[ad_1]

Banks in Japan are starting a trial for issuing fully compliant stablecoins on an ultra-fast but largely centralized blockchain known as the Japan Open Chain.

The bank trials will be the first experiment with stablecoins in Japan that is fully compliant with local laws, a press release sent out on Thursday said.

For now, the trial involves the three Japanese banks Minna no Bank, Tokyo Kiraboshi Financial Group, and Shikoku Bank, with each bank set to issue its own stablecoin.

Proof-of-Authority

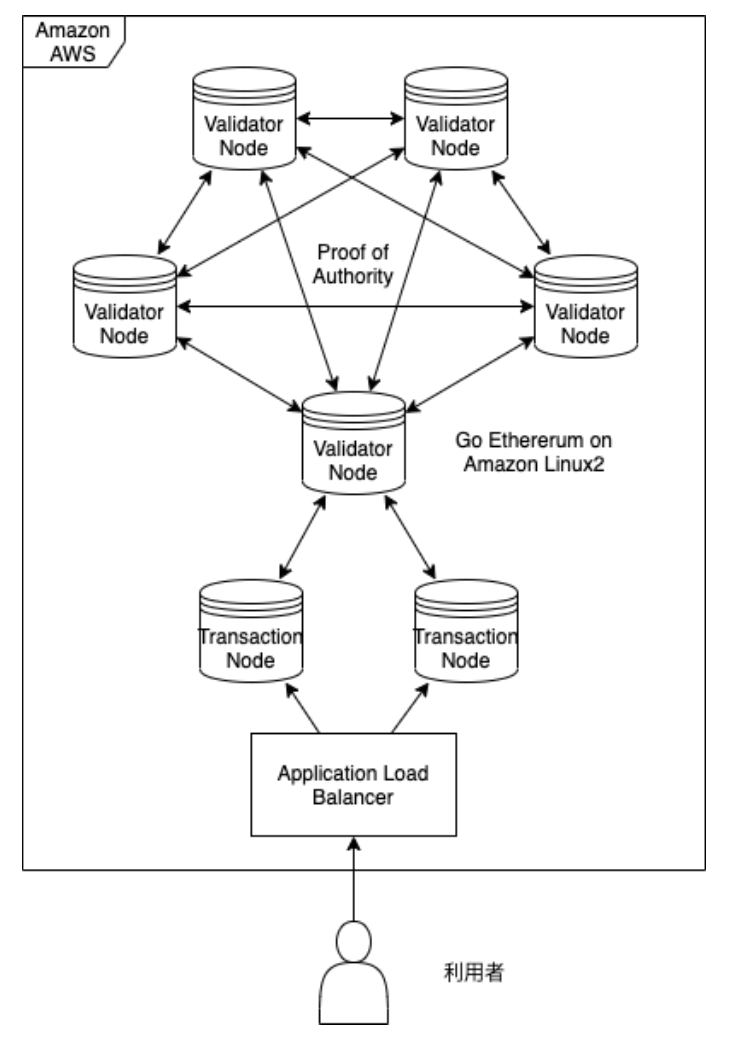

The blockchain the banks will use – the Japan Open Chain – is developed by the local firm GU Technologies. The chain can reportedly process 1,000 transactions per second, and uses a consensus algorithm called Proof of Authority (PoA) instead of the more widely known Proof-of-Work (PoW) or Proof-of-Stake (PoS).

As is often the case, however, higher transaction speeds come at the expense of decentralization.

According to its website, the Japan Open Chain has only six network validators, compared to the tens of thousands of node operators on for example the Bitcoin network. Over time, Japan Open Chain aims to increase the number of validators to 21 companies, its website states.

Fully compatible with Ethereum

Japan Open Chain is fully compatible with Ethereum, which has the world’s largest ecosystem for decentralized applications, the press release explained.

It added that this also makes the chain compatible with the popular Ethereum wallet MetaMask, which makes it easily available for a large number of regular crypto users.

The issuing of stablecoins on the Japan Open Chain will be a “great business opportunity” for Japanese financial institutions, potentially enabling them to process transactions made all around the world, the press release concluded by saying.

[ad_2]

cryptonews.com