[ad_1]

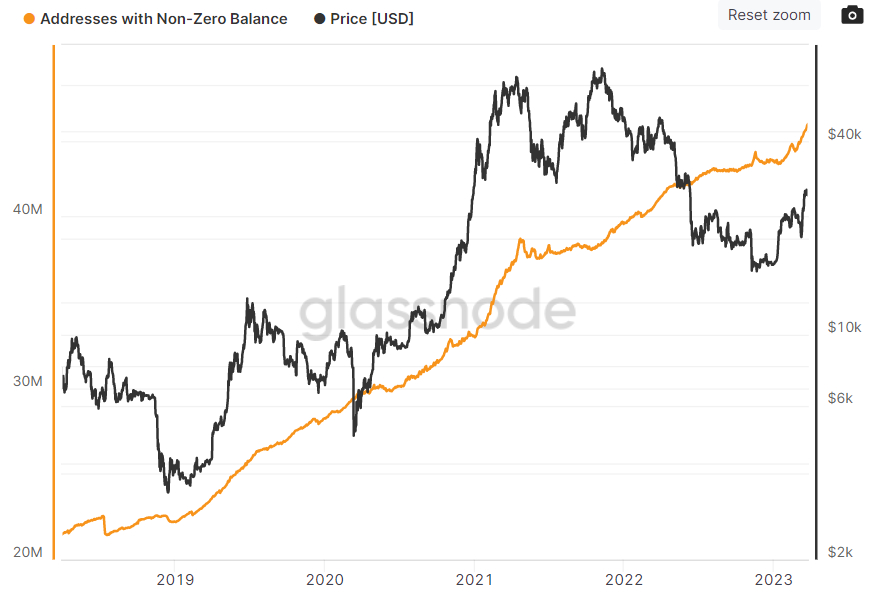

The number of Bitcoin wallets holding a non-zero BTC balance continues to rocket higher, hitting a new all-time high of 45.388 million on Sunday, as per data presented by crypto analytics firm Glassnode.

That’s a rise of over 2 million since the start of 2022 and is the fastest rate at which the Bitcoin network has added non-zero wallet addresses since early 2021.

That’s good news for the Bitcoin price, as a higher number of wallets with a non-zero balance implies a greater number of investors are stepping into the Bitcoin market, or, in simpler terms, that demand continues to grow.

However, a few other widely followed metrics pertaining to activity on the Bitcoin blockchain have weakened in the last few days, in wake of Bitcoin’s failure to test $30,000 last week.

If Bitcoin is to blast past $30,000, a pickup in these metrics will likely be needed.

Bitcoin Network Activity Weakens

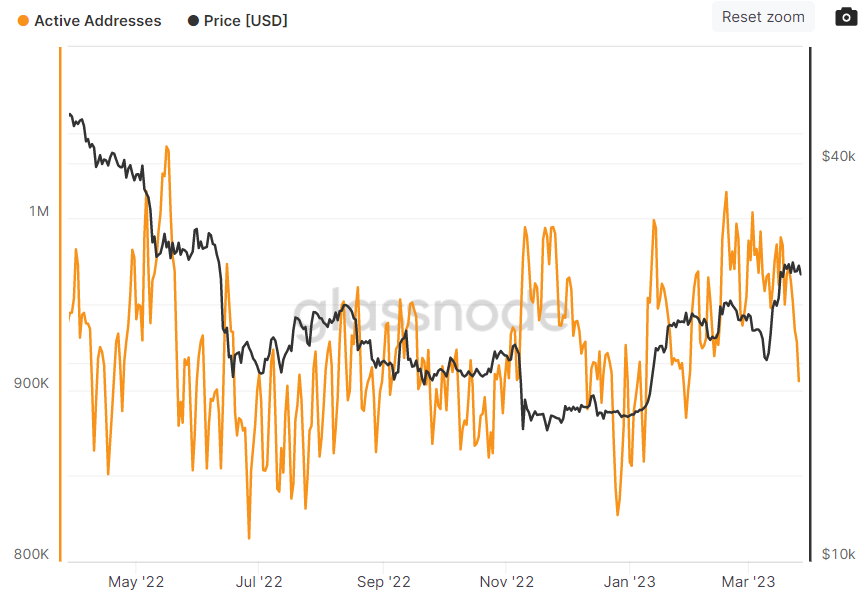

The seven-day moving average of the number of active addresses interacting with the Bitcoin network on a daily basis recently fell to its lowest level since late January.

Less activity between wallets on the Bitcoin networks suggests that Bitcoin trading volumes have fallen versus their levels over the last few weeks, implying demand weakness.

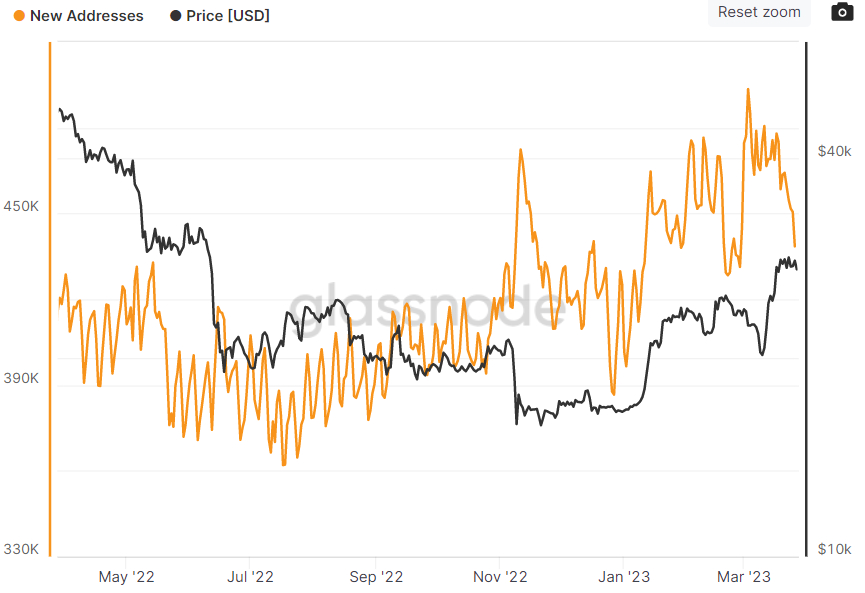

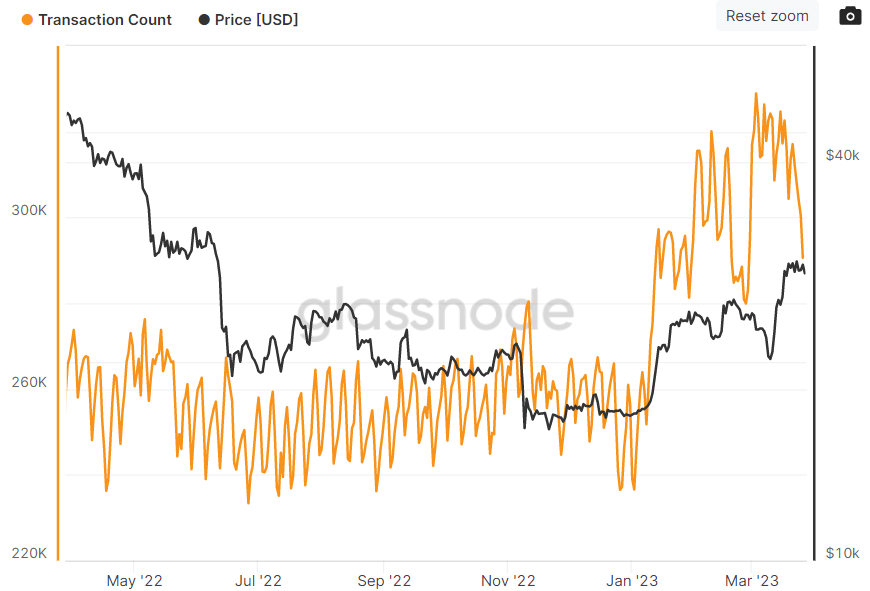

Meanwhile, the seven-day moving average of the number of new addresses interacting with the Bitcoin network recently fell to one-month lows, as did the seven-day moving average number of transactions taking place on the Bitcoin network.

As above, this weakness in key metrics measuring network activity, utilization and growth suggests a slight weakening of demand for Bitcoin.

But Bulls Shouldn’t Panic

Bitcoin bulls shouldn’t panic. Despite some modest weakness in these metrics, all three remain in an uptrend for the year and should, at the very least, remain at elevated levels compared to where they were for much of 2022 assuming the Bitcoin price can at least hold in the upper $20,000s.

While Bitcoin does look at risk of a drop back towards key support in the $25,000 given some technical indicators have also pointed to the March rally becoming a little overstretched, analysts expect dips to be bought and price predictions remain, for the most part, upbeat.

That’s because the fundamental narratives that drove the spectacular bounce from mid-March lows under $20,000 are likely to remain tailwinds for the foreseeable future.

Readers will recall that three US banks went under earlier this month, sparking concerns about a broader global banking crisis and pushing traders to aggressively pare back on bets on more tightening from the US Federal Reserve.

As expected, the Fed delivered a dovish pivot in its rate guidance at its meeting this week (despite still lifting interest rates by another 25 bps), with investors now betting that a cutting cycle will commence in the second half of the year.

The combination of financial crisis concerns and bets on easier monetary policy have given Bitcoin the dual tailwind of safe-haven demand (as a fiat currency alternative) and demand for assets that perform well in a lower interest rate environment (which Bitcoin typically has).

Despite some recent positive developments, like the SVB buyout and reports of action by US authorities designed to save First Republic, bank contagion risks remain high.

Meanwhile, the US economic outlook has darkened substantially, and the combination of these factors means that Bitcoin’s tailwinds should remain strong.

As prices rise in the coming months, on-chain metrics should continue to follow suit, adding further legitimacy to the rally.

[ad_2]

cryptonews.com