[ad_1]

As leading Gamefi project Gala Games (GALA) continues to tumble in the fallout of a major legal dispute between co-founders Eric Schiermeyer and Wright Thurston – with the future of GALA at risk, bag-holders are asking ‘is GALA going to zero’?

This comes amid allegations of theft amounting to $130 million in Gala tokens and corporate mismanagement by Thurston, alongside his investment firm True North United Investments

While Thurston’s counter-claim alleges Schiermeyer lent Gala’s funds to himself for personal use, and even purportedly created Gala-related entities in Switzerland and Dubai, positioning himself as the controlling shareholder to pursue his own business interests.

Yet, despite the dramatic legal dispute, there are signs of life in the GALA ecosystem as top game developer, Peter Molyneux, announced a launch date for a new GameFi business simulator in conjunction with Gala Games.

The blockchain-based ‘Legacy’ title will launch on October 26, and feature Land NFTS and in-game earning mechanisms.

GALA Price Analysis: Can Legacy Launch Save Gala Games from Going to Zero?

As price action enters localised retracement, Gala Games is currently trading at a market price of $0.014 (representing a 24-hour change of +0.69%).

This comes following a brief recovery by GALA following a break back above the 20DMA on September 29, in a +23% move that saw GALA recover almost a month of lost value.

Price action is now fighting to consolidate above the 20DMA at the $0.0145 level.

Meanwhile, the 200DMA remains descendant but high up at $0.0267 – a level untouched for 154 days since May 5.

Despite the impressive upside recovery, the RSI has remained at low bullish divergence – indicating the potential for a strong rally from the potential foothold of support developing above the 20DMA.

While the MACD has also flipped to a bullish signal at 0.00031 – signalling the appetite and buy pressure at this level is strong.

Overall then, Gala Games faces an interesting duality here – with technical structure appearing incredibly poised for a break-out rally, but trading against a background of significant risk stemming from the founder’s legal dispute.

To the upside, a bounce here would target higher support at $0.02 (a potential +37.65%).

While downside risk remains significant, with a potential tumble back down to lower trendline support at $0.012 (a possible -17.4%).

This leaves Gala Games with a risk: reward of 2.16 – a strong entry with upside potential, but risking serious downside stemming from the founders legal dispute.

But while GameFi enthusiasts are balancing the potentially catastrophic legal battle against a moderate +37.65% gain, smart money are betting big on an emerging meme coin project aiming to capitalize on inter-community tribalism.

Meet Meme Kombat: Community Battles Meme Coin Races to +$350k Raised

Meet Meme Kombat, a trailblazing initiative that has seamlessly blended the memetic love of nostalgic gaming, and GambleFi, into a decentralized Web3 platform.

So, what makes Meme Kombat tick, and why should potential investors keep a keen eye on this presale?

The essence of Meme Kombat lies in its captivating arena where characters aiming to tap into deeply tribal crypto communities lock horns.

Players have the liberty to place their bets on these animated battles, predicting the outcomes and possibly reaping attractive rewards.

With a sturdy promise of Season 1 showcasing 11 distinct meme characters, there’s no shortage of action, and Season 2 is already on the horizon for December 2023.

The decentralized nature of the project, combined with the thrill of AI-driven battles, ensures that the outcomes are both transparent and unpredictable – every battle is a new experience, ensuring players stay engaged.

Meme Kombat Aims to Revolutionize GameFi with Gamified Staking Rewards

The project isn’t just about excitement; it’s built on a foundation of trust – Meme Kombat’s commitment to transparency is evident through initiatives like the impending security audit of their smart contract.

The findings of this audit will soon be public, a move that many projects shy away from.

The founder and project lead, Matt Whiteman, isn’t an unknown entity in the crypto space.

His experience spanning two decades in process design, combined with his position as the COO of North Technologies, adds credibility to Meme Kombat.

When so many projects hide behind the veil of anonymity, Whiteman’s open profile and the project’s physical address in Amsterdam offer an extra layer of trustworthiness.

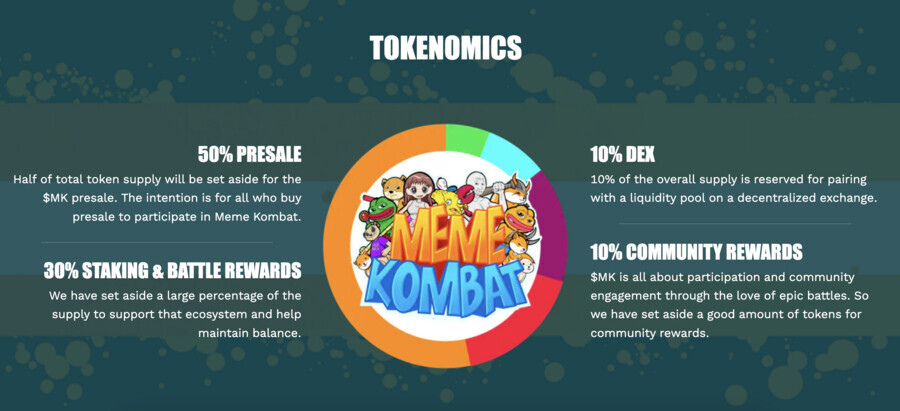

The tokenomics of Meme Kombat is also an appealing factor for potential investors – Stake the Meme Kombat ($MK) token, priced attractively at $1.667, and dive into a rewarding ecosystem.

With a generous APY of 112%, stakers not only benefit from passive income but can also use their staked tokens to place bets in the arena – this dual functionality – earning while gaming – sets Meme Kombat apart.

Intriguingly, engagement on the platform directly influences the income one can earn, so, the more you participate, the more you stand to gain.

With the GambleFi industry booming following coins like Rollbit, Meme Kombat seems poised to tap into this lucrative market with its innovative approach.

By merging memes, gaming, and blockchain, the platform is presenting something fresh to the crypto community.

For those looking to diversify their portfolio with a unique offering, Meme Kombat seems like an opportunity too good to miss – so, don’t be left behind (stay tuned with the MK Telegram).

Embrace the future of meme-based gaming and betting with Meme Kombat.

Buy Meme Kombat Here

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

[ad_2]

cryptonews.com