[ad_1]

In today’s rapidly evolving cryptocurrency landscape, Bitcoin (BTC), the pioneer of the digital currency realm, finds its position and value influenced by emerging blockchain platforms and their associated tokens.

With the current BTC price standing at $26,130 and a 24-hour trading volume of $12 billion, Bitcoin has experienced a decline of nearly 2% within the past day.

Despite this, Bitcoin maintains its premier spot on the CoinMarketCap ranking, boasting a live market cap of $509 billion.

Currently, there are 19,495,550 BTC coins in circulation out of a maximum supply of 21,000,000.

As BTCBSC gains traction, one can’t help but ponder: How might its growing popularity impact Bitcoin’s future value?

Unique Features of Bitcoin BSC Token on BNB Smart Chain

Bitcoin BSC, a token on the BNB Smart Chain, seeks to transport investors to 2011, when Bitcoin was priced at merely $1 and had a circulation of just over 6 million.

In its pre-sale, $BTCBSC replicates this by offering tokens at $0.99, matching Bitcoin’s 2011 supply and pricing. Unique to this token is its integrated staking feature, allowing users to generate passive income through additional tokens.

Contrasting Bitcoin’s energy-extensive Proof of Work mechanism, $BTCBSC offers effortless staking with a single post-purchase click.

Staking rewards, modelled after Bitcoin’s 2011 figures, are dispensed every 10 minutes, in line with Bitcoin’s block confirmation, and are subject to a halving every four years. This ensures a gradual release over 120 years until all 21 million $BTCBSC tokens are in circulation.

While Bitcoin pioneered the crypto realm, advancements in the sector have outpaced its original design.

Buy Bitcoin BSC Here

Bitcoin Price Prediction

Bitcoin’s valuation is currently demonstrating a downward trajectory, having breached the pivotal $26,500 support threshold. There’s an impending risk of BTC diminishing further beneath the significant $26,000 benchmark in the imminent future.

Despite several attempts, Bitcoin was unsuccessful in surpassing the resistance at $27,500 and subsequently underwent a notable pullback.

This decline led the digital currency below critical support levels of $27,000 and $26,500, pushing it into a bearish domain. Additionally, BTC’s valuation dipped beneath the $26,200 support, briefly approaching the $26,000 sector.

A recent bottom was established around the $26,026 mark, and presently, BTC seems to be in a phase of loss consolidation. It currently hovers slightly above the 23.6% Fibonacci retracement level stemming from the recent fall, which spanned from a high of $26,711 to the aforementioned low.

With BTC priced beneath both $26,500 and the 100-hour Simple Moving Average, there’s a looming resistance near $26,350. A significant barrier arises close to $26,500, characterized by a notable bearish trend line and the 61.8% Fibonacci retracement of the previous slide.

Should BTC manage to breach the forthcoming $26,700 resistance, there’s potential for a bullish resurgence. In such a scenario, BTC might ascend towards the $27,000 threshold, and potential additional upswings could target the $27,500 region.

Conversely, if BTC cannot instigate a rebound surpassing $26,500, a further decline seems probable. Immediate support resides around $26,050, with a significant cushion of nearly $26,000. A

conclusive drop beneath this mark could propel BTC towards the $25,400 level in subsequent trading sessions. A continued downtrend might even beckon a valuation close to $25,000.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

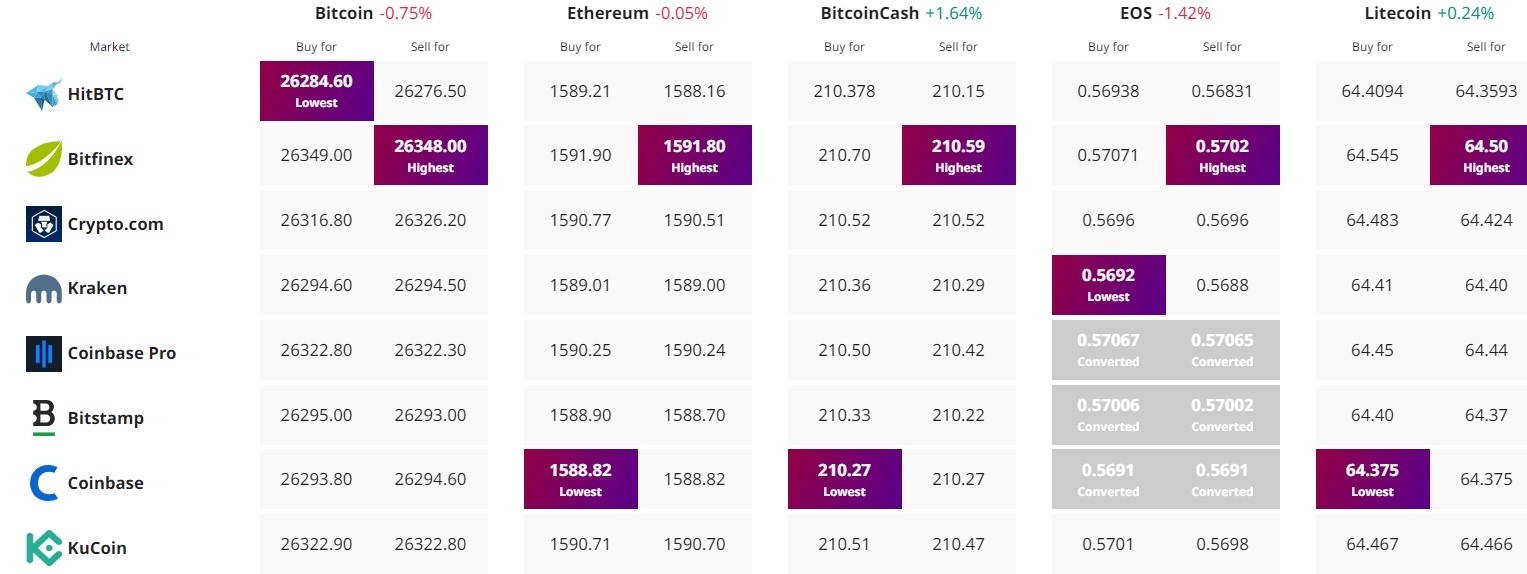

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

[ad_2]

cryptonews.com