[ad_1]

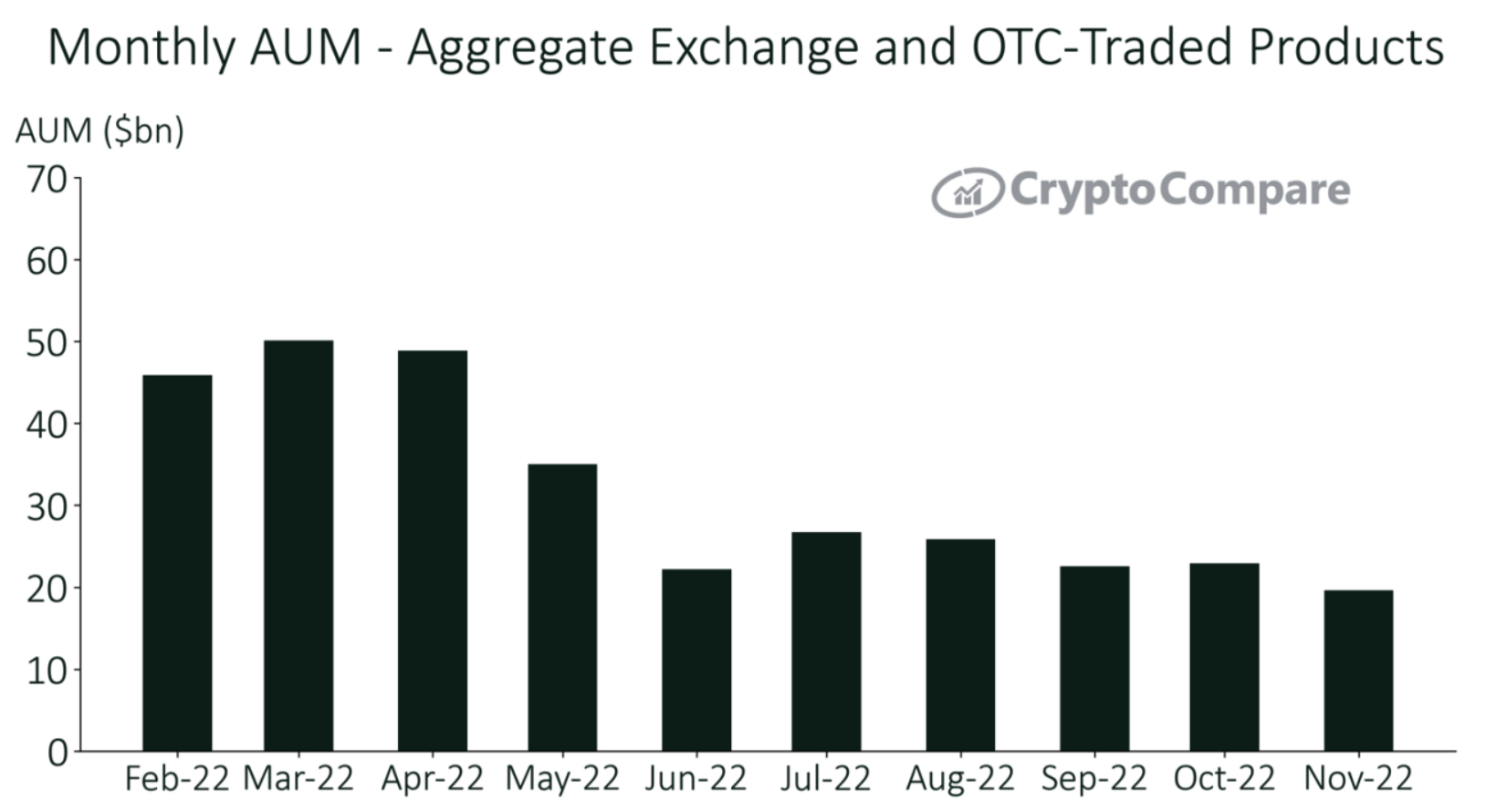

Asset management firms operating in the crypto space saw their assets under management (AUM) decline by 14.5% on average in November, marking the worst month for the industry since December of 2020.

The figures were revealed in a new report by crypto researcher CryptoCompare, which pointed out that the declines were fueled by fears surrounding exposure to the collapsed crypto exchange FTX, and the potential for contagion to other players in the industry.

The latest data now shows that total AUM in digital asset investment products fell to $19.6bn in November, the lowest level since December 2020. Coincidentally, December 2020 also marked the last time bitcoin (BTC) prices traded around the same level as they do today.

ETH funds gain market share

For bitcoin-backed investment products specifically, AUM fell by 15.9% to 13.4bn in November, the report said. It added that this marked the biggest drop in the AUM of bitcoin-backed products since June of this year.

Notably, the market share held by bitcoin-backed products fell by just under 1% in November, to a market share of 68.9%. At the same time, investment products backed by ethereum (ETH) increased their market share for the second consecutive month to 24.9% of the total crypto AUM.

Grayscale still dominates crypto investment space

Worth noting in the report was also the fact that investment products issued by Grayscale continued to dominate the total AUM for crypto-backed products. This was despite the fact that Grayscale’s parent company, Barry Silbert’s Digital Currency Group (DCG), did not escape the FTX collapse unscathed. Additionally, Genesis Global – another company under the DCG umbrella – is reportedly struggling for survival after having failed to raise enough fresh capital.

According to the report, Grayscale’s products had a total AUM of $14.7bn, making up 75.5% of total market. The second company on the list was XBT Provider, an issuer of many exchange-traded crypto products in Europe, which came in with a total AUM of $ $1.03bn, or 5.3% of the total.

Physically backed spot exchange-traded funds (ETFs) and exchange-traded products (ETPs) are listed in several countries in Europe, but attempts at doing the same in the US have so far been rejected by the SEC. Instead, the SEC has allowed bitcoin ETFs backed by futures contracts to be listed on American exchanges.

[ad_2]

cryptonews.com