[ad_1]

Despite crypto penetrating the masses from Bitcoin ATMs to Super Bowl ads, scams in this sector have been going through the roof because more than $1 billion has been lost since 2021, according to a study by the Federal Trade Commission (FTC).

Per the report:

“Since the start of 2021, more than 46,000 people have reported losing over $1 billion in crypto to scams – that’s about one out of every four dollars reported lost, more than any other payment method.”

Some of the top cryptocurrencies preferred by scammers include Bitcoin (BTC) at 70%, Tether (USDT) at 10%, and Ethereum (ETH) at 9%.

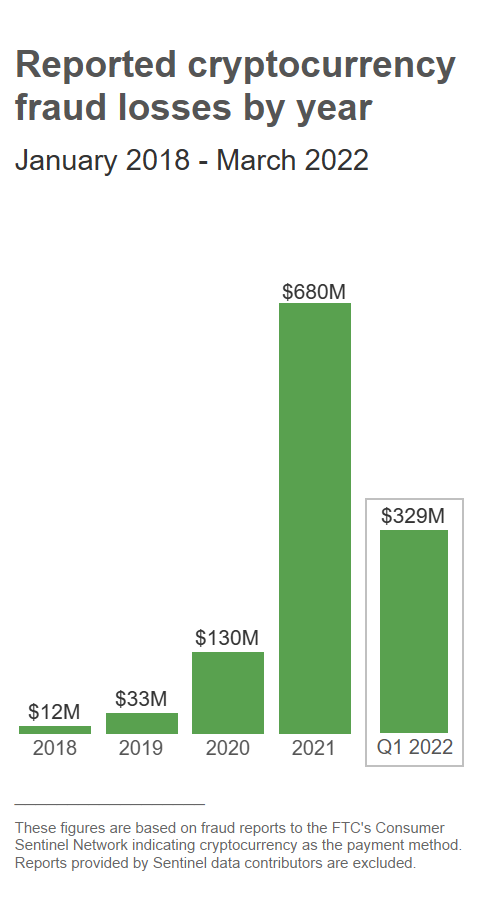

The report acknowledged that losses from crypto scams have increased by nearly 60 times from 2018 to 2021 based on factors like people being inconversant with how cryptocurrency works and crypto transfers not having a reversal option.

Source:FederalTradeCommission (FTC)

According to the study, people who shared their stories noted that the scams were a perfect storm because they were wooed with false promises of getting easy money.

Social media has been fueling scams in the cryptocurrency sector, the FTC acknowledged:

“Nearly half the people who reported losing crypto to a scam since 2021 said it started with an ad, post, or message on a social media platform.”

The FTC added:

“The top platforms identified in these reports were Instagram (32%), Facebook (26%), WhatsApp (9%), and Telegram (7%).”

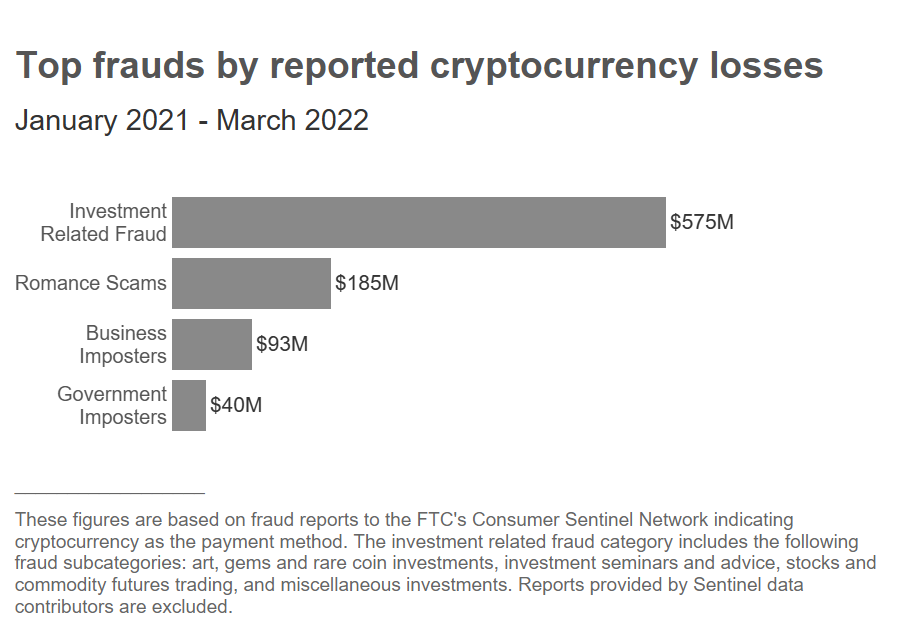

Investment scams took the lion’s share at $575 million, followed by romance-related at $185 million. The FTC pointed out:

“These keyboard Casanovas reportedly dazzle people with their supposed wealth and sophistication. Before long, they casually offer tips on getting started with crypto investing and help with making investments.”

Source:FederalTradeCommission (FTC)

In July 2020, Silviu Catalin Balaci, a 35-year-old Romanian programmer, confessed to orchestrating the BitClub Network, a crypto mining Ponzi scheme that siphoned off investors’ funds worth $722 million.

Image source: Shutterstock

[ad_2]

blockchain.news