[ad_1]

Ethereum (ETH) has not been able to get the right footing since the much-anticipated Merge went live on September 15.

The second-largest cryptocurrency was down by 10.40% in the last 24 hours to hit $1,305 during intraday trading, according to CoinMarketCap.

This price action is being experienced amid high liquidation in the cryptocurrency market. Crypto Reporter Colin Wu or Wu Blockchain pointed out:

“Ethereum fell below $1,300, a 24-hour drop of 10%, and the total liquidation amount in 12 hours reached $300 million. On September 21, the Fed will announce its decision to raise interest rates, and the market is expected to raise interest rates by 75bps.”

Given that interest rate hikes usually have a bearish impact on cryptocurrencies, it remains to be seen how this month’s review by the Federal Reserve (Fed) transpires.

A downward trend is already being experienced in the Ethereum network. Wu added:

“ETC hashrate is 211.11T, down 32.14% from its peak; price is $29.82, down 13% in 24h; ETHW hashrate is 35.48T, down 56.23%, price is $4.66, down 46% in 24h; ETF hashrate is 6.3 TH/s, down 82%, price is $1.22, down 19.8% in 24h.”

The merge changed the consensus mechanism on the ETH network from proof-of-work (PoW) to proof-of-stake (PoS), which is deemed more environmentally friendly and cost-effective.

Despite the bearish momentum being experienced, more Ether continues to be staked in the ETH 2.0 deposit contract. Market insight provider Glassnode stated:

“Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 13,801,319 ETH. Previous ATH of 13,799,319 ETH was observed on 18 September 2022.”

Source:Glassnode

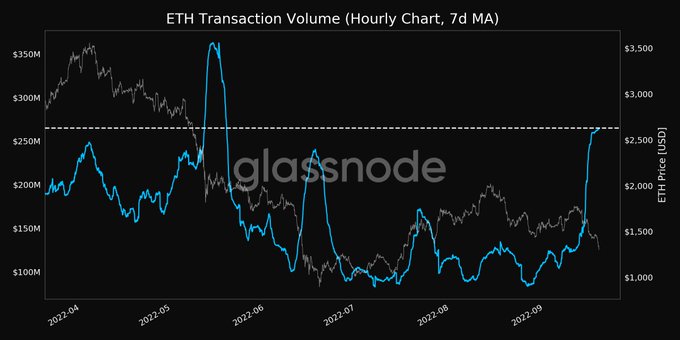

Furthermore, transaction volume has been going through the roof after hitting a 4-month high of $264 million.

Source:Glassnode

Crypto analyst Rekt Capital believes that the bullish effects of the Merge will emerge in the long run.

American multinational investment bank Citigroup or Citi had also stipulated that the Merge would slash the overall Ether issuance by 4.2% annually, making it deflationary,

Image source: Shutterstock

[ad_2]

blockchain.news