[ad_1]

With Bitcoin and Ethereum stuck in narrow ranges for some time, investors are wondering whether the two leading cryptocurrencies can break out and reach new highs. Despite the recent volatility, there are several bullish indicators that suggest BTC and ETH may be gearing up for a significant move.

Let us examine the major fundamentals of the cryptocurrency market that could be impacting the overall price action.

Crypto Veteran Analyzes BTC and Crypto Markets: What Has Changed & What to Expect?

After two weeks of silence, a prominent cryptocurrency trader who has maintained a bearish stance on Bitcoin throughout its 2023 rally has spoken out. Known by the pseudonym “Capo,” the trader withdrew from the markets when Bitcoin dropped to $40,000 in April 2022.

Since then, he has held on to his belief that the bear market will conclude with BTC hitting a new low of $12,000. Despite acknowledging that Bitcoin’s recent price surge is a significant bear market rally, Capo admits to being taken aback by its scale, as he didn’t foresee such a move.

Capo believes that the recent Bitcoin rally is a bear market rally, which is being artificially pumped with BUSD and USDC. According to him, this is still the biggest bull trap ever, and bearish analysis is not invalidated yet. Capo expects Bitcoin to hit a fresh low of $12,000.

While he admits that he didn’t see this bounce coming, he congratulates those who were able to take advantage of the situation, especially with some altcoins seeing stronger rallies than expected due to the Al narrative.

Coinbase Fined Over $3 Million by Dutch Bank

Dutch bank, De Nederlandsche Bank (DNB), has imposed a fine of over $3 million on Coinbase, a leading US cryptocurrency exchange. According to the DNB, Coinbase had been operating without registration since November 2020. Though Coinbase adhered to the registration protocols in September 2022, it failed to pay supervisory fees for the two-year period before registration.

As per the Dutch law, any company that provides cryptocurrency services in the country must register with the DNB under the Anti-Money Laundering and Anti-Terrorist Financing Act. However, Coinbase is challenging the fine, stating that the period in question was how long it took the company to register in the Netherlands, and that it has been compliant with the law.

This penalty comes as regulators across the world are tightening their grip on cryptocurrency exchanges, with a focus on improving security and preventing money laundering. The fine imposed on Coinbase is one of the largest regulatory fines levied on a cryptocurrency exchange.

Ethereum Tests 5-Month High As Whales Hoard Over 80% Of Supply

Sentiments recent data revealed that large ETH holders, including whale and shark addresses, continued to hold onto their ETH holdings. The graph displayed that the addresses holding 100-100,000 ETH still owned nearly 47% of the total ETH supply. Additionally, the lack of a sell-off after the recent price hike indicated that investors expected more price gains in the future.

Furthermore, an analysis of the supply held by the largest addresses indicates that these addresses have been accumulating Ethereum.

During most of January, the graph depicting the amount held by the largest addresses as a percentage of Ethereum’s total supply was on an upward trend. Although it has now stabilized, as of writing, it remained at 123.

Bitcoin Price

The current price of Bitcoin is $24,756, with a 24-hour trading volume of $18.7 billion. In the past 24 hours, the price of Bitcoin has increased by less than 0.50%. As the top-ranked cryptocurrency, Bitcoin has a live market cap of $477 billion, according to CoinMarketCap. It has a circulating supply of 19,295,475 BTC coins and a maximum supply of 21,000,000 BTC coins.

On Sunday, the BTC/USD pair continued to trade sideways, maintaining a narrow range between the $24,400 to $25,250 levels. A bullish breakout of the $25,250 level can potentially expose the BTC price to $26,000 or $26,450.

Bitcoin’s immediate support is at $24,300, and a break below this level could send the BTC price down to $23,750 or the $23,300 mark. Further on the lower side, an additional breakout of the $23,300 level could send BTC toward the $22,850 mark.

Overall, the trading bias is neutral, and both the RSI and MACD indicators are signaling indecision among investors. The closing of Doji and spinning top candles in the 4-hour timeframe also signifies uncertainty among investors. It is recommended to keep an eye on the $24,300 mark for buying opportunities and vice versa.

Buy BTC Now

Ethereum Price

As of now, the Ethereum price is trading at $1,701, with a 24-hour trading volume of $5.3 billion. Over the last 24 hours, Ethereum has gained more than 0.10%. Its current market cap is $208 billion, and it is ranked #2 on CoinMarketCap.

During the Asian session, the ETH/USD pair is experiencing sideways trading, remaining within a narrow range of $1,670 to $1,720. The direction of Ethereum’s trend will depend on whether this range is broken.

On the 4-hour timeframe, Ethereum has formed an upward channel that is keeping the ETH price supported near the $1,650 level. If buying pressure increases, ETH could break through the $1,720 mark and reach the next resistance areas of $1,740 and $1,825.

On the other hand, a break below the $1,675 level could extend the downtrend toward the $1,635 or $1,600 mark.

Buy ETH Now

Bitcoin and Ethereum Alternatives

Apart from Bitcoin (BTC) and Ethereum (ETH), the cryptocurrency market is home to several other altcoins that display significant potential. The CryptoNews Industry Talk team has performed an analysis and compiled a list of the top 15 cryptocurrencies to keep an eye on in 2023.

This list is regularly updated with new altcoins and ICO projects, so it is advisable to check back frequently for the latest additions.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

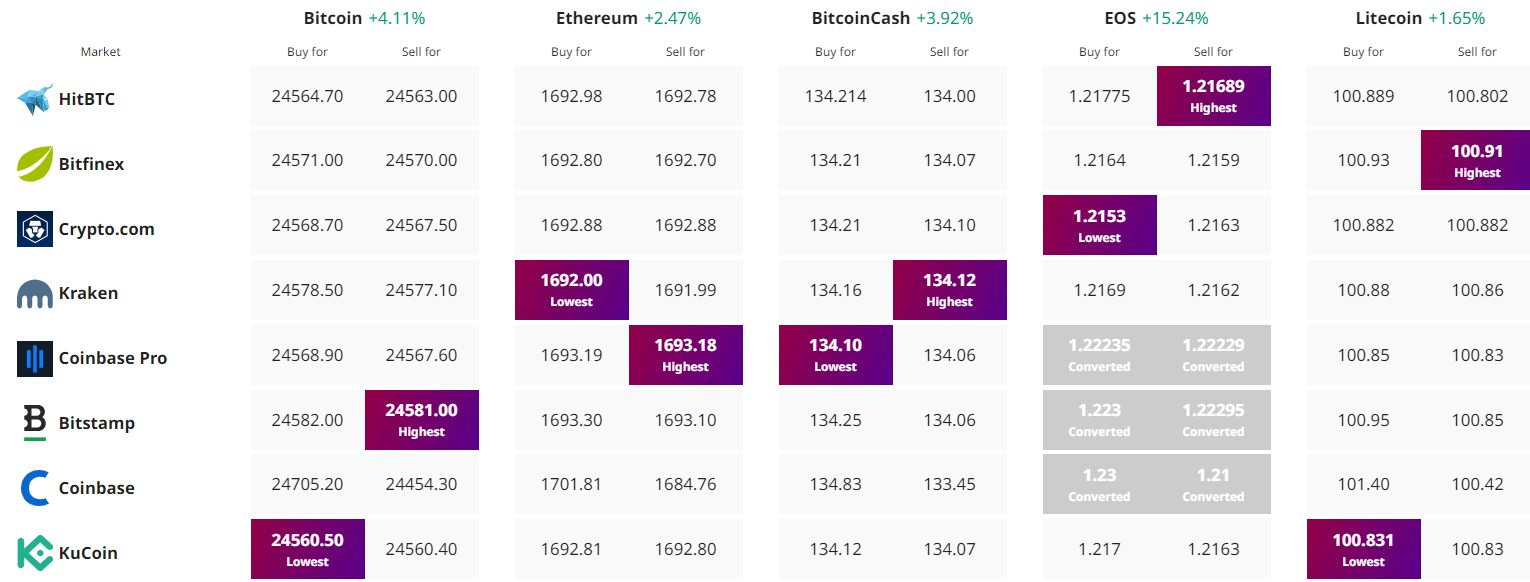

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com