[ad_1]

Bitcoin and Ethereum prices have been on the rise for the past few months, and even today. This has resulted in many investors wondering if another 5% rise is possible for BTC and ETH today.

To answer this question, we need to look at the current market conditions and analyze whether or not there is enough momentum in the market to push Bitcoin and Ethereum prices higher.

Risk-On Crypto Mood: What You Need To Know About The Current Market Opportunities

Cryptocurrency markets had a positive start on January 30th with the global crypto market capitalization growing by 1.77% to $1.07 trillion in the last 24 hours. Total crypto trading volume also increased significantly by 24.92%, bringing it up to $49.61 billion in the same period of time.

Multiple aspects such as favorable market conditions, augmented institutional buying, and the anticipation of extensive utilization contributed to the success of the market.

In contrast, there is reason to be concerned if the US Federal Reserve decides to raise interest rates, as shifting market perceptions about it could have a significant impact on the cryptocurrency market.

Notably, if the interest rate increase is greater than expected by the market, the impact on the cryptocurrency market may be slightly negative.

Moving on, if macroeconomic factors remain stable, the current momentum could be maintained in the coming weeks.

Understanding The Bitcoin Premium In Nigeria: What You Need To Know

Nigeria’s central bank has continued to push its citizens to use digital currency, causing the price of Bitcoin to skyrocket far above market levels.

As of this writing, 1 BTC costs 17.8 million Naira, or $38,792 on the Nigerian cryptocurrency exchange NairaEX. This represents a more than 60% premium over the current market price of Bitcoin, which is around $23,700 as of this writing.

In order to accelerate the country’s transition to a cashless society, the Central Bank of Nigeria has continued to impose restrictions on ATM cash withdrawals.

The central bank restricted cash withdrawals earlier this month due to a decision made in December.

Institutional Investors Expect bitcoin to Have a Strong Year

According to a recent survey, institutional investors are bullish on bitcoin’s long-term value and expect it to have a good year. It is worth noting that the results of a Nickel Digital Asset Management survey on how high institutional investors expect the price of bitcoin to rise were released on Thursday.

Pureprofile, a market research firm, conducted a survey this month with 200 institutional investors and wealth managers from the United States, the United Kingdom, Germany, Singapore, Switzerland, the United Arab Emirates, and Brazil. However, respondents managed a total of $2.85 trillion in assets.

It is also worth noting that the study discovered high levels of confidence in cryptocurrency’s long-term trend. According to the asset manager, 23% of respondents believe BTC will be worth more than $30,000 by the end of 2023.

Furthermore, 65% of institutional investors polled believe bitcoin will eventually reach $100,000. Almost a quarter believe it will take five years or more, while 58% believe it will take three to five years.

As a result, these positive predictions were viewed as one of the key factors that influenced BTC prices and restored investor confidence in Bitcoin.

Bitcoin Price

As of today, the current Bitcoin price is around $$23,672; its 24-hour trading volume is around $26 billion. According to CoinMarketCap, it has a market cap of $456 billion and ranks 1st.

The BTC/USD price has broken through the triple top level of $23,400 on the 4-hour timeframe and now has the potential to move higher towards $24,066. If the price breaks through $24,066, it could rise to $25,150.

In Bitcoin, the breakout of a symmetrical triangle pattern typically drives an uptrend. As a result, we can expect the BTC price to continue rising.

On the downside, Bitcoin’s immediate support remains at $23,350, and a break of this level might extend the selling trend all the way to $22.800 or $22,350.

Buy BTC Now

Ethereum Price

As of now, Ethereum is being traded for $1,629 with a 2.25% surge in the last 24 hours & a trading volume of $8.1 billion. It’s currently second on CoinMarketCap with a market capitalization of $199 billion.

Since the breakout of a symmetrical triangle pattern, Etherum is on a rise, and now likely to gain an immediate support near $1,620 levels. On the lower side, support is present at $1,560, and a break below this level could lead ETH toward $1,500.

On the upside, Ethereum’s immediate resistance prevails at $1,660 or $1,680 levels. A bullish break above the $1,680 level could send ETH toward the $1,745 mark.

Buy ETH Now

Bitcoin Alternatives

CryptoNews Industry Talk has evaluated the top 15 cryptocurrencies for 2023. If you’re looking for a more promising investment opportunity, there are other alternatives to consider.

Every week, new altcoins and ICO projects are added to the list.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

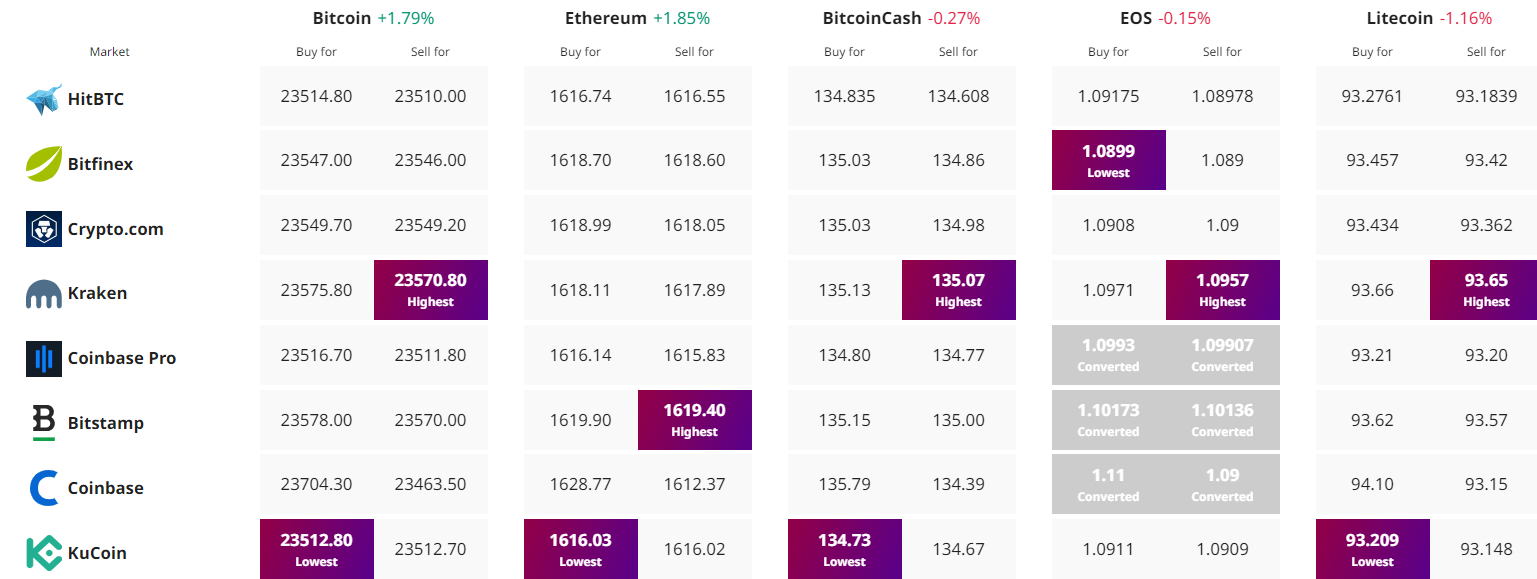

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com