[ad_1]

A “bloodbath” in risk assets, including the crypto market, could become a reality as Wednesday’s important Federal Reserve (Fed) meeting moves closer, one market strategist has warned.

According to the strategist, who goes by the Twitter username The Carter, Fed Chair Jerome Powell will come out in a more forceful and hawkish way on Wednesday than the market currently expects. This, he believes, will lead to a sharp sell-off across all risk assets, which would include bitcoin (BTC) and most other digital assets.

“There will be blood on February 1. Powell will re-tighten financial conditions by forcefully addressing rate cuts head-on,” he wrote in a Twitter thread posted on Friday.

The strategist defended his view by describing Powell as “perhaps the most transparent Fed Chair in history,” while adding:

“He plays with a wide open hand. Let’s look at his ‘hand’…”

The popular analyst went on to refer to earlier statements from Powell, where he indicated that ‘overtightening’ is less of a risk for the economy than not doing enough to get inflation down to its target.

“We can support economic activity strongly if that happens,” Powell was quoted as saying with regards to the risk of overtightening.

The Fed watcher and market strategist added in the thread that both the Fed’s written statement as well as Powell’s press conference on Wednesday are likely to be “very hawkish.”

“It’s a matter of HOW Powell hammers on February 1, not IF,” he wrote, before adding some advice on what traders should look for in Powell’s press conference:

“Look for him to forcefully shift the conversation toward how long the Fed needs to hold at the terminal rate, and WHY. Look for him to expand on the lessons of the 1970s.”

The Carter further said it is “beyond me” how the market can continue to “punch Powell in the face and not expect a counter-punch […].”

He went on to reiterate:

“There will be blood on February 1.”

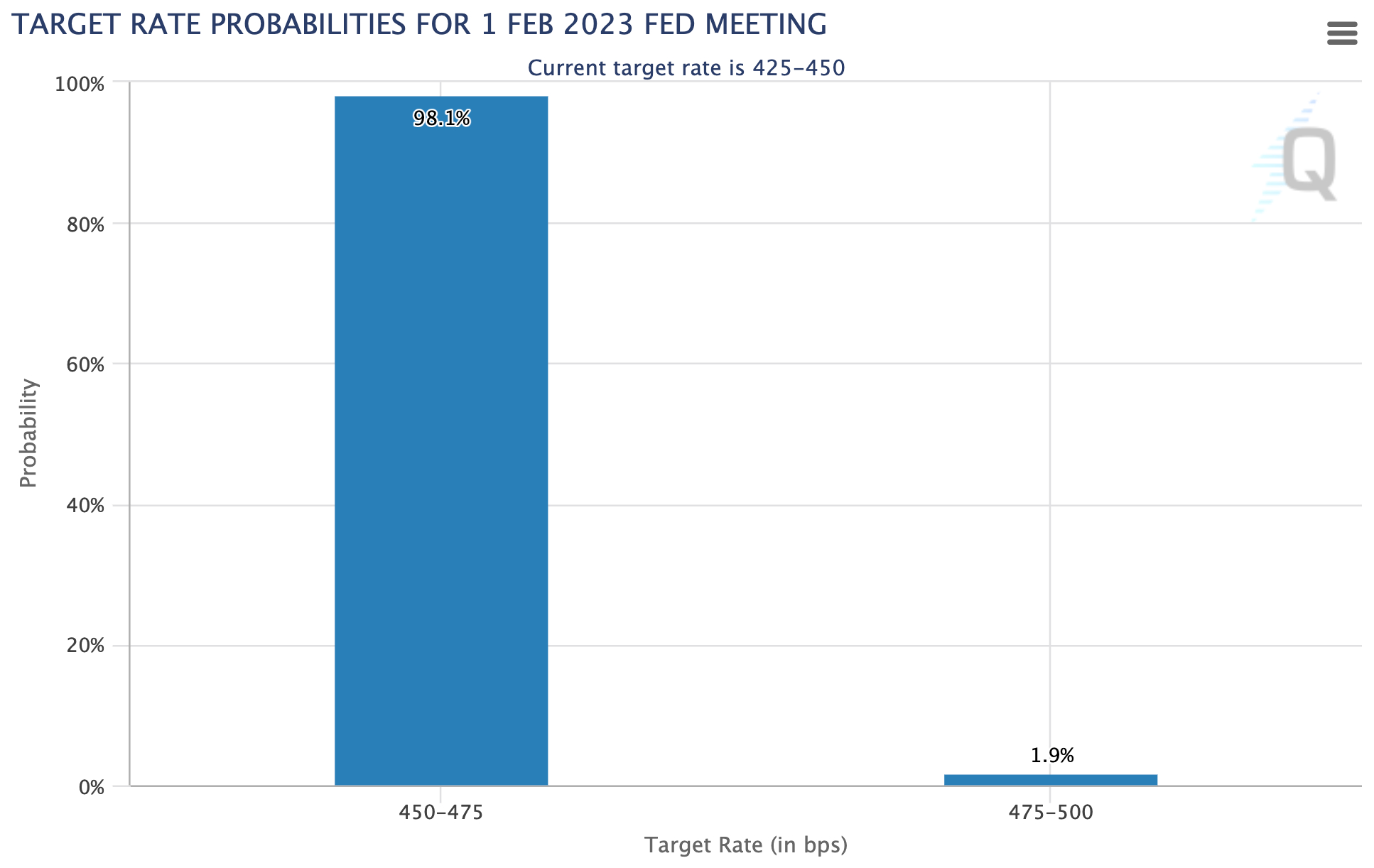

The Fed is set to announce its latest interest rate decision this Wednesday at 2 pm ET (7 pm UTC), with most analysts expecting a 25-basis point rate hike. This is also what the market has currently priced in, with for instance CME’s FedWatch Tool estimating a 98.1% probability for a 25-basis point hike.

Fed Chair Jerome Powell has in the past indicated that he would need to see inflation move lower in a meaningful way before the Fed will consider pausing its rate hikes. The latest inflation report from December showed that US inflation has eased to 6.5% annually.

The Fed’s long-term inflation target is at 2% annually.

[ad_2]

cryptonews.com