[ad_1]

The price of Bitcoin has been calm and trading sideways in recent weeks. However, as the new week begins, there are signs of advancement for BTC. The big question on everyone’s minds is whether Bitcoin can reclaim the $24k mark today.

In this article, we’ll explore the current state of the market and analyze the factors that may influence the price of Bitcoin in the short term.

Understanding the Current Crypto Regulatory Landscape

At the G20 meeting in India on February 25, the managing director of the International Monetary Fund (IMF), Kristalina Georgieva, expressed a preference for identifying and regulating crypto assets rather than implementing a total ban. However, the possibility of banning private cryptocurrencies still remains on the table.

In a recent interview with Bloomberg (February 27), Georgieva clarified her remarks regarding a potential total ban on cryptocurrency, acknowledging the current uncertainty surrounding the classification of digital currency. She also discussed the United Nations’ financial agency’s stance on digital assets and its preferred regulatory framework.

Senior White House officials have recently urged the US Congress to enhance efforts to regulate the cryptocurrency sector, while the UK government has proposed plans to subject crypto assets to the same legal framework as traditional financial services.

As demand for further regulation grows, understanding potential regulatory structures and how to operate in a more regulated crypto sphere has become increasingly important for cryptocurrency investors.

Anticipating Prolonged Interest Rate Hikes

The latest Gross Domestic Product (GDP) figures as of February 23 reveal that the US economy expanded by 2.7%, which is slightly less than the preliminary estimate of 2.9%. Meanwhile, the Bureau of Economic Analysis (BEA) reported on February 24 that inflation increased by 5.4% in January compared to the previous year, as shown in the Personal Consumption Expenditures (PCE) data.

The higher-than-expected PCE Price Index, the Federal Reserve’s preferred inflation gauge, supports a hawkish approach. The Federal Reserve has set a target of 2% overall inflation, and market participants expect interest rates to rise for an extended period to control inflation.

During the early US session, retail sales data showed mixed results. In January, orders for manufactured goods declined by 4.5%, largely due to a drop in volatile passenger-plane bookings. However, there was good news for the early-year economy, as business investment increased at the fastest rate in five months.

According to economists polled by the Wall Street Journal, orders for durable goods, which include products like cars, planes, and computers intended to last for at least three years, were expected to decline by 3.6%. However, if transportation is excluded, new orders rose a solid 0.7% last month.

Additionally, a crucial measure of business investment experienced its most significant growth since the previous summer.

CEO of Grayscale Inc. Requests SEC Approval of GBTC Exchange-Traded Fund

Grayscale CEO Michael Sonnenshein is advocating for the conversion of GBTC to an ETF, a goal the firm has pursued for some time. According to Sonnenshein, the SEC is violating the APA’s Section 706(2)(A) by approving Bitcoin futures ETFs but not GBTC’s conversion. Grayscale’s GBTC, which enables institutional investors to gain regulated Bitcoin exposure, has traded at a significant discount to its NAV.

If the SEC approved the conversion, the discount would disappear, and GBTC would trade near the Bitcoin spot price, drawing in new investors and generating billions in capital.

Bitcoin Price

Currently, the live Bitcoin price today is $23,250 with a 24-hour trading volume of $23.3 billion. Bitcoin is down nearly 1% in the last 24 hours. The current CoinMarketCap ranking is #1, with a live market cap of $448 billion.

On the 4-hour timeframe, Bitcoin struggled to surpass the significant resistance level of $23,750. The closing of candles below this level resulted in a bearish correction, potentially pushing the price of BTC further down to the $22,800 mark.

The immediate support level for the BTC/USD pair is currently at $22,800, and if it breaks below this, it could expose BTC’s price to the next support area at the $22,150 level.

Although the BTC/USD pair is currently oversold, a rebound is possible if the oversold condition persists, allowing Bitcoin to break past the $23,500 resistance level and potentially leading to a price of $24,250.

Buy BTC Now

Bitcoin Alternatives

Investors looking to buy into Bitcoin may want to consider alternatives with more room for growth in the short term. Cryptonews has released an in-depth analysis of the top 15 cryptocurrencies that investors may want to consider for 2023. Click below to find out more.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

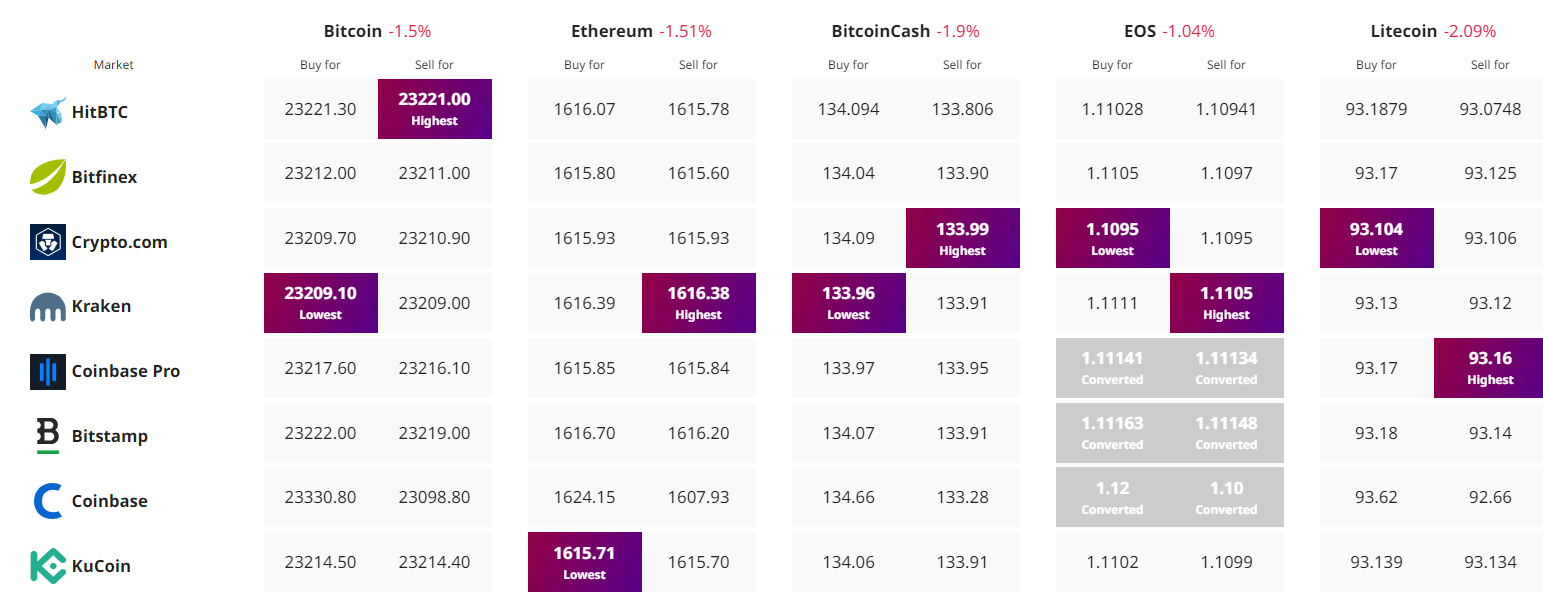

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com