[ad_1]

Bitcoin, the world’s largest cryptocurrency, along with Ethereum, lost some of its value and dropped below $28k and $1,800 levels respectively. However, the reason could be linked to the release of a dovish statement from the US Federal Reserve regarding interest rates.

The Fed raised rates as predicted, but suggested a possible halt in its rate rise cycle in the wake of a financial collapse. But, at the same time, the central bank reaffirmed its commitment to lowering inflation, expecting at least one more rise this year and stating that it has no intention of decreasing interest rates this year.

This generated some uncertainty and volatility in the market, causing Bitcoin’s price to momentarily dip.

It is worth noting that Bitcoin is used as a way to protect your wealth against inflation, so when interest rates go up, people may not want to invest in Bitcoin as much as it reduces the appeal of Bitcoin as a hedge against inflation.

Plus, higher interest rates can make it more attractive to invest in US dollars, causing people to sell their Bitcoin and other cryptocurrencies. Thus, this decision by the Federal Reserve was seen as a negative sign for Bitcoin and another cryptocurrency.

Bitcoin’s Safe Haven Status Boosts Crypto Market, But Fed Decision Affects Its Appeal

The global cryptocurrency market has been performing impressively in recent weeks. This is due to people’s positive opinions on Bitcoin since they think it is a safe alternative to keeping their money after Silicon Valley Bank, as well as two other banks, Silvergate Capital and Signature Bank, collapsed.

Despite this, Bitcoin’s value did not fall but gained significant traction as this has prompted some Bitcoin supporters to assume that Bitcoin is a viable alternative to established financial institutions for keeping your money safe.

It is referred to as a “safe haven.” This was seen as one of the key reasons behind the upward bitcoin market.

Although, the declines in the BTC seem to be fading right after the announcement of a 25 basis point increase in interest rates by the US Federal Reserve. The Federal Reserve emphasized that they prioritize inflation despite the recent banking crisis.

Bitcoin has been viewed as a safe place to put your money and a way to protect yourself from rising prices. However, when the US Federal Reserve raises interest rates, it can make it less appealing to invest in Bitcoin.

This is because higher interest rates can make the US dollar more attractive, causing people to sell their Bitcoin and other cryptocurrencies in favor of the dollar.

The surge in Whale Activity as Big Investors Show Confidence in Bitcoin

On the bright side, sources indicated that more large investors were buying Bitcoin, as well as Wrapping Bitcoin on other networks. This has been going on for a while.

As of today, there have been over 13,000 large transactions done by Bitcoin whales and over 100 transactions performed by Wrapped Bitcoin whales. This indicates that the whales are being more active than normal.

Hence, both Bitcoin and Wrapped Bitcoin are witnessing their highest levels of whale activity in several weeks. This revelation will likely have a positive impact on Bitcoin’s price since it indicates that large investors believe in Bitcoin’s future.

Bitcoin Price

The current market value of Bitcoin is $27,695.00 with a trading volume of $32.3 billion within the last 24 hours. Bitcoin’s value has declined by nearly 2% in the past 24 hours. It is currently ranked #1 on CoinMarketCap, with a market capitalization of $535 billion.

The BTC/USD pair is currently consolidating near the $28,400 level, having breached the resistance level of $29,250. Due to the continuous bullish trend, there is a likelihood of further increase in Bitcoin’s value to touch $29,250 or even $30,700.

Meanwhile, Bitcoin’s support levels continue to hold steady at around $26,600 and $25,200.

Buy BTC Now

Ethereum Price

The current Ethereum price is $1,753, and the 24-hour trading volume is $12.6 billion. Ethereum has decreased by nearly 2.50% in the past 24 hours. As of now, Ethereum holds the #2 position on CoinMarketCap with a live market cap of $214 billion.

The ETH/USD pair is currently experiencing a minor correction, albeit with less intensity than Bitcoin. Ethereum is facing some difficulty in breaking through the resistance at $1,800 and is hovering around the support zone of $1,700.

If the pair manages to surpass the $1,800 level, it is expected to face resistance at the $1,900 mark.

The ETH/USD pair is expected to find immediate support at either the $1,700 or $1,620 level on the downside.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Have a look at the top 15 altcoins to watch in 2023, curated by Cryptonews’ Industry Talk team. The list is regularly updated with new ICO projects and altcoins, so be sure to check back often for the latest updates.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

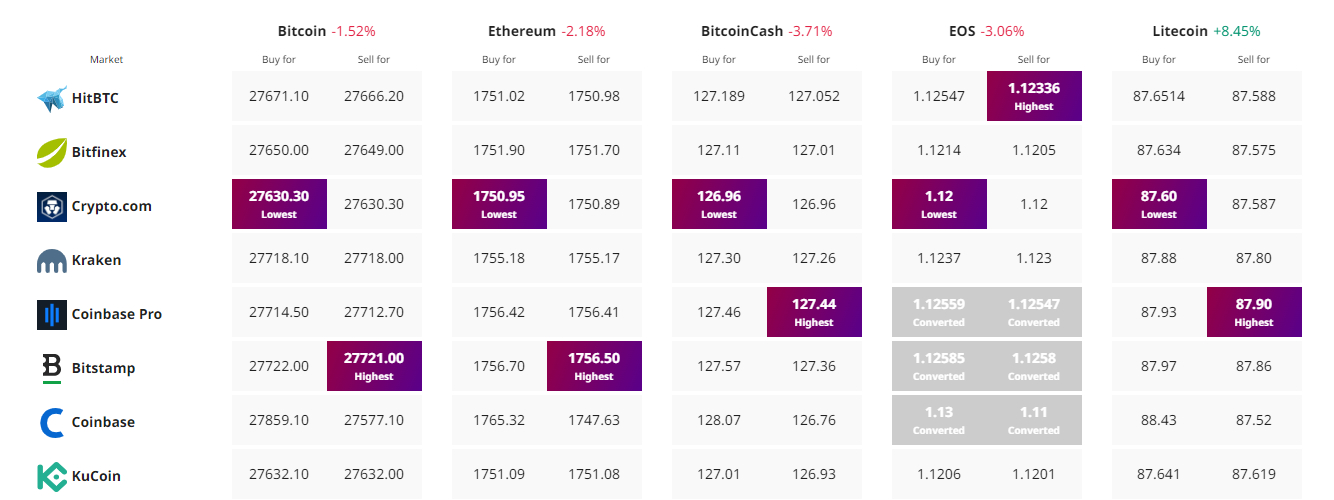

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com