by institutional buying and the expectation of further adoption.

The technical outlook is suggesting bullish predictions for BTC’s future, but it remains unclear how high the asset will go. In this article, we explore how far BTC could climb in the near future and what factors will influence its path.

Institutional Investors Reveal Their Bitcoin Predictions: 65% Expect BTC to Reach $100K in 2023

According to a recent survey, institutional investors are confident about the future of Bitcoin and firmly believe that it could even reach $100,000. This strong sentiment is reflected in their expectations for the upcoming year as well.

The opinions of significant institutional investors on Bitcoin’s future price were disclosed in a poll by Nickel Digital Asset Management on Thursday. The Financial Conduct Authority (FCA) of the United Kingdom and the Commodity Futures Trading Commission of the United States both authorize and regulate the London-based investment management (CFTC).

Recently, Nickel hired Pureprofile, a market research firm, to undertake a global survey among institutional investors and wealth managers in the United States, the United Kingdom, Germany, Singapore, Switzerland, the United Arab Emirates, and Brazil. It was determined using the study of more than $2.85 trillion in AUM.

Nickel presented the findings of the survey in detail.

Professional investors are forecasting a strong year ahead for bitcoin and are confident about its long-term valuation. Nearly nine out of 10 professional investors predict bitcoin price rise this year. Two out of three agree $100,000 valuation is possible but only for long-term investors.

The asset manager’s study uncovered a strong belief in bitcoin’s price trend for the foreseeable future; in fact, 23% of participants believed that it will surpass $30,000 by 2023.

Besides, according to a survey, two-thirds of institutional investors believe that Bitcoin could potentially hit $100,000 in the long term. Among them, nearly 60% think that the price level would be achieved in 3-5 years while 25% say it would require more than five years.

According to a survey, 39% of respondents think that the value of Bitcoin will reach its record-breaking peak price of $69,000 in 3 years’ time while 76% said it will happen within 5 years. According to a recent survey by an asset management firm, only 3% of people doubted that bitcoin could reach its all-time high again.

Fed Interest Rate Hikes

Investors will be tuning in to Jerome Powell’s press conference after the policy meeting to gain further insight into how much more interest rates could increase and learn when the Federal Reserve may halt their increases.

Industry experts anticipate the federal funds rate to increase by 0.25%, bringing it to a range of 4.5% to 4.75%, when the Federal Reserve meets on Wednesday. This would mark the second consecutive rise in this rate, albeit at a slower pace than before.

In addition, the official Labor Department report set to be released on Friday will likely demonstrate that there was an addition of 185,000 jobs in January – a decline in comparison with the 223,000 added in December.

The unemployment rate is expected to have gone up slightly and will stand at 3.6%. There are predictions that hourly wages will decrease as compared to the previous month.

Bitcoin Price

Currently, the price of Bitcoin is $23,526 and has seen a positive gain of 2.50% over the last 24 hours. Its market volume is estimated to be at $22 billion while its market cap stands at an impressive $453 billion and holds the number 1 position on CoinMarketCap’s rankings.

On the 4-hour timeframe, the BTC/USD price has broken through the triple top level of $23,400 and now has the potential to move higher towards $24,066. If the price breaks above $24,066, it could move even higher to $25,150.

The breakout of symmetrical triangle pattern typically drives an uptrend in Bitcoin. So, we can expect a continuation of an uptrend in the BTC price.

On the downside, Bitcoin’s immediate support stays at $23,350, and a breakout of this level can extend the selling trend until $22.800 or $22,350.

Buy BTC Now

Bitcoin Alternatives

CryptoNews just listed the 15 most promising cryptocurrencies for 2023. If you want to invest, there are alternative ventures out there that could provide a nice return if you do your homework.

Cryptocurrency investors and traders are always monitoring altcoins and ICOs in the digital asset arena in order to stay up to date on all emerging trends and opportunities.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

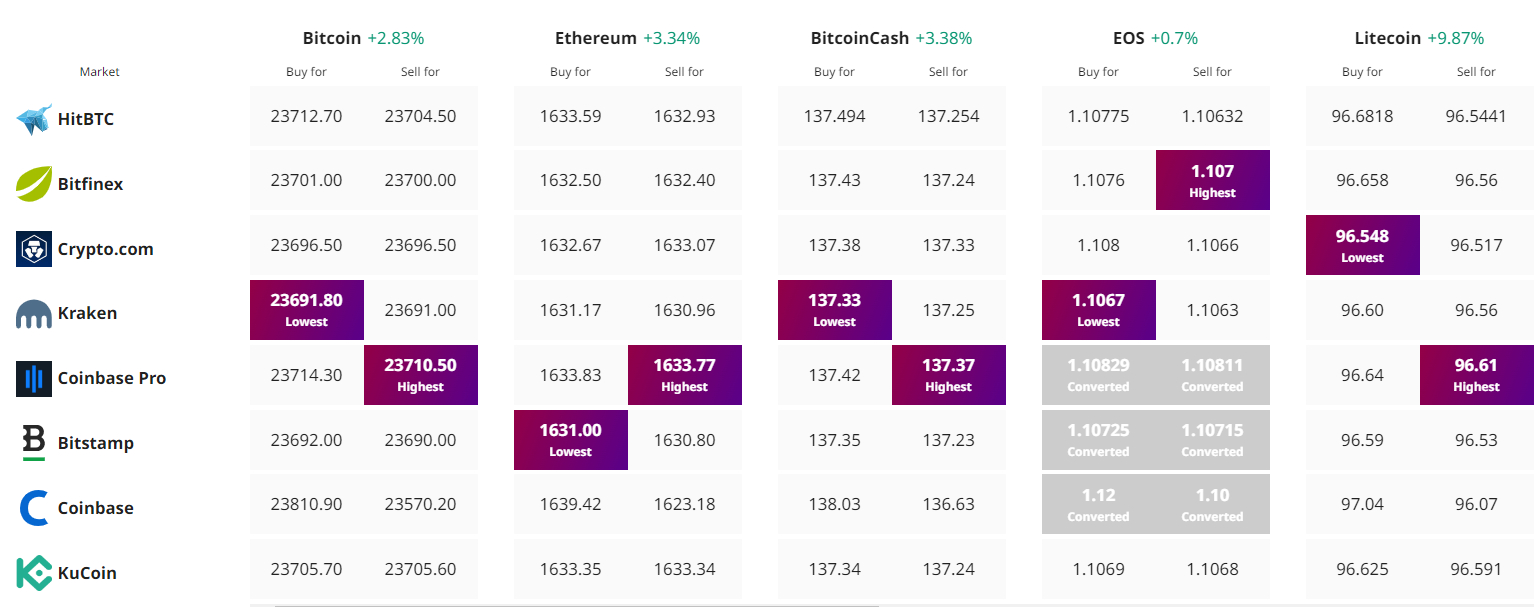

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com