[ad_1]

It looks like Santa Clause has arrived early for crypto investors this year, with strong rallies seen across bitcoin (BTC), ethereum (ETH), and the broader altcoin market in the past 24 hours.

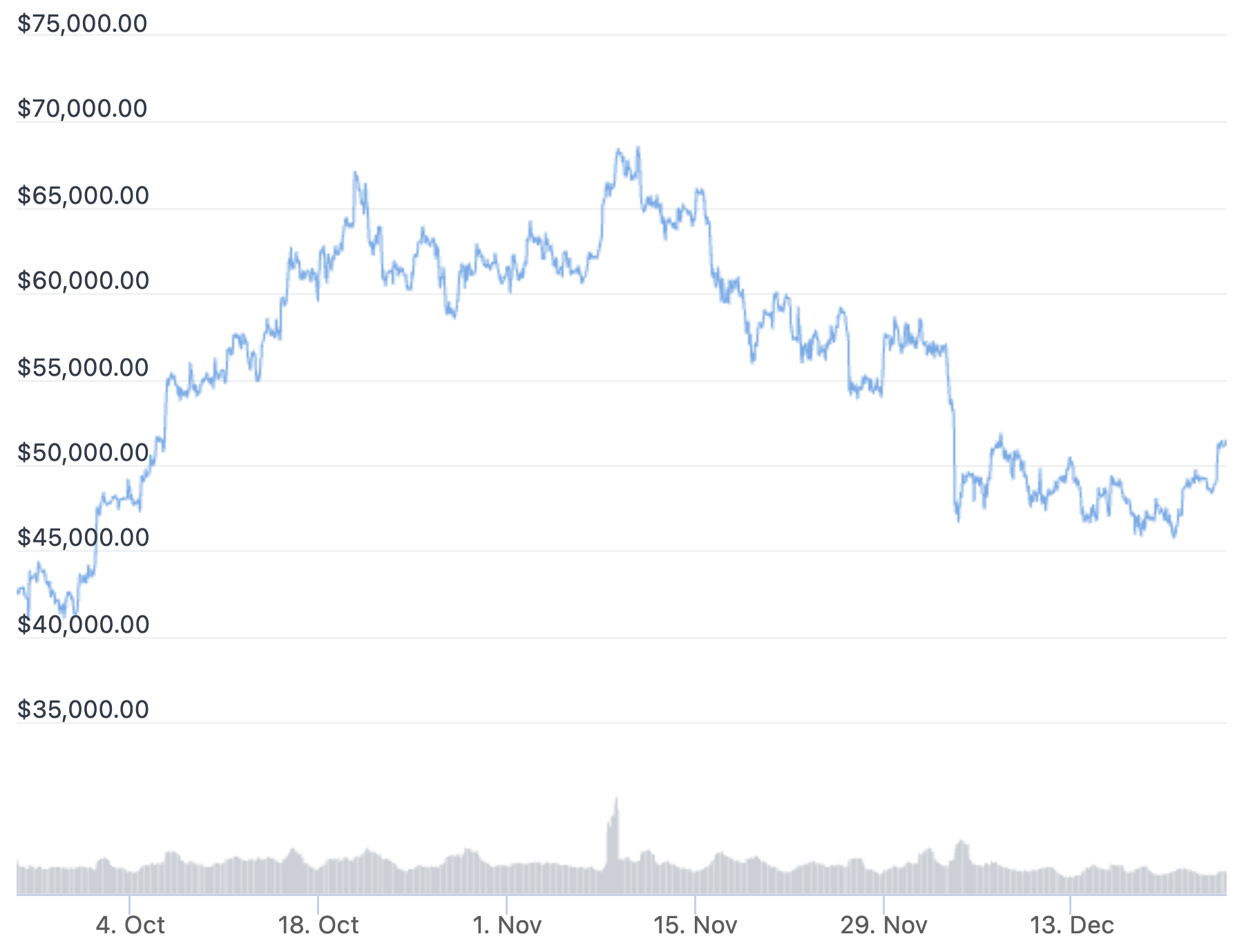

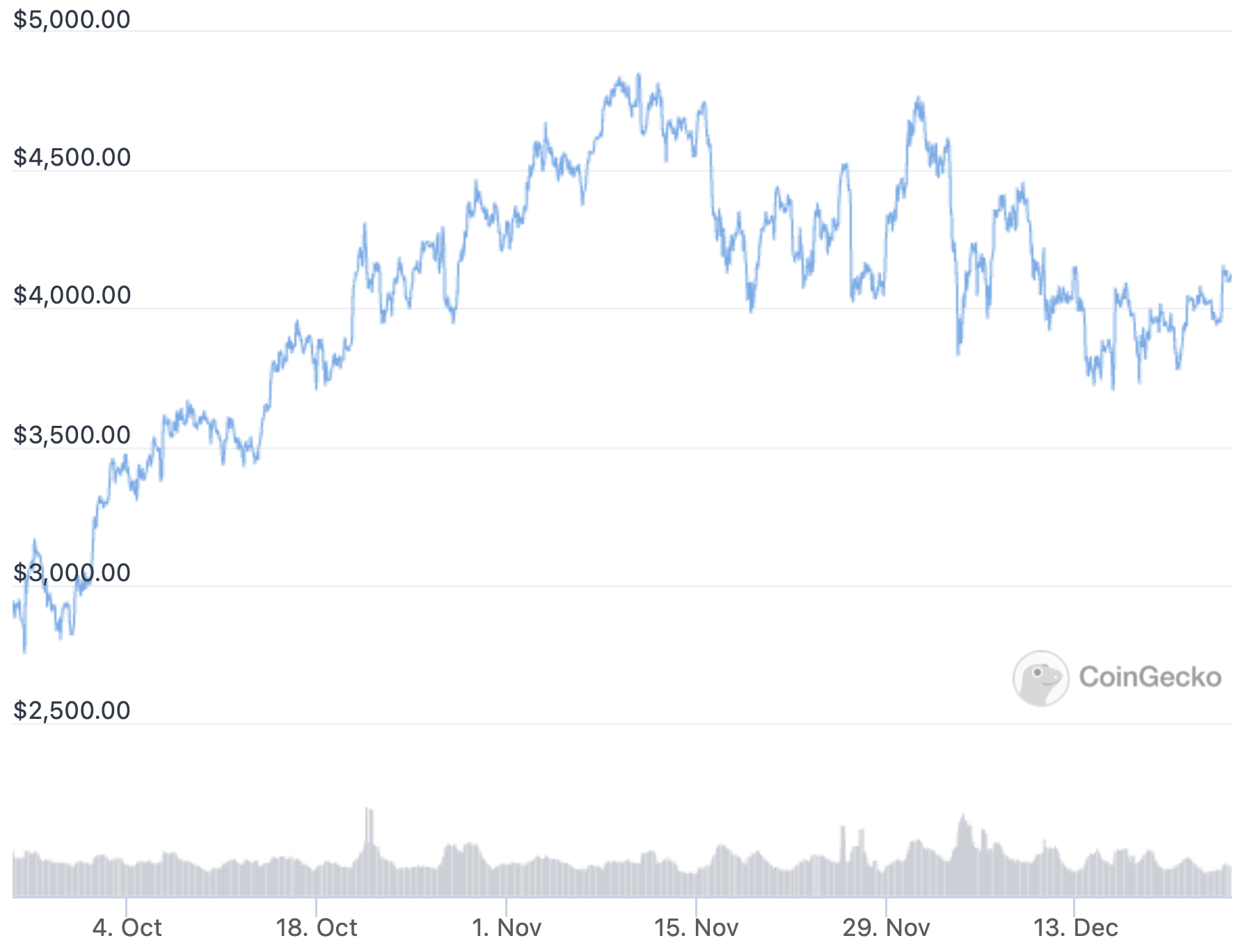

At 13:10 UTC, BTC traded at USD 51,038, up 4.3% for the past 24 hours and 7.1% for the past week. Meanwhile, ETH stood at USD 4,090, up 2.9% for the past 24 hours and 3% for the week.

Elsewhere in the crypto market, performance was also strong over the past day, with the vast majority of coins in the top 100 by market capitalization seeing higher prices. Among the ones that stood out were the sandbox (SAND), fantom (FTM), arweave (AR), and internet computer (ICP), which have all seen 24-hour gains between 20% and 13%, respectively.

The rally for bitcoin over the past 24 hours marked a break through the key USD 50,000 level, boosting sentiment among bitcoin HODLers and traders. Meanwhile, the price has also recently broken through a descending trendline that can be drawn back to the USD 69,000 all-time high from November 10, improving the technical set-up of the bitcoin chart.

90-day price of BTC:

For ethereum, the recent rally has brought the second-most valuable cryptocurrency up above the USD 4,000 mark, after buyers pushed it up from a low of just over USD 3,640 on December 15.

90-day price of ETH:

And as the bitcoin chart in particular is looking stronger from a technical analysis perspective, on-chain signals also look promising for the number one cryptocurrency.

Among several bullish signals, some members of the bitcoin community today pointed out that large whales have continued to add more coins to their holdings throughout November and December.

Along with an accumulation of coins by whales, the supply of BTC on exchanges has also seen a steady decline during the past two months, although a slight uptick was seen between Thursday and Friday this week, data from Coinglass showed.

BTC balances on exchanges:

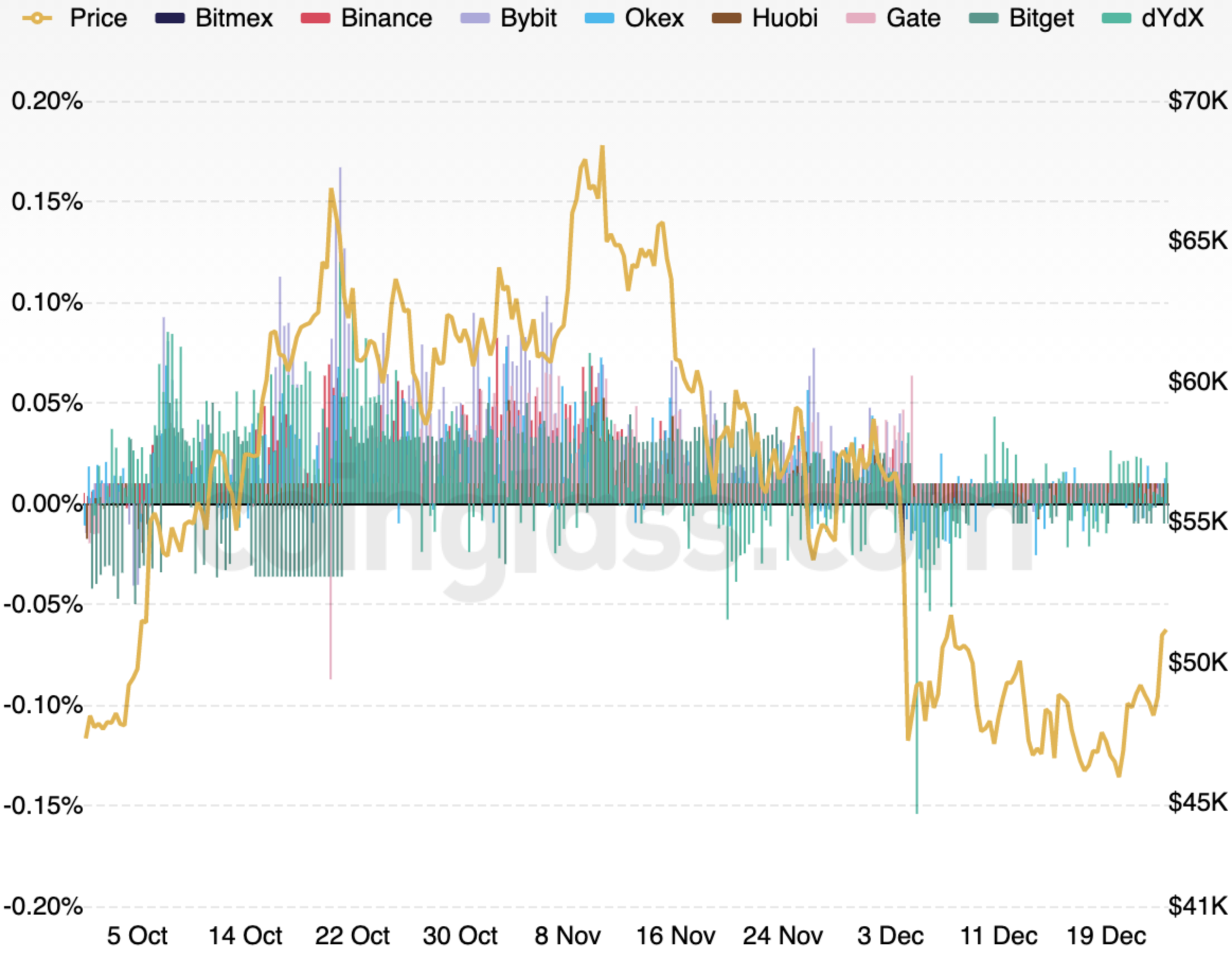

Meanwhile, according to Zhu Su, CEO of crypto hedge fund Three Arrows Capital, the bitcoin market currently looks primed for “a gamma squeeze” – a phenomenon caused by rapid price moves higher, which forces market makers in the options market to buy spot bitcoin as money is flowing into call options.

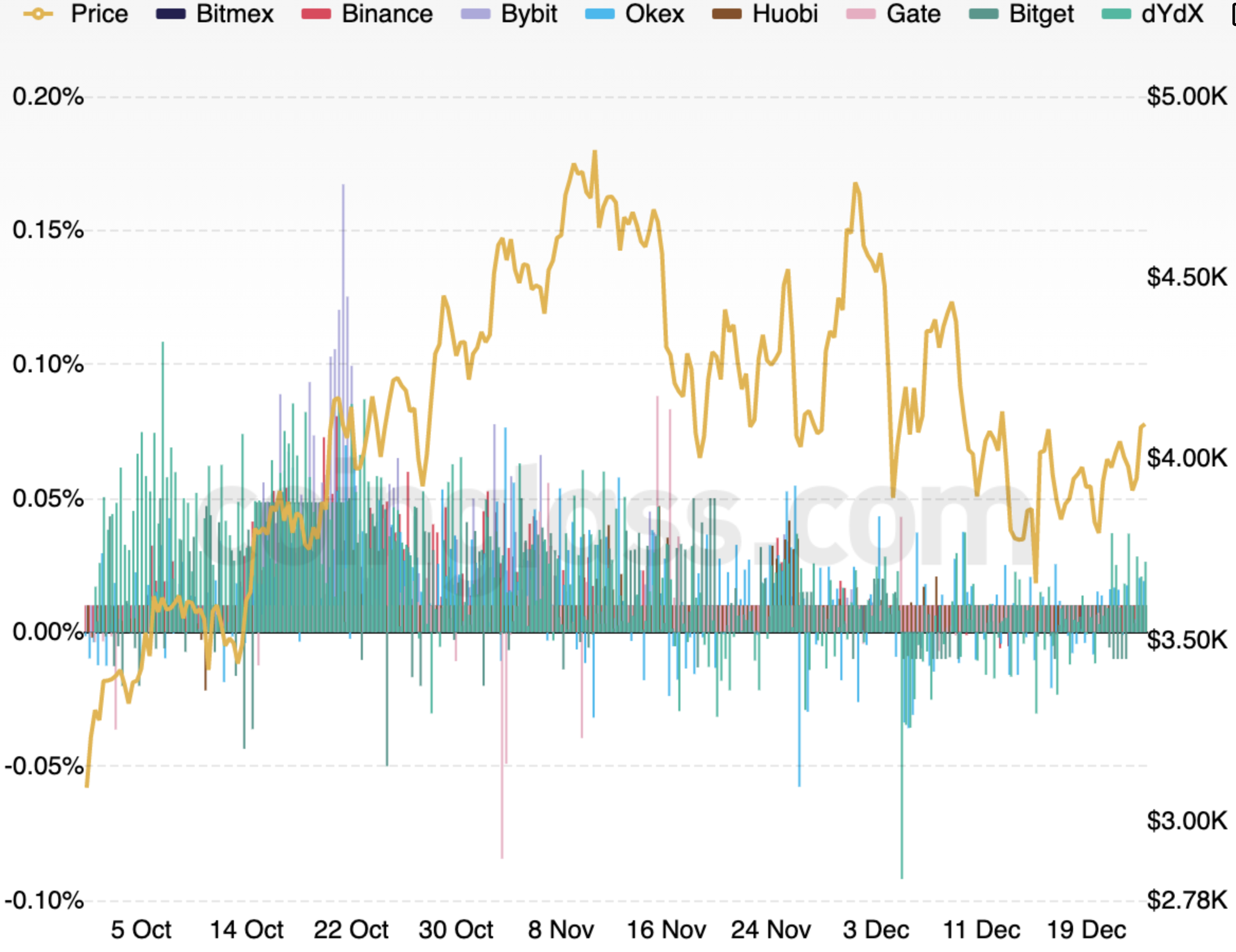

Moreover, looking at funding rates in the perpetual futures market for BTC and ETH, we see that the rates for both of the two largest cryptocurrencies generally remain in the positive territory, although the rates in December have come down slightly compared to November.

Positive funding rates mean that traders who are long on perpetual futures contracts pay those who are short, while negative rates mean that short positions are paying longs. As such, funding rates are generally positive when bullish sentiment dominates among traders.

BTC funding rates compared with price:

ETH funding rates compared with price:

Commenting on the latest change in funding rates on Reddit’s r/CryptoCurrency forum, one user said that signs that rates are recovering could signal “the beginnings of another bull rally.”

The same user added that although the level now is still not very high, “it signals that investors’ sentiment may be skewing back into the positive.”

Meanwhile, the early Christmas rally and improved sentiment among crypto traders followed an appearance on CNBC by Galaxy Digital CEO Mike Novogratz yesterday.

In the interview, the well-known crypto proponent said that he expects “less volatility” going forward. He added that he sees bitcoin as “tailor made as a store of value” and not a transactional currency.

____

Learn more:

– Bitcoin and Ethereum Price Predictions for 2022

– How Global Economy Might Affect Bitcoin, Ethereum, and Crypto in 2022

– Half of Surveyed Millennial Millionaires Set to Buy Even More Bitcoin, Ethereum in 2022

– Altcoins in for a Bumper 2022 as Number of Crypto Traders Set to Double – Report

– Crypto Adoption in 2022: What to Expect?

– Bitcoin, Ethereum Jump as Fed Doubles Tapering, Signals Rate Hikes, Talks Crypto

[ad_2]

cryptonews.com