[ad_1]

Investors are delicately walking on eggshells following a series of events with the potential to alter the direction of the entire market for weeks—and possibly months. The largest meme coin by market capitalization bowed to the massive overhead pressure during the weekend.

Panic reverberated across the market as reports of another bank collapsing – the second in March. Silvergate, a United States-based crypto bank was the first to announce its financial troubles after its capital position weakened significantly from the previous monthly report to the Securities and Exchange Commission (SEC).

Meanwhile, the most recent and biggest blow to the crypto market is the collapse of Silicon Valley Bank (SVB). The 40-year-old bank and previously the 16th largest in the US has for a long time been at the epitome of technological advancement while catering to the financial needs of tech companies the world over.

However, a series of ill-fated investment decisions has seen it fall from grace, leaving regulators and governments with more questions than answers.

How SVB Toppled From The Top

According to the Guardian, SVB’s downfall began when it made significant investments in US government bonds with long maturity periods, including those supported by mortgages, which were considered extremely secure.

Bonds and interest rates have an inverse correlation, meaning bond prices decrease when interest rates increase. As the Federal Reserve began to raise rates quickly to reduce inflation, SVB’s bond investment suffered substantial losses.

SVB faced a shortage of liquid funds, which prompted it to sell its bonds at significant losses, leading to panic among investors and clients. The company’s disclosure of the asset sale was followed by its collapse after only two days.

Why Dogecoin and the Crypto Market Dumped?

News of a liquidity crunch at SVB sent panic across the world with clients rushing to withdraw funds – typical of a bank run. Circle, the company that issues the second largest stablecoin USDC, announced it had exposure to SVB with $3 billion of reverses stuck in the bank.

The news fueled a sell-off in the crypto market with USDT dropping 10% from its dollar peg. Investors panic-sold, fearing a repeat of the TerraUSD (UST) crash in May 2022. Bitcoin price dropped to sub $20,000, pulling most cryptos down.

Due to the sell-off, the total market capitalization slipped below the $1 trillion mark. However, Monday came with renewed interest among investors and hence the spike to $1.05 trillion at the time of writing.

The most popular meme token was not spared by the explosive selling activities over the weekend. Dogecoin price stretched the leg significantly below the monthly open roughly at $0.0825 and tested support at $0.0625.

Retail traders flipped bearish to take advantage of the available short positions, which kept DOGE suppressed throughout the weekend. However, Elon Musk’s most loved crypto shot up 5% on Monday to trade at $0.06914 at the time of writing.

The trading volume has also been on an upward roll with over $500 million recorded in 24 hours, representing a 90% increase. Spikes in trading volume often indicate the presence of liquidity, in addition to a heightened accumulation of DOGE tokens. In other words, an expanding volume is often a positive signal for the token being traded.

Evaluating Dogecoin Price Profitability This Week

Dogecoin investors will throughout the week mainly be concerned about securing higher support, preferably above $0.07. Such a move will reduce the chances of declines extending below $0.06. However, investors should be open to Dogecoin price revisiting the most recent support at $0.0625.

Key levels to watch to the upside would be the region at $0.07 as mentioned. Holding above this level is crucial for the immediate resumption of the uptrend. Furthermore, DOGE staying above this level would repair investor confluence in a short-term trend reversal for gains targeting $0.08 and $0.10, respectively.

Dogecoin price will likely complete a daily bearish candle close On Monday and below $0.07. Nonetheless, all would not be lost for the meme coin, considering the Moving Average Convergence Divergence (MACD) indicator could validate a buy signal anytime from now.

Traders would be looking forward to the MACD line in blue flipping above the signal line in red. A general upward movement in the momentum indicator toward the mean line at 0.00 and the positive region above it would keep investor interest intact.

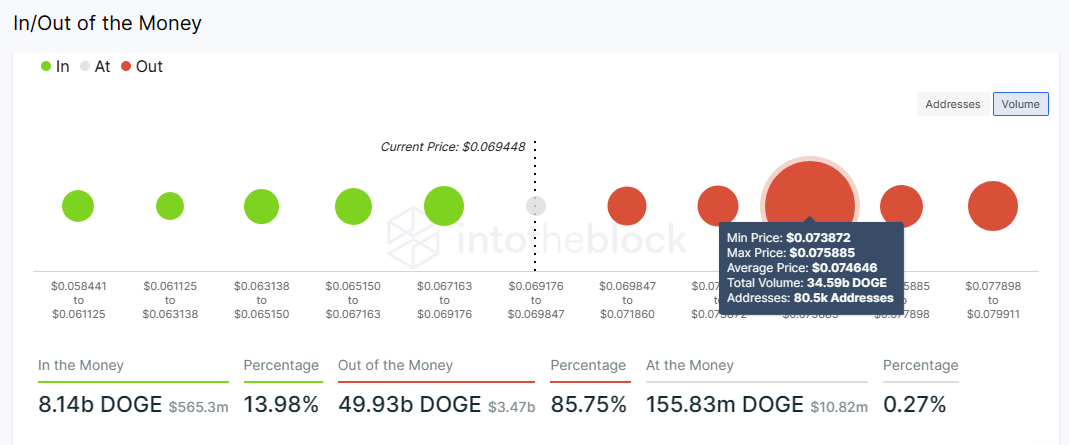

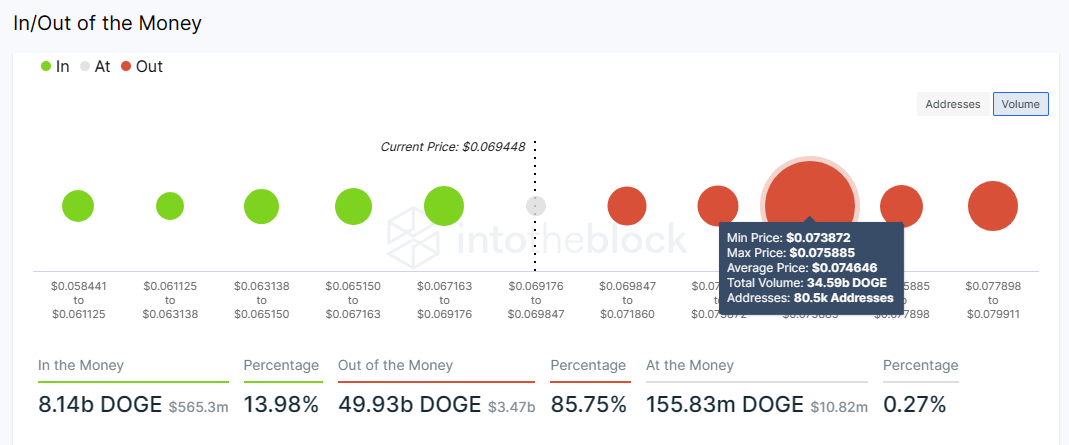

Approximately 80,500 addresses that bought 34.59 billion DOGE between $0.0738 and $0.0758 are out of the money. This means if they sold at the current market rate, they would realize a loss relative to the price at which they purchased the tokens.

Investors must keep in mind that as Dogecoin price strikes above $0.07, it is likely to face resistance in the range between $0.0738 and $0.0758 because investors in this cohort will likely sell at various breakeven points.

On the downside, Dogecoin price lacks robust support as observed from the chart above. The small green circles represent potential liquidity areas where DOGE can find support and rebound.

Given that support areas remain suppressed, a little spike in overhead pressure could force Dogecoin price below $0.06 with potential support at $0.58 before it bounces again.

Buy Dogecoin Now.

Dogecoin Alternatives To Buy Today

If you’re looking for other high-potential crypto projects alongside DOGE, we’ve reviewed the top 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Related Articles:

[ad_2]

cryptonews.com