[ad_1]

Price action remains perilous for Solana (SOL) as bulls wrestle to get rally back on track.

With a current trading price of $21.73 (a 24hr change of -0.51%), Solana continues to fight to hold rally structure – but judgement day is approaching.

Like most risk-on assets, SOL has posted a steady rally into the New Year. With bulls riding high on the back of positive macro sentiment throughout January.

Indeed, a bullish Bitcoin (BTC) – egged on by an uptick in the S&P500 and dovish sentiment from Powell – has ignited markets.

Is Solana (SOL) rally running out of steam?

But some fear the SOL rally could be running out of steam.

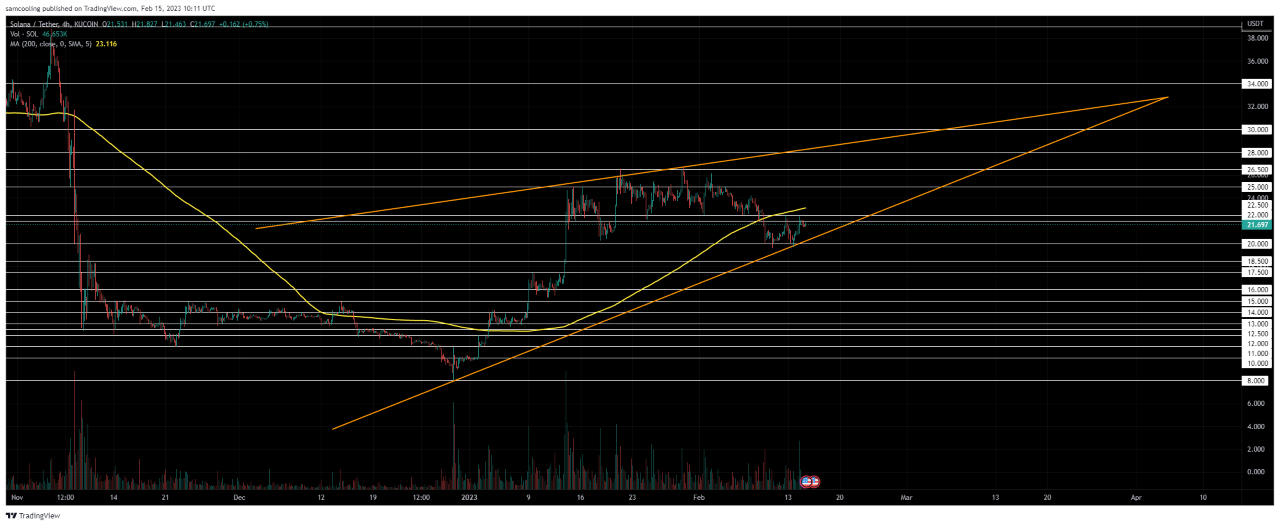

The onset of February saw weeks of hammering against key resistance at $22.50 reject.

The consequent retrace has been a messy 10 day affair. On February 9, Solana price critically dropped below the steadfast 200 Day MA.

Rally chart structure remains as bulls’ hastily caught support and found local legs at $20.00. Yet, SOL is not out of the woods. Trapped in a consolidatory ranging pattern between the 200 Day MA and the vitally supportive lower trend line.

This perilous pendant arrangement is being forced to a head. Local resistance from the 200 Day MA will have to be broken for this rally to resume.

A breakdown from here would be devastating for rally structure. With prices likely to tumble down to the nearest support at $16.00.

But a break upwards above the 200 Day MA would see the rally resume testing at $22.50. If this ceiling gives way, price would surge up to around $26.00.

Key Solana (SOL) indicators

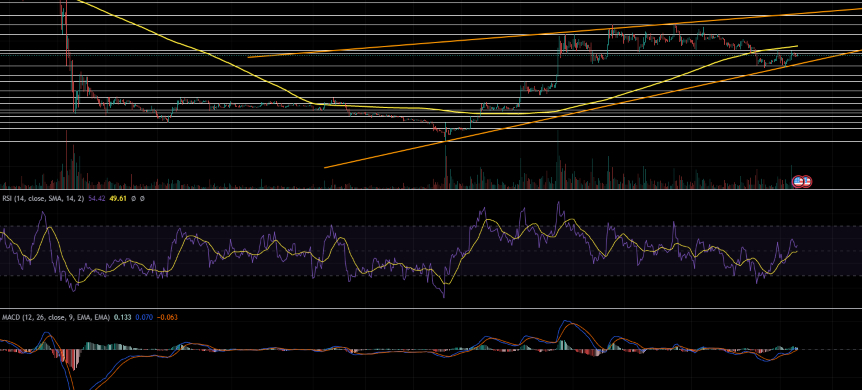

The RSI 14 does little to illuminate current price action. Reading at an on-the-fence 55 – minor bearish divergence reflecting cautious buy pressure.

The MACD on the other hand is sat at 0.139 – minor bullish divergence reflecting bulls running up to test local resistance off the 200 Day MA.

Overall then, judgement day is coming for SOL’s New Year rally.

Upside potential if things go well is $26.00 (+18.8%). Whereas downside risk is more significant at $16.00 (-26.8%).

This produces a Solana price analysis Risk:Reward ratio of 0.7 – a risky and unattractive entry.

Buy SOL Now

Is Now A Good Time to Buy SOL?

While SOL is due a substantial rally at some point in the future, this may not come for several months. So if you’re looking for other high-potential crypto projects alongside SOL, we’ve reviewed the top 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

[ad_2]

cryptonews.com