[ad_1]

Central bank digital currencies (CBDCs) will not be coming to Florida any time soon, if Governor Ron DeSantis gets his way.

In a press release, Governor DeSantis said his intention with the bill is to “protect Floridians from the Biden administration’s weaponization of the financial sector through a Central Bank Digital Currency.”

It added that the legislation is necessary to “prevent the proliferation of woke ideology into the financial sector.”

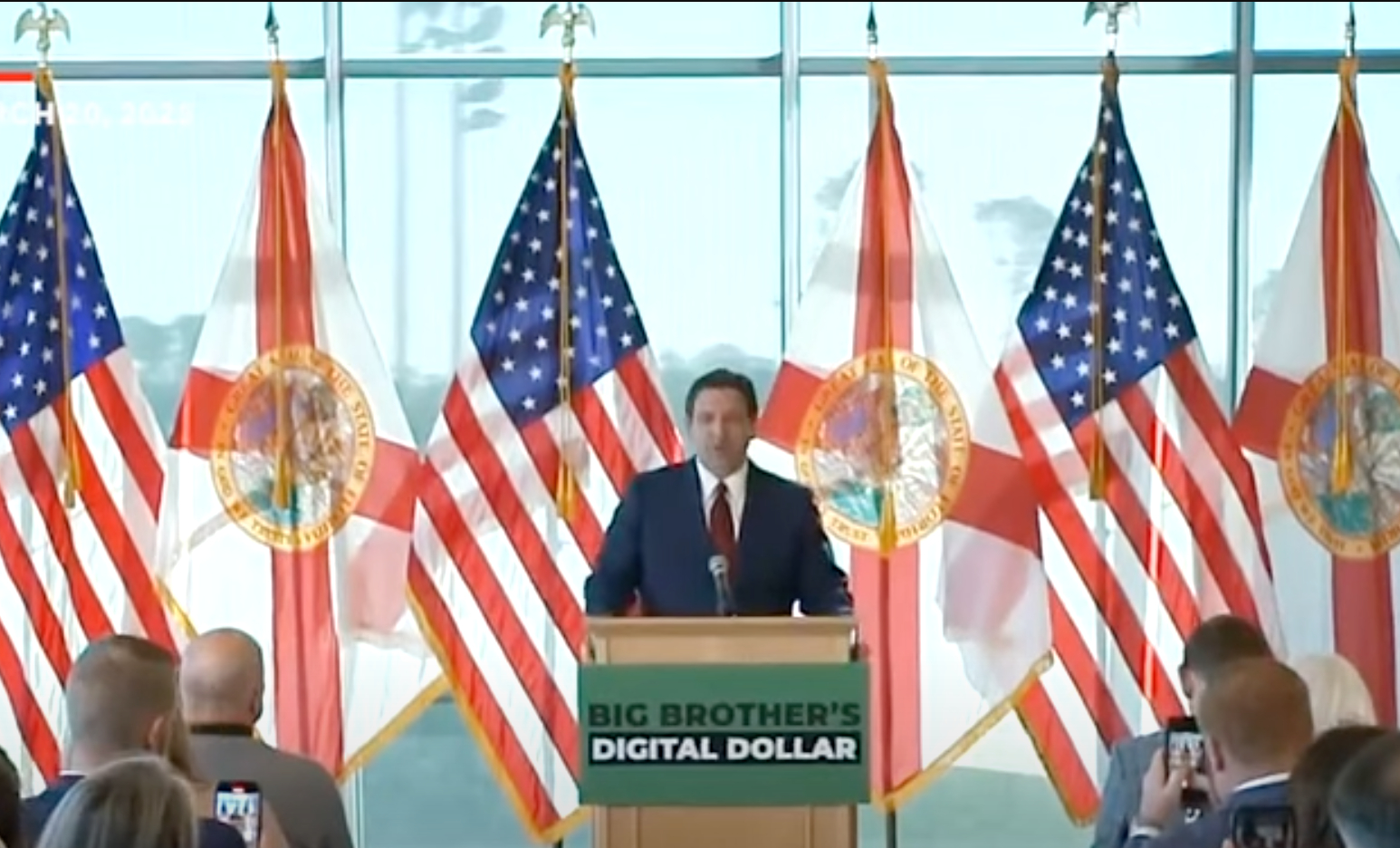

The legislation was announced during a public appearance by DeSantis on Monday, where he stood behind a podium with the words “BIG BROTHER’S DIGITAL DOLLAR.”

Specifically, the new legislation will prohibit the use of a federally issued CBDC, or a CBDC from another country, within Florida’s Uniform Commercial Code, the Governor’s office said.

The announcement also called on other states to follow Florida’s example in an effort to “fight back against this concept nationwide.” So far, however, no other US states have announced similar measures designed to protect against a potential CBDC.

“Surveillance and control”

In a comment, Governor DeSantis – a popular Republican who is seen as potential challenger to Donald Trump in the next Presidential election – said a CBDC is more about control than it is about offering better financial services:

“The Biden administration’s efforts to inject a Centralized Bank Digital Currency is about surveillance and control. Today’s announcement will protect Florida consumers and businesses from the reckless adoption of a ‘centralized digital dollar’ which will stifle innovation and promote government-sanctioned surveillance.”

Florida will not side with economic central planners; we will not adopt policies that threaten personal economic freedom and security,” he added.

DeSantis has in the past also warned about CBDCs. In March last year, the Governor said he sees “a lot of hazards” with centrally controlled digital currencies as “someone in a central authority” could “basically be able to shut off access to purchasing certain goods.”

While opposed to CBDCs, however, the Governor is seen as pro-crypto in general, having in the past proposed a program that would allow business to pay state fees using cryptocurrencies.

[ad_2]

cryptonews.com