[ad_1]

Bitcoin and Ethereum prices have been steady despite experiencing significant volatility in the past few weeks. Bitcoin is maintaining a narrow range between $22,350 and $23,350, while Ethereum is trading choppily within a tight range of $1,550 to $1,630.

As we enter the weekend, many investors are wondering if this could be the time for a breakout.

The answer to this question lies in the analysis of Bitcoin and Ethereum prices over recent days. By looking at the historical trends of these two leading cryptocurrencies, investors can get an idea of whether or not this weekend could see BTC & ETH break out from their current ranges.

Furthermore, by understanding the underlying factors that influence Bitcoin and Ethereum prices, investors can make informed decisions about their investments.

Cryptocurrency Market Overview: The Fundamentals Of An Upcoming Boom

A cryptocurrency bullish rally was sparked by the previously released Personal Consumption Expenditures (PCE) report, which showed a slowdown in inflation at the end of last year.

As a result, traders expect the FOMC to raise interest rates by 25 basis points (or 0.25 percentage points) at its February meeting. If the Fed maintains its hawkish stance, Bitcoin (BTC-USD) may suffer.

The recent US inflation print, on the other hand, served as a confirmation signal for investors to buy Bitcoin and other cryptocurrencies.

Furthermore, increased institutional investors in the United States were responsible for rising Bitcoin prices.

New York Introduces Groundbreaking Legislation To Allow Crypto Payments

Since early 2023, there have been numerous developments in the cryptocurrency space that have been helping to support and drive the crypto market. On 26th January, the New York State Senate introduced a bill allowing government establishments to accept cryptocurrency as an official form of payment.

This could help further legitimize the use of digital currencies in mainstream commerce.

If New York Assembly Bill 2532 is passed and becomes law, cryptocurrencies will be accepted as payment under certain conditions, which will benefit the cryptocurrency sector in the long run. It should also be noted that this bill does not appear to support the commercial use of cryptocurrencies.

Alternatively, the current legislation would be amended to allow state agencies to use cryptocurrencies.

However, the bill specifies Bitcoin Cash, Ethereum, Litecoin, and Bitcoin as acceptable currencies. The bill was written by Assemblyman Clyde Vanel, who has also proposed legislation on cryptocurrency fraud and the formation of industry task forces.

Wendy Rogers Introduces Bills To Make Bitcoin Legal Tender In The US

Senator Wendy Rogers from Arizona is making her mark in the US Senate by introducing a number of bills on cryptocurrencies. Her work is bringing about several cryptocurrency-related changes and making a positive impact on the state of Arizona.

It is important to recognize the efforts of Senator Wendy Rogers who has been actively involved in issuing bitcoin banknotes. Rogers mentioned a study by Goldman Sachs which revealed that Bitcoin is the most profitable asset in the world, regardless of geographical region. This data indicates that Bitcoin has emerged as the top performer globally.

The United States is contemplating on the potential of officially recognizing Bitcoin (BTC) as a legal tender. If this proposal is successful, it will open up new opportunities for cryptocurrency and could bring about an exponential surge in its value.

Higher US Dollar Might Cap Gain In BTC

The broad-based US dollar has been flashing green and has risen from eight-month lows as expectations for a Federal Reserve-engineered economic soft landing and a pause in its aggressive monetary tightening next week have grown in response to slowing inflation data.

According to a report from the Commerce Department, consumer spending in the United States declined for two consecutive months in December.

The report also showed the smallest increase in personal income in eight months, largely due to moderate wage growth – though not necessarily positive signs for inflation.

Bitcoin Price

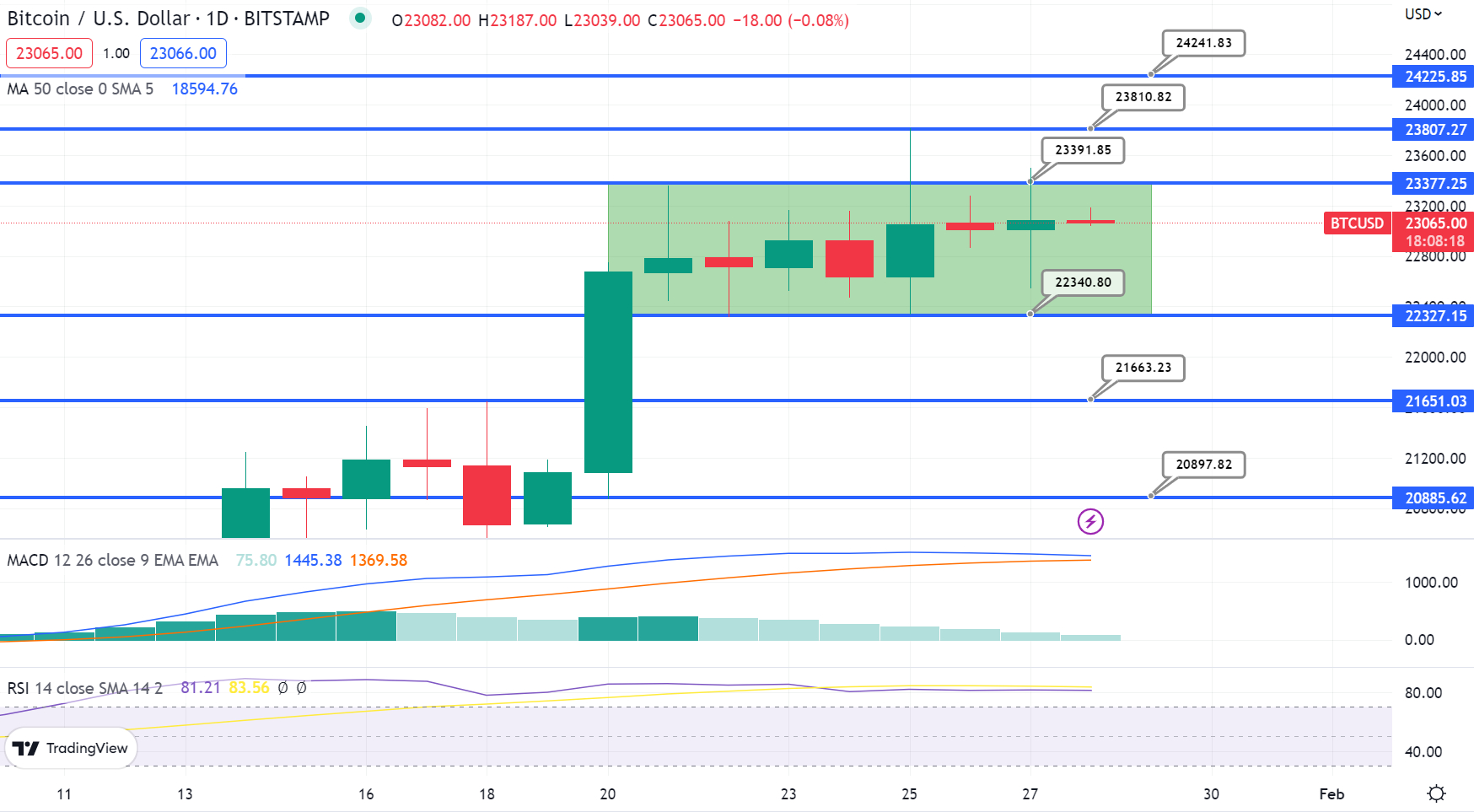

Bitcoin is currently valued at $23,004, with a 24-hour trading volume of $22 billion. In the last 24 hours, Bitcoin has been choppy, up less than 0.50%. With a live market worth of $435 billion, CoinMarketCap currently ranks top.

Bitcoin is currently encountering resistance at the $23,250 level, with immediate support remaining stable at $22,500. If the price of Bitcoin falls below $22,500, a bearish market trend is likely, and it could reach as low as $21,500. If it continues to fall from there and reaches $20,450, we may see an even more bearish trend.

The Relative Strength Index and the Moving Average Convergence Divergence are both overbought. Nonetheless, a bullish engulfing candle was recently observed, suggesting that the bullish market trend will continue.

Bitcoin’s immediate resistance level is at $23,250; if it breaks above this price point, it could move as high as $23,900 and $25,150.

Buy BTC Now

Ethereum Price

Ethereum is currently trading at $1,595 and has experienced a 1.5% decrease in the past 24 hours with a total trading volume of $6 billion. It’s ranked 2nd on CoinMarketCap, with a live market capitalization of $195 billion.

In the 4-hour timeframe, the ETH/USD pair fell sharply from the $1,600 level. This drop was caused by a break in an upward channel and a subsequent close below this price point. The downward trend eventually resulted in a bottom at $1,525 per share.

At $1,600, Ethereum may encounter resistance. If it can break through this barrier, its price might rise to $1,675. Alternatively, there is a chance of a bearish trend beginning at $1,525 that might extend to $1,445 if it does break down.

Buy ETH Now

Bitcoin Alternatives

CryptoNews Industry Talk has reviewed the top 15 cryptocurrencies for 2023. If you’re looking for a higher potential investment opportunity, there are plenty of other projects worth considering.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

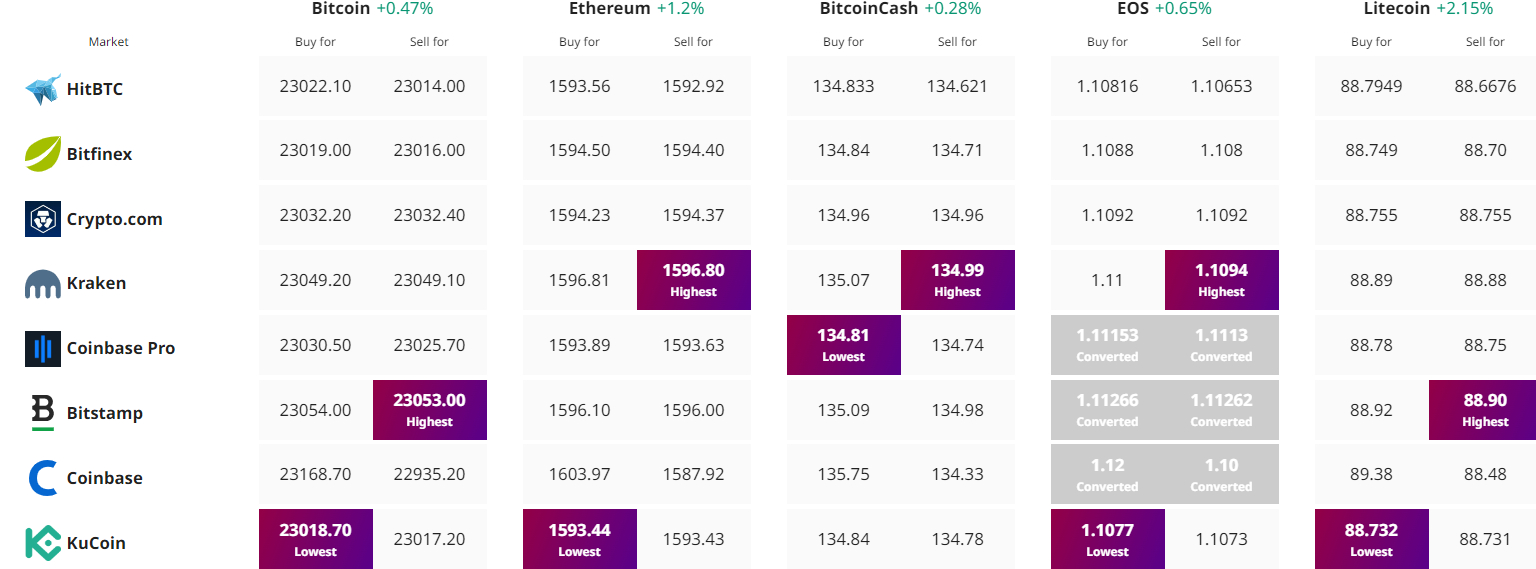

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com