[ad_1]

Here is what happened in the Cryptoworld in the second quarter of this year:

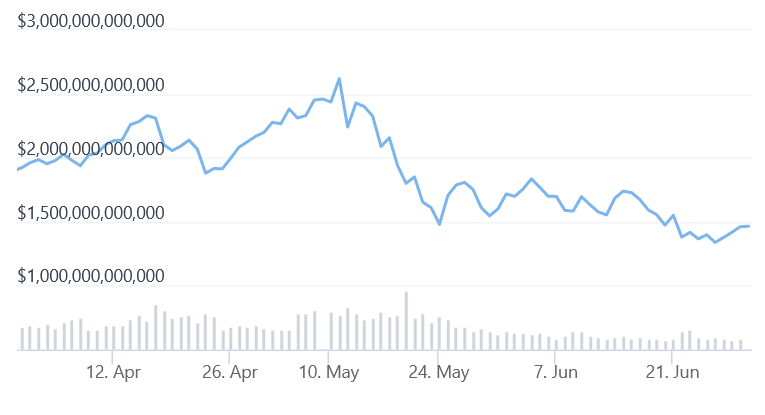

Total crypto market capitalization in Q2

April

- The second quarter of 2021 started with altcoins booming while bitcoin (BTC) was consolidating around the USD 60,000 mark. However, soon BTC saw a slight sell-off as crypto exchange Coinbase announced its full-year outlook, saying that in the best scenario, the annual average number of its monthly transacting users (MTUs) was expected to reach 7m.

- One day before the Coinbase direct listing, BTC and ETH hit new all-time highs, as many industry insiders saw the listing as a bullish event for the crypto space and decentralized finance (DeFi). Over 1,700 Coinbase employees were given 100 shares ahead of the listing. The exchange finally went public on April 14, and on to test various crypto narratives.

- Bitcoin transaction fees hit an all-time high (ATH) after an explosion in China had forced miners offline.

- Venmo, the PayPal-operated peer-to-peer mobile payments app, announced that it has started supporting select cryptocurrencies, including BTC, ETH, litecoin (LTC), and bitcoin cash (BCH).

- Brad Garlinghouse, the CEO of California-based start-up Ripple, backtracked on BTC criticism after a backlash on social media, conceding that he had “hit a nerve”, and clarified that he was not in favor of a “ban” on BTC. Meanwhile, Ripple scored a legal victory against the US Securities and Exchanges Commission (SEC), and the judge allowed Ripple to examine the SEC documents.

- An attorney indicated that a settlement was the most likely outcome in the Ripple vs. SEC case, and then XRP doubled as Ripple’s bosses scored another legal victory.

- Grayscale, a crypto asset management firm, said that it was “100% committed” to converting their Bitcoin Trust into an exchange-traded fund (ETF).

- Technology firm MicroStrategy spent another USD 15m on BTC, purchasing an additional BTC 253 at an average price of USD 59,339 per coin. However, later, Major UK bank HSBC banned the InvestDirect users from purchasing MicroStrategy stock, probably due to the firm’s exposure to bitcoin.

- Gaming behemoth Nexon spent some USD 100m on BTC, acquiring BTC 1,717 at an average USD 58,226 per coin.

- The 113-year-old giant Baillie Gifford injected some USD 100m into financial services company Blockchain.com. In another crypto investment, the Rothschild family invested in crypto exchange Kraken through their RIT Capital Partners venture.

- In South Korea, crypto trading volumes outperformed stock market activity for the first time in the nation’s history. Some reports claimed that the “kimchi premium,” a phenomenon whereby BTC and some major altcoins were trading on domestic exchanges at significantly higher prices compared to international exchanges due to heightened demand, has returned. The country’s government said it was targeting kimchi premium crypto sellers by looking into policing international remittances. But the government also saw a furious backlash from 20-to-39-year-olds over its proposed crypto crackdown. Meanwhile, commercial banks saw a massive influx of new customers thanks to crypto.

- The central Bank of Japan started a series of tests on a digital yen, while Sweden’s central bank Riksbank forged ahead with its e-krona pilot project.

- The Bank of England (BoE) and Her Majesty’s Treasury announced the joint creation of a new taskforce aimed at coordinating work on the potential UK central bank digital currency (CBDC).

- And we reported on five ways in which Visa wanted to work with crypto and CBDCs.

- Li Bo, the new deputy governor of the central People’s Bank of China (PBoC), called BTC an investment alternative.

- Turkey banned crypto payments, citing volatility and lack of regulation as main issues, but later, the new Governor of Turkey’s central bank, Şahap Kavcıoğlu, said he wouldn’t seek to carry out a total crypto ban.

- The Argentine central bank asked the commercial banks to hand over data on crypto transactions.

- The US Internal Revenue Service (IRS) said that the bitcoin cash (BCH) received from the Bitcoin hard fork in 2017 was taxable gross income.

- Mohamed El-Erian, Chief Economic Adviser of German insurer Allianz, warned that BTC could only establish itself if governments allowed it to.

- Billionaire Mark Cuban praised ethereum (ETH) as superior to BTC but acknowledged that he was storing much more of his wealth in bitcoin.

- Ethereum’s Berlin update went live but ran into some issues. For instance, Etherscan said they were facing syncing issues related to OpenEthereum – a popular multi-network Ethereum client, formerly known as Parity.

- Polkadot (DOT), an open source, blockchain platform and cryptocurrency that allows for distributed computing, announced that tether (USDT) would become the first stablecoin on its blockchain. Meanwhile, Coinbase Pro listed USDT.

- Non-fungible token (NFT) sales took a slight plunge. Meanwhile, the New York Stock Exchange revealed that they aim to launch the NYSE First Trade NFTs on Crypto.org Chain. At the same time, gaming retailer GameStop posted a new job vacancy suggesting that it could take the NFT plunge.

- America’s Time magazine sealed a deal with major cryptoasset management firm Grayscale to create a series of educational videos about crypto and get paid in BTC.

- Digital asset platform Bitpanda announced the launch of Bitpanda Stocks, a new product that promised to enable users to invest in tokenized fractional shares.

- Crypto exchange Gemini, payments giant Mastercard, and the Utah-based industrial bank WebBank decided to give ‘real-time’ crypto rewards.

- London-headquartered crypto platform Luno reached 7m users, and said it’s on track to hit 1bn by 2030.

- A bunch of people flocked to Binance Smart Chain (BSC) project SafeMoon even when others called it a scam. The token burst in price within its first days of inception, though it crashed as the team failed to deliver on the promise of website buy and swap. As Binance Chain was surpassing Ethereum in several metrics, BSC-based Uranium Finance got hacked.

- Traders of Thodex, a crypto firm based in Turkey, filed complaints alleging fraud, while the CEO reportedly fled Turkey. Turkey police later revealed that 62 people had been arrested in association with the incident.

- More users started to flock to crypto in Argentina and Peru.

- BitPay, a bitcoin payment service provider, said the share of BTC in their payments was the lowest in the last week of April as altcoins like dogecoin (DOGE) had been gaining traction.

- The Cryptocurrency Open Patent Alliance (COPA) announced that it was filing a lawsuit against the controversial entrepreneur Craig Wright over his copyright claims to the Bitcoin whitepaper.

May

- Meme coin DOGE led April, but ethereum took over as we entered the month of May. Further, within the early days of May, ethereum surpassed the USD 3,000 level for the first time ever, making the projects co-founder Vitalik Buterin a very rich boy. Meanwhile, DOGE did not go out of sight as it took over BTC and ETH on Google Trends for a bit.

- Notably, Bitcoin started its Taproot Speedy Trial without locking it in the first epoch. As bitcoin mining difficulty hit a new ATH and the flagship cryptocurrency rallied past USD 59K, people started arguing whether it’s time to switch to sats from BTC.

- Elon Musk announced that Tesla had suspended vehicle purchases using BTC, once again moving the whole crypto market and triggering a sharp selloff.

- DOGE hit an ATH before slumping spectacularly after Musk had called the token a “hustle”.

- DOGE rallied again following a boost by Musk and Coinbase, as Musk announced he was working with Doge developers to improve system transaction efficiency, while Coinbase confirmed its plan to list the meme coin.

- Shiba inu (SHIB) started to take over the Cryptoverse, calling itself the DOGE killer, but lost around 40% after Vitalik Buterin dumped and donated massive amounts of dog-themed tokens to charity and community projects. Buterin burned nearly all SHIB he had had and he kept some for charity, but said he would not get a tax write-off on his SHIB donation to India’s Crypto COVID Relief Fund.

- By mid-May, as the Cryptoverse was hard at work debunking Elon Musk’s BTC criticism, many accused him of market manipulation. Meanwhile, markets turned super-red in a flash crash, and BTC nearly tested USD 30K.

- Buterin said that, contrary to Musk’s idea, there were limits to blockchain scalability.

- Meanwhile, Polygon (MATIC) flipped Ethereum in daily transactions, as an 18-month-long threat for Ethereum was revealed following a released fix.

- Major financial services and investment management firm Galaxy Digital analysts said that ‘the most honest shitcoin’ DOGE would survive alongside BTC, and also unveiled its intentions to acquire crypto services provider BitGo in a USD 1.2bn deal.

- Paradoxically, investment banking giant JPMorgan boss bashed BTC again as his firm was readying a BTC fund. Researchers found that traders were rotating from bitcoin to ethereum and alts as JPMorgan saw ETH overvalued.

- Tether presented its reserves breakdown for the first time, claiming that almost 76% of its reserves on March 31 consisted of cash, cash equivalents, and other short-term deposits and commercial paper. USDT and some other stablecoins took a brief plunge below USD 0.9, while sceptics remained unconvinced by Tether’s revealed numbers.

- A report concluded that China’s digital yuan failed to impress in early large-scale pilots, as China’s blockchain business expansion appeared to be slowing down. Soon, experts said that digital yuan would be limited to domestic use-cases.

- In the world of regulation, Iran banned Bitcoin mining over the summer citing energy concerns. China reiterated its crypto ban, and the police launched a campaign meant to help wipe out crypto scams. India said it would scrap talk of a ban and go for regulating crypto.

- Diem announced its plans to launch in the US as stablecoin, while experts opined that stablecoins could fall under the scrutiny of financial policymakers. Meanwhile, Facebook CEO Mark Zuckerberg named his goat Bitcoin.

- Internet café owners started turning their businesses into crypto mining centers because of social distancing measures. Analysts noted a ‘seismic shift’ in mining amid the Chinese ‘crackdown.’

- Alejandro De La Torre, Vice President at Hong Kong-headquartered major mining pool Poolin, said that the next great miner migration would be from China to the rest of the world, as two Chinese mining players proceeded to restrict access from Mainland Chinese IP addresses.

- Miami Mayor and Republican politician Francis Suarez blasted a New York draft bill by Senator Kevin S. Parker, a member of the New York State Legislature from the ruling Democratic Party, seeking a crypto mining moratorium.

- The MicroStrategy head and crypto bull Michael Saylor, Elon Musk, and some miners formed the Bitcoin Mining Council in a bid to promote Bitcoin’s energy usage transparency.

- South Korea’s imposed regulations, which forced crypto exchanges to ensure all of their customers use real names, were a threat to the “big four” domestic crypto exchanges, as a tax U-turn seemed unlikely despite the outcry.

- Three of South Korea’s biggest banks said they didn’t want to work with crypto exchanges, claiming the sector was “too risky.”

- Crypto lender BlockFi made a clerical error that ended up in payments of over BTC 700 in a promo but threatened to take legal measures in a bid to reclaim the funds.

- The international cross-border P2P payments and money transfer company MoneyGram teamed up with Coinme, a digital currency exchange, to facilitate BTC buying and selling.

- Crypto exchange Binance-backed online travel agency Travala launched ‘Concierge’ to offer the expanding ranks of “bitcoin millionaires” access to private jets, yachts, private islands, helicopters, and limousine transfers.

- Coinbase announced their Coinbase Prime for institutional investors, as it acknowledged that institutional customers generated USD 122bn worth of assets on its platform during Q1 2021.

- Status (SNT), a crypto marketplace application and decentralized mobile and desktop client for Ethereum, revealed that it aimed to enable crypto-to-crypto payments on its Keycard hardware wallet.

- Trezor, crypto hard wallets created by SatoshiLabs, reported that sales had gone ‘through the roof’ this year.

- GameStop rolled out a website to promote a forthcoming NFT platform, but did not disclose details.

- Uniswap (UNI) launched its third version, which offered “unprecedented” capital efficiency for liquidity providers (LPs), improved execution for traders, and “superior” infrastructure for DeFi. Meanwhile, internet computer (ICP) entered the top 10 list just weeks after its debut.

- Larva Labs, the company behind digital collectibles known as CryptoPunks, sold out their new NFT Meebits collection in hours.

- A survey revealed that developing economies and better-educated people were leading the crypto ‘space race’.

- Actor Ashton Kutcher invested in BTC against actress and his wife Mila Kunis’ advice.

- Overall, decentralized exchange (DEX) and centralized exchange (CEX) trading volume exploded in May, surpassing USD 2trn, marking the best month for crypto exchanges.

June

- By early June, bitcoin was stuck in a “digital copper” phase as gold was rallying. Bitcoin had lost nearly 35% of its value over May alone, while it was down by almost 50% compared to April peaks.

- There was talk that crypto markets would be seeing a paradigm shift from pure speculation to tactical allocation, while US-based financial advisers were increasingly recommending investments in cryptos to their clients.

- The El Salvador President unveiled plans to give bitcoin the status of legal tender, adding that this would officially happen in just 90 days. Meanwhile, some lawmakers across Latin America expressed their support for bitcoin adoption, including the Ecuadorian Vice Minister of Economic Inclusion.

- Some economists wanted El Salvador’s Bitcoin law repealed, but the head of the Central American Bank for Economic Integration promised to “provide technical assistance”, and the country’s cabinet started “discussing” plans to allow firms to pay employees in BTC, which then fell through. Soon after, the World Bank stated it would not assist El Salvador to create a BTC-powered economy.

- El Salvador said it would start its big Bitcoin test with a BTC airdrop, saying that every citizen would receive USD 30 worth of BTC when they registered with their wallet app, Chivo.

- After Latin America, key individuals started coming out in support of bitcoin adoption in Africa.

- There was some hope despite Beijing-backed anti-mining activities continuing, with more positivity added following the Sichuan energy meeting, but China was determined in its crackdown. The Chinese central bank said that all of the nation’s biggest commercial banks and the Alibaba-run e-pay provider Alipay had agreed to help it enact a stronger crackdown on crypto, which followed the announcement that many major farms in Sichuan would close.

- Meanwhile, a digital yuan giveaway saw USD 6.2m distributed in Beijing, and a chief architect of the digital yuan discussed a possibility of CBDCs operating on networks like Ethereum or Diem.

- While May’s crypto crash slashed crypto exchange Bithumb‘s value by over 50%, South Korean crypto exchanges were given a short extension for implementing anti-money laundering (AML) protocols. However, crypto exchanges were readying a lawsuit against the government.

- As South Korea’s latest tax evasion bust saw crypto worth USD 47m seized, the country’s financial regulator was looking to Singapore for inspiration as it formed new crypto sector policies.

- The ruling Russian party conducted blockchain-powered online primaries. A political insider wanted the Parliament to discuss how Moscow could use cryptos to bypass Western sanctions, as senior lawmakers proposed a new law to allow citizens to inherit crypto.

- In the US, Hester Peirce, a senior official from the SEC, opposed her fellow regulators’ efforts to enforce strict regulation on crypto instead of promoting self-regulation.

- Eric Adams, who was the frontrunner in the race to become the Mayor of New York by late June, said he aimed to make New York a “Bitcoin Center.”

- The G7 summit, the first in-person meeting of world leaders since the start of the COVID-19 pandemic, finished without tackling issues directly related to crypto and CBDCs.

- Leaders in France and the US urged for crypto regulation ‘before it’s too late’.

- Regulators from various jurisdictions accused Binance of providing crypto exchange services without registration. Also, UK-based customers claimed they had been frozen out of GBP withdrawals, with some also having issues with bank card-linked transactions.

- Six Coinbase users sued the exchange, seeking more than USD 5m in compensation for being banned from accessing their accounts for arbitrary reasons.

- Coinbase Card added support for mobile payments via Apple Pay and Google Pay.

- By mid-June, BTC was slightly recovering from the May crash as it managed to touch USD 40K. Fuelling some optimism, Elon Musk said that Tesla would resume supporting BTC payments “when there’s confirmation of reasonable (~50%) clean energy usage by miners with the positive future trend” – also, importantly, Taproot activation was confirmed.

- Furthermore, major crypto investment firm Pantera Capital CEO Dan Morehead said that bitcoin was that cheap only 20% of its history.

- Bitcoin saw a double-digit drop in its hashrate in a single day on June 21. Ethereum, Litecoin, and other crypto-assets shared the same fate. Then, on June 22, BTC dropped below USD 30,000 for the first time since January.

- Meanwhile, the Ethereum address activity approached Bitcoin’s level in June.

- A new fee structure proposal for Dogecoin was released, which Elon Musk described as ‘important.’

- PayPal, Visa, and other traditional investors doubled down on crypto investments through a Blockchain Capital fund, pouring in some USD 300m.

- MicroStrategy announced a proposed private offering of USD 400m of senior secured notes to raise more money for BTC shopping. The company received some USD 1.6bn in orders. It also said it had no specific target for their BTC holdings.

- US-based venture capital powerhouse Andreessen Horowitz (a16z) secured USD 2.2bn for their crypto investments.

- Solana (SOL), a so-called “Ethereum killer,” rallied on the news that the team raised USD 314m in order to launch an incubation studio to accelerate the development of decentralized applications building on the platform.

- France-based major manufacturer of crypto hardware wallet Ledger said it had “ambitious plans” in DeFi as it raised USD 380m, earning a valuation of USD 1.5bn.

- BitDAO, a decentralized autonomous organization (DAO), raised over USD 230m from a private sale funding round meant to fuel R&D.

- Amber Group, an Asian crypto trading and technology firm, became a new unicorn in the Cryptoverse.

- There was a rapidly growing appetite for crypto assets reported among institutional investors.

- US crypto investors raked in USD 4bn in realized BTC gains in 2020, more than 3x that of Chinese investors.

- Mexican billionaire Ricardo Salinas Pliego said his bank would become the first in the nation to accept BTC.

- US-based payments giant NCR and digital asset management company NYDIG teamed up to enable 24m customers of 650 US banks to buy and sell BTC.

- Crypto platform Crypto.com became the inaugural, global, and NFT partner of the Formula 1 ‘Sprint’ series.

- George Soros and Steve Cohen, two high-profile investors, were both reportedly going crypto.

- US-based model, activist, and businesswoman Gisele Bündchen and American football star Tom Brady took an equity stake in crypto exchange FTX.

- Daymak, a major Canadian electric car maker, announced that its electric cars would come with the ability to mine crypto.

- Popular antivirus software Norton 360 said it would launch an Ethereum mining platform along with a wallet.

- Major producer of Bitcoin mining equipment Canaan became a bitcoin miner in Kazakhstan.

- Craig Wright won a legal battle against the Bitcoin.org operator on a technicality.

- Also, news hit the cryptoverse that antivirus software entrepreneur John McAfee died.

- The Dallas Mavericks owner Mark Cuban found himself among the victims of the Iron Finance “bank run”, with the Cryptoverse yelling ‘DYOR before screaming regulation’.

- Cajee brothers, two individuals who ran the crypto platform Africrypt, vanished in Africa with USD 3.8bn in BTC.

- With this, June ended, and with it the second quarter and the first half of 2021.

____

Learn more:

– Crypto News Rewind 2021: Q1 – Rallies, Tesla & MicroStrategy & PayPal Bitcoin Moves, Historic NFT Moments

– 1BN Crypto Users, Friendlier Regulations, Countries Adopting Crypto – Crypto.com’s 2022 Predictions

– Insiders Predict: NFTs the ‘Gateway Drug to Crypto’, More Countries May Adopt Bitcoin in 2022

– DeFi Trends in 2022: Growing Interest, Regulation & New Roles for DAOs, DEXes, NFTs, and Gaming

– Crypto Adoption in 2022: What to Expect?

– Crypto Investment Trends in 2022: Brace for More Institutions and Meme Manias

– Messari’s Selkis Names His Top ‘Narratives and investment Theses’ for 2022

[ad_2]

cryptonews.com