[ad_1]

On Sunday, Bitcoin price prediction remains neutral, as BTC has failed to break out of a narrow range of $16,850 to $17,250. Bitcoin miners appear to have given up on the long-term profitability of holding any significant amount of the pioneer crypto and are instead selling off enormous quantities of Bitcoin.

CryptoQuant has revealed that on December 1st, Bitcoin miners dropped 10,000 BTC. Compared to the 2,569 units that entered the market and were subsequently sold by miners on November 26th, this amount is much lower.

Joaowedson, a CryptoQuant analyst, weighed in on the subject, citing the high cost of Bitcoin mining and the precipitous decline in value of the crypto asset as causes.

Joaowedson added:

“Miners are being compelled to sell their stakes because of the present price of Bitcoin and the high cost of mining in various countries.”

The “makers” of the largest cryptocurrency by market cap and the asset itself are both doomed in their current states. Because of the recent drop in Bitcoin’s value and the high cost associated with creating a single Bitcoin, Bitcoin miners may no longer make a profit from their efforts.

The price of the cryptocurrency could fall and its volatility could increase if they keep dumping the results of their labor into the market. Past market selloffs have also had an impact on mining industry earnings.

Glassnode reports that miners made 814.28 BTC at the time this article was written. Given this, it’s not hard to see how one may conclude that Bitcoin doesn’t provide anything in the way of rewards or transaction fees for its miners.

US Dollar Fell Multi-Month Low

Another key reason supporting BTC prices was the fall of the US dollar, which touched a three-month low.

Investors took advantage of unexpectedly favorable job data, which was considered as one of the primary drivers in limiting the dollar’s falls.

The dollar gained some ground, meanwhile, when data showed that private-sector employers increased payrolls by 263,000 in November, well over the 200,000 predicted.

However, the declines were short-lived, as they fell to a three-month low amid a dovish stance.

Putin Calls for Digital Currency Settlements

Russian President Vladimir Putin has advocated for a new international settlements system that is unconstrained by banks and other intermediaries. The Russian leader was quoted as saying that it is possible to construct such a system using digital currency technologies and distributed ledgers.

Russian financial powerhouse Sberbank hosted Putin at a conference focused on AI. During his talk, he stressed that financial flows and payments between states are currently under threat amid tight relations between Russia and the West.

The president Putin elaborated:

“We all know very well that under today’s illegitimate restrictions, one of the lines of attack is through settlements. And our financial institutions know this better than anyone because they are exposed to these practices,”

Putin was referring to the international sanctions that have severely restricted the Russian Federation’s access to global financial and market institutions following the country’s invasion of neighboring Ukraine.

The Prime news agency claims that he also mentioned:

Today, the system of international payments is expensive, with correspondent accounts and regulation controlled by a small club of states and financial groups.

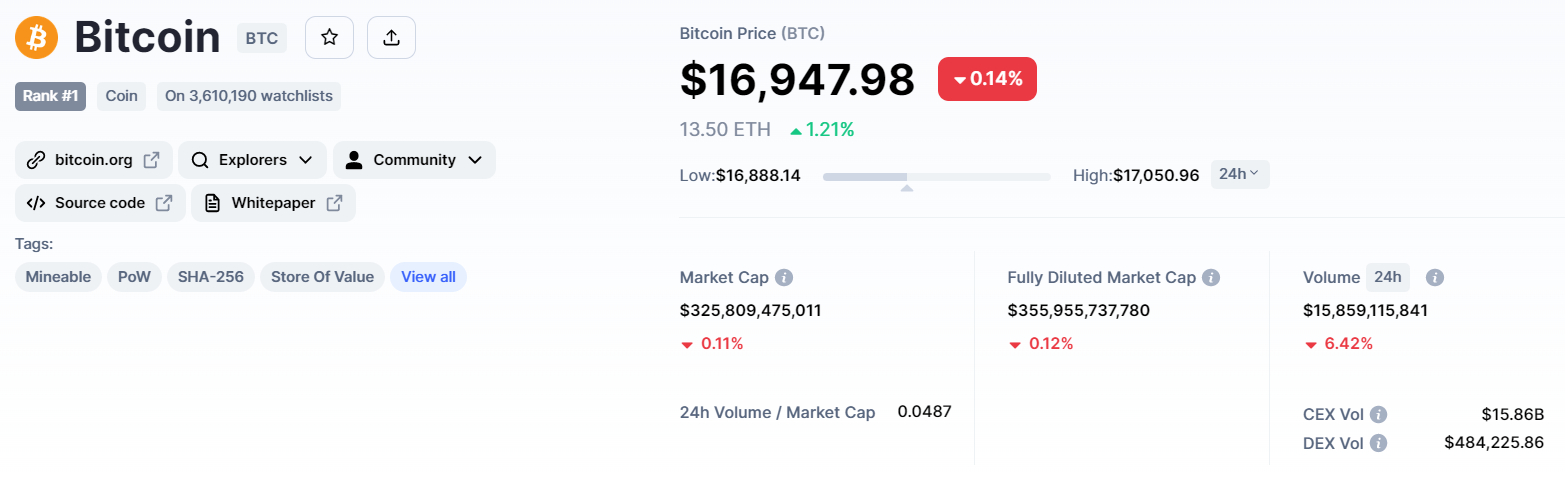

Bitcoin Price

The current Bitcoin price is $17,010, with a 24-hour trading volume of $15 billion. The BTC/USD pair has surged over 0.10% in the last 24 hours. Additionally, its value has increased by around 2.75% in the past week.

The BTC/USD pair has struggled to break over $17,250, and it is currently trading sideways in a narrow trading range of $16,800 to $17,250.

Bitcoin has completed a 23.6% Fibonacci retracement at $16,900, and closing candles below $16,950 may prompt new selling until the $16,750 resistance level is achieved.

Further down, Bitcoin can aim for the $16,600 level, which is a 50% Fib extension, and a break below this level will expose BTC to the $16,450 level, which is a 61.8% Fib extension.

A bullish breach of the $17,250 resistance level, on the other hand, might expose BTC to levels as high as 17,650 and $18,100.

Coins with Massive Potential

Despite the market collapse, some coins have outperformed, garnering the interest of crypto whales.

One of these is IMPT, whose presale ends in less than a week.

IMPT: 1 Week to Buy This $13.5 Million Green Crypto

Another Ethereum-based platform, IMPT, is a carbon-credit marketplace that will compensate customers for doing business with environmentally beneficial businesses. These benefits will be delivered in the form of the company’s IMPT token, which can be used to purchase NFT-based carbon offsets that may be sold or retired.

Since its initial public offering in October, IMPT has raised more than $13.6 million, with 1 IMPT now trading at $0.023. Due to its phenomenal success, IMPT.io, a new platform for carbon offsetting and carbon credits trading, will end its token presale on December 11th.

Visit IMPT Now

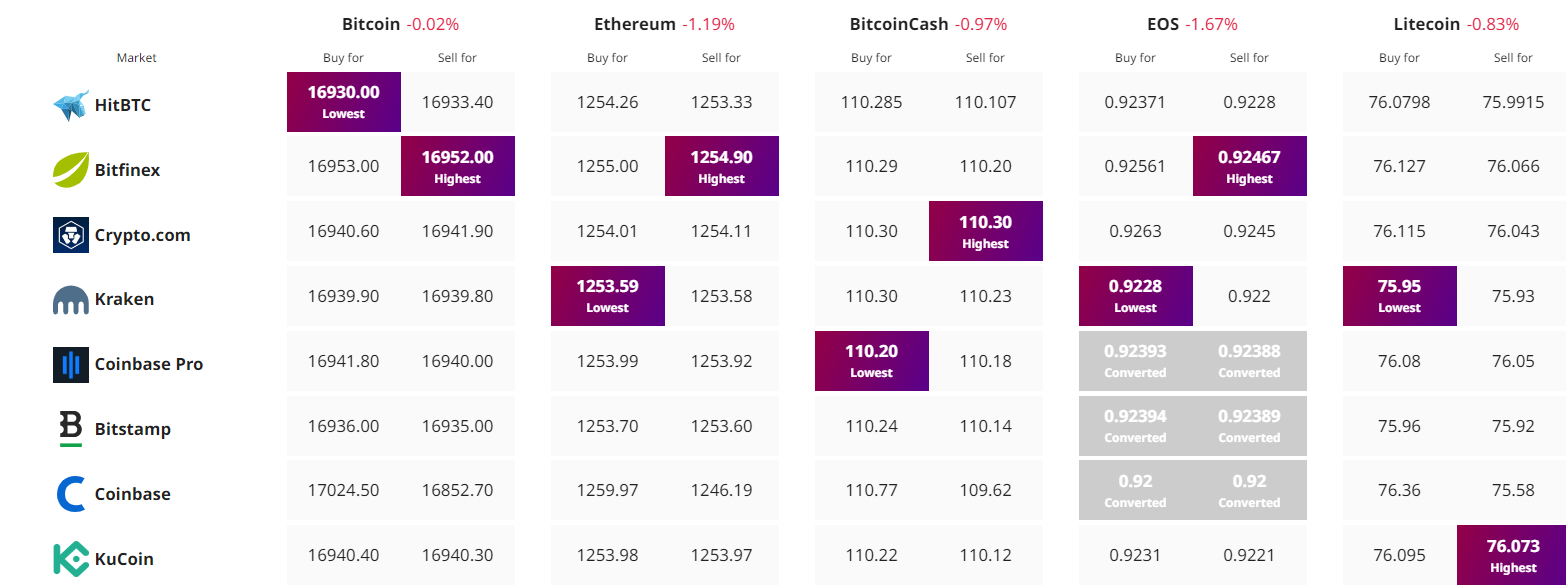

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com