[ad_1]

USDC stablecoin is depegging – and at an alarming rate – falling to as low as $0.89, way off its $1 peg.

Volatility is expected to continue throughout the weekend as panic sets in after the Silicon Valley Bank collapse.

The failure of SVB is hurting the reserve position of USDC, which is issued by Circle.

Members of the consortium behind the USDC stablecoin include Coinbase, the largest exchange in the US. Coinbase could see its share price come under pressure when markets open on Monday.

In a tweet last night, Circle let it be known that USDC has a quarter of its reserves in cash held at 7 banking partners, including Silvergate and SVB. USDC has $3.3 billion tied up at SVB.

The remainder of USDC’s reserves are in short-dated US Treasuries money market funds held at BNY Mellon Bank.

Unfortunately for many USDC depositors – which are mostly tech startups and VCs – the vast majority of their funds are not insured by the Federal Deposit Insurance Association (FDIC), as the guarantee only covers the first $250,000.

The California Department of Financial Protection and Innovation took control of SVB – and made the FDIC the receiver – after depositors initiated a run on the bank by trying to withdraw as much as $45 billion on Thursday.

USDC is the second-largest stablecoin in the crypto ecosystem and is an essential part of the industry’s plumbing.

How SVB was laid low – which banks could be next?

The trouble began for SVB when it was forced to sell its long-dated US Treasuries at a loss.

SVB had been using customer deposits to buy long-dated US government bonds that it intended to hold to maturity for a small yet reliable return. This is common practice in the fractional banking model that underpins modern banking.

But in order to meet deposit withdrawal demands, SVB had to sell those bonds at a loss. The Fed putting up interest rates means the value of bonds falls, because bond yields and price have an inverse relationship.

That meant SVB’s assets were worth less than it bought them for. It ended up incurring a loss of $1.8 billion.

Again, in normal times these would not be a problem as the bonds would be held to maturity, but if forced sales take place then those unrealized losses become realized.

To cover those loses, and future expected loses, SVB decided to issue equity.

That’s when the alarm bells started ringing among its depositor base.

SVB has $175.4 billion total deposits of which $151 billion are uninsured, accounting for 85% of its deposits.

Peter Thiel’s Founders Fund advised depositors to get out, which was the nail in the coffin for SVB – bank runs are hard to stop.

Banking system frailties make the case for bitcoin as a store of value

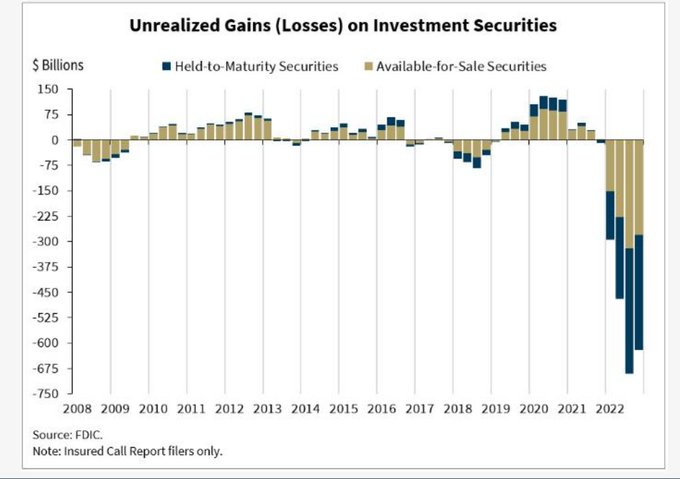

Worryingly for the banking system, SVB is not alone in having these sorts of unrealized losses on its balance sheet, as the chart from the FDIC shows below:

Other banks could now become a target for short sellers and their depositors could start to become nervous.

California-based First Republic Bank, which caters to a wealthy client base, saw its shares fall as much as 15% on Friday. Other regional banks have come under pressure too.

The banking system’s frailties may not extend to the well-capitalized big banks, but the regulator may have taken its eye off the ball as far as the smaller institutions are concerned, as seen with Silvergate and SVB.

Although it may be hard to appreciate this right now, but the unfolding drama does actually highlight the solid use case of bitcoin as a store of value.

Maybe that’s why the price of bitcoin hasn’t cratered on news of the Silicon Valley Bank failure, although that could be because the Silvergate news before it was enough to get the sellers out.

Still, the bitcoin price in the past 24 hours and has held up well, but market participants can expect more volatility ahead.

Bitcoin has rallied 64% from its near-term bottom and has only pulled back 20% so far.

At this point traders might be forgiven for thinking bitcoin is a stabler coin than USDC.

Also, bitcoin holders will be comforted by the fact that it has a huge region of support at the volume profile line of control (red line) around the $16,000 levels.

USDC and DAI in trouble – which of the top stablecoins are at risk?

Traders and crypto firms reacted to the news of USDC reserve exposure to SVB by exiting their positions in the stablecoin and moving into Tether (USDT).

USDT is the original stablecoin but has never conducted a full audit of its reserves, nevertheless is now seen as safer than USDC.

As a resulting of the buying pressure, Tether has now moved off its peg in a positive direction, valued at $1.01.

Other stablecoin issuers have rushed to put out statements stating they have no SVB exposure, including Gemini which issues Paxos, Binance, the issuer of BUSD.

Tether CTO Paolo Ardoino published a statement saying that USDT has no SVB exposure.

The implosion of USDC is having far flung impacts in the crypto space that could turn the crypto winter into an Ice Age crisis.

Decentralized exchange Curve has seen its 3Pool stablecoin pool go wildly out of balance. DAI, USDC and USDT are held in roughly equal in proportions – but that’s in normal times.

Now only about 6% is in USDT while USDC and DAI each make up more than 40% of the pool.

DAI is heavily collateralized by USDC and is also being depegged as of now – currently changing hands for $0.90 instead of $1. DAI is the fourth-largest stablecoin.

Ethereum gas fees spike

Another direct consequence of the latest twist in the crypto crisis is Ethereum gas fees surging to 300+ Gwei.

That equates to transaction costs on the Ethereum blockchain that at one stage were forcing Uniswap users to pay on average $90 to move funds.

At the time of writing average Gwei is 83 but could spike again as the US Saturday session opens.

The Ethereum chain is becoming congested as various crypto firms attempt to reposition their funds to protect themselves from SVB contagion.

Yikes! One trader paid $2m to receive $0.05 USDT

Such is the level of disorder in the marketplace, one trader who was staking in a liquidity pool tried to get out but did not set his slippage – similar to setting a limit order in equities.

As a result the trader fell victim to a so-called maximal extractable value bot. The transaction ended up costing $2,080,468.85 to receive $0.05 of USDT:

Buy USDC today and you could make a lot of money – you could also lose it all

For those who are not afraid of high-octane risk there could be huge amounts of money to be made.

Arbitrageurs could buy USDC in its depegged state and then redeem it for $1 on Monday, pocketing the difference.

But of course that is incredibly risky because no one knows what the FDIC will do about the uninsured deposits at SVB, of which the USDC reserves to pay redemptions are a part.

Some will argue that the taxpayer should have no business with bailing out a bank that went all in on building a deposit base that lacked diversity, due to its preponderance of tech startup and VC deposits.

Michael Egorov, founder of Curve Finance, in comments to Bloomberg said everything will turn out okay, but he would say that wouldn’t he?

“I think that we will see a lot of volatility in USDC price over the weekend because USDC redemptions won’t work in that time – banks don’t work on weekends,”

He then optimistically added: “However, the situation might become better once redemption start working on Monday, and some traders will buy cheap USDC and redeem 1:1 to USD.”

Who Will buy SVB? Elon Musk?

On Monday market participants will be looking to see how the FDIC intends to handle the issue of the uninsured deposits. Ket to that will be if a buyer of the bank can be found.

However, may big banks will be wary of getting entangled with SVB at a time of great uncertainty.

Elon Musk, playfully perhaps, hinted that he might be interested in buying the bank.

But Musk has form on not following through on his tweeted statements.

[ad_2]

cryptonews.com