[ad_1]

In the world of cryptocurrencies, Bitcoin and Ethereum have recently experienced a noteworthy 5% surge in their prices, momentarily pausing as they prepare for their next move. As investors and market enthusiasts closely monitor the situation, anticipation builds around the future for these leading digital assets. Will they continue their upward trajectory or face a potential correction?

Let’s explore the factors influencing BTC and ETH prices and what may be just around the corner.

BTC/USD is trading at 30,268, up 2.50% in 24 hours. As investors raised their bets that the US Federal Reserve would soon cease its hawkish policy, the most valuable cryptocurrency reached $30,000 for the first time in ten months.

Uncertainty Over Fed Rate Hike Decision

In the US, the official jobs report from the previous week, released on Good Friday, revealed a robust job market that helped lower the unemployment rate to 3.5%. This strongly suggests that further interest rate increases are possible when Federal Reserve officials meet again in May. However, this report contrasts with earlier weak data, which showed that US job postings dropped to their lowest level in over two years in February.

This focuses on Wednesday’s inflation figures and the Fed’s March meeting minutes.

Recent banking industry turbulence and the slowdown of the US economy have fueled hopes that the central bank would soon halt its aggressive monetary tightening campaign.

As a result, markets are awaiting the CPI data to determine the Fed’s next moves. If the data indicates decreasing inflation, this could be the next potential driver for an increase in the BTC/USD price.

Meanwhile, the market’s prediction that the Fed would raise rates by 25 basis points at its May meeting has dropped to 66.5%, while the expectation of no change has risen to 33.5%, according to the CME FedWatch Tool.

Furthermore, the uncertainty surrounding the direction of the Fed’s rate-hiking cycle has led to a decline in the US dollar. The Dollar Index (DXY) was trading at 102.08, down 0.13%.

The weak dollar and optimism that the Fed might cease its aggressive interest rate hikes if the US economy cools further have improved market sentiment and boosted BTC/USD.

Argentina Embraces Bitcoin Adoption

On Tuesday, April 11, Argentina’s financial regulator, the National Commission Of Value (CNV), allowed the regulation of Bitcoin index futures contracts on the Matba Rofex exchange.

The futures contracts provide investors access to the price of Bitcoin without requiring them to hold the underlying asset.

The initiative is a part of the CNV’s innovative strategy goal, which seeks to respond to the difficulties faced by new technologies in delivering financial goods.

CleanSpark Boosts Its Bitcoin Mining Capacity

On Tuesday, April 11, US bitcoin miner CleanSpark announced the purchase of 45,000 brand-new Antminer S19 XP mining rigs for $144.9 million. The company stated that all units would be ready for delivery by the end of September. The new fleet will add 6.3 exahashes per second (EH/s) of processing power to the company’s existing 6.7 EH/s, a 95% increase.

The press release claims that the company utilizes low-carbon energy sources for Bitcoin mining. Moreover, it adopts a balanced capital management strategy by selling a portion of the bitcoins it mines to reinvest the profits in business expansion.

According to CleanSpark’s CEO, Zach Bradford, as the Bitcoin halving event approaches, the company’s focus on operational efficiency, technological expertise, and treasury management strategy will be crucial in securing its position among the top bitcoin mining firms in America.

Bitcoin Price

From a technical perspective, Bitcoin is encountering significant resistance around the $30,580 mark. If candle closes fall below this level, it could trigger a downtrend towards $29,500, and amplified selling pressure might further push Bitcoin’s value down to the $28,950 level.

Bitcoin has formed a bearish engulfing candle, which generally indicates that the upward momentum is losing strength and exposing a bullish inclination.

Buy BTC Now

Ethereum Price

The price of Ethereum started a downward correction from the $1,940 region against the US Dollar. In the near term, ETH might retest the critical $1,840 support level.

Ethereum’s price tried to achieve additional gains above the $1,925 and $1,940 resistance levels. However, like Bitcoin, ETH struggled to solidify its position above the $1,925 resistance area.

A successful close above the $1,925 level, followed by a move above $1,940, could push the price towards the $2,000 resistance level. The subsequent significant resistance may be around $2,120. Any further gains could pave the way for a test of the $2,200 resistance level.

The next major support is close to the $1,840 area, below which the price of Ether might drop towards the $1,825 level. If the price breaks below $1,825, it might extend its decline towards $1,780.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Keep abreast of the latest ICO projects and altcoins by frequently consulting the expert-curated list of the top 15 most promising cryptocurrencies to watch in 2023, as recommended by industry specialists at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

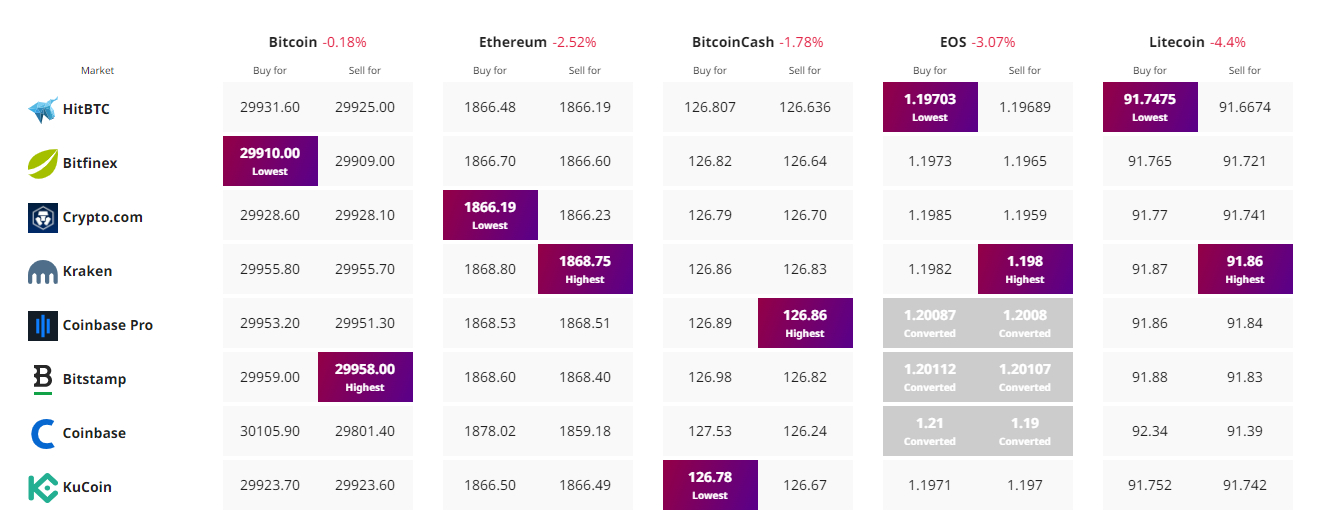

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com