[ad_1]

The urge to sell in the cryptocurrency market has dwindled based on the surge of leading coins, according to on-chain insight provider Santiment.

Santiment stated:

“Crypto traders’ enthusiasm to sell has quickly subsided, especially as Bitcoin jumped back over $25k and Ethereum over $2k this weekend. Ideally, bulls will actually want FUD to stay high, as prices historically flourish when there is doubt.”

Source: Santiment

This is a bullish sign because once selling pressure shrinks, the demand to buy kicks in and this triggers an upward push.

Despite retracing to the $24K and $1,880 levels, Bitcoin and Ethereum were up by 0.74% and 5.88%, respectively, during intraday trading, according to CoinMarketCap.

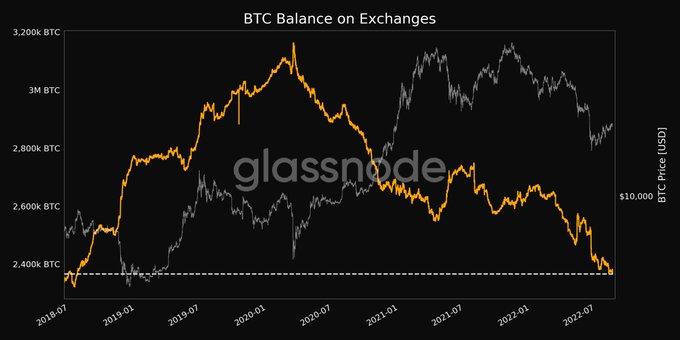

Meanwhile, a hodling culture continues to play out in the BTC market, given that the balance on crypto exchanges hit a 4-year low. Market insight provider Glassnode stated:

“Bitcoin balance on exchanges just reached a 4-year low of 2,366,543.394 BTC Previous 4-year low of 2,368,067.658 BTC was observed on 15 August 2022.”

Source: Glassnode

This correlates with the fact that the amount of BTC hodled or lost hit a 21-month high, Glassnode added.

Source: Glassnode

Coins leaving exchanges illustrate a hodling trend because coins are transferred to cold storage and digital wallets for future purposes other than speculating and selling. Therefore, it is another bullish signal.

Meanwhile, the leading cryptocurrency has held the 200-week moving average (WMA) as support for three consecutive weeks. Crypto analyst Rekt Capital explained:

“Notice how the BTC $23400 level (blue) is approximately confluent support with the orange 200-week MA A dip into ~$23400 would constitute another retest of the 200-week MA. The 200-week MA has been held as support for three consecutive weeks thus far.”

Source:TradingView/RektCapital

The 200 WMA is a long-term indicator that shows whether a market is bullish or bearish.

On the other hand, Bitcoin’s open interest has been experiencing an uptick, Blockchain.News reported.

Image source: Shutterstock

[ad_2]

blockchain.news