[ad_1]

As Bitcoin (BTC) continues hovering around the $20K area, the balance on exchanges is shrinking.

Market analyst Ali Martinez explained:

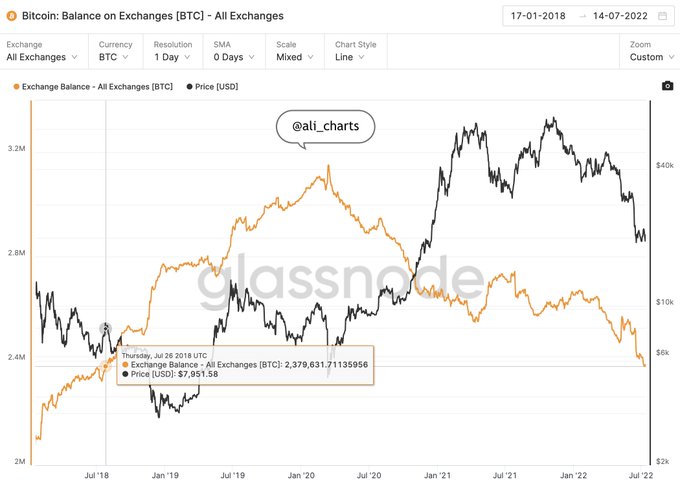

“The last time the BTC balance on exchanges was below 2.38 million BTC was in late July 2018 when Bitcoin was trading at around $8,000.”

Source:Glassnode

Bitcoin exiting crypto exchanges is bullish because it symbolizes a hodling culture, given that coins are often transferred to cold storage and digital wallets for future purposes other than speculation.

With BTC’s balance on exchanges dropping to a 4-year low, time will tell whether this will trigger the much-needed momentum to drive the leading cryptocurrency upwards based on its current consolidation around the psychological price of $20,000.

For the ranging market to be breached, Michael van de Poppe believes the $21,200 area should be broken. The CEO and founder of educational platform Eight stated:

“No break of $21.2K for Bitcoin means some more consolidation. On the other hand, the coming weeks are crucial for EUR/USD. It makes sense to have a slight reversal there, and I’m also expecting Bitcoin not to be done with the upside. Cracking $21.2K is a crucial one.”

Similar sentiments were shared by crypto trader Rekt Capital, who pointed out:

“It’s easy to become bullish on BTC on a green day & bearish on a red day. But BTC is still just between $19K-$22K. This will continue until either of these levels is broken.”

Bitcoin oscillated around the $20.6K zone during intraday trading, according to CoinMarketCap.

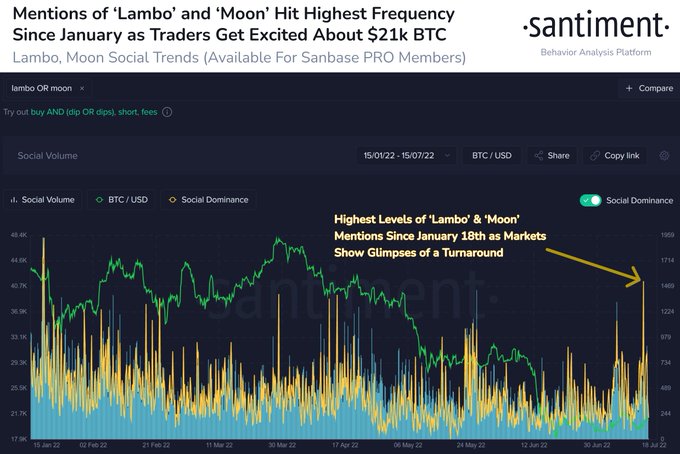

Meanwhile, Bitcoin traders are depicting high optimism levels, suggesting that they expect a bullish momentum. On-chain insight provider Santiment stated:

“Bitcoin’s mild +8% July rise has been enough for crypto traders to begin breaking out the lambo & moon mentions again. Whether sarcasm or not, this occurs when traders are becoming overly optimistic. Mentions hit their highest levels since Jan 18.”

Source:Santiment

Furthermore, BTC was one of the trending topics among investors due to high social dominance levels, Blockchain.News reported.

Image source: Shutterstock

[ad_2]

blockchain.news