[ad_1]

South Korean prosecutors have arrested a group of foreign nationals – comprising North Korean defectors and at least one Libyan national – over suspected “kimchi premium”-type crypto trading offenses.

Per Yonhap, prosecutors have charged and detained three individuals, including a 44-year-old Libyan and a 43-year-old North Korean defector. The trio was held on charges of violating the Specific Financial Information Act and the Foreign Exchange Transactions Act.

Two other North Korean defectors, one aged 43 and the other aged 54, were charged with violating the Electronic Financial Transaction Act and the Specific Financial Information Act respectively. Both of these individuals were released on bail pending trial.

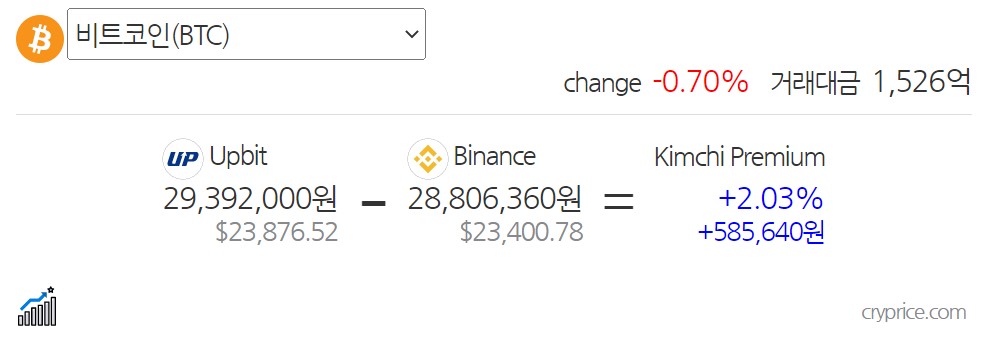

Current kimchi premium values – as trading volumes grow in South Korea, the discrepancy between domestic prices and those on overseas platforms has grown. (Source: Cryprice.com)

Prosecutors say the group spent over $76 million buying coins – and made “thousands” of token buys on overseas exchanges. Officers said the group worked on behalf of suspected “accomplices” and “clients” in Libya.

An official from the prosecution service was quoted as stating:

“We are continuing to investigate [suspected] accomplices. We will work hard to recover [the funds] and prevent similar crimes.”

What Is the Kimchi Premium?

The kimchi premium is a phenomenon whereby bitcoin (BTC) and altcoins trade on South Korean exchanges at significantly higher prices than on international platforms. This phenomenon tends to occur when demand rises among South Korean retail investors.

Some traders have sought to exploit this by buying coins from over-the-counter vendors and then “dumping” them on domestic platforms.

In the 2017 bull run, the premium peaked at about 55%. The premium then vanished. But it resurfaced and rose into the late teens and above during the 2020-2021 bull run.

Prosecutors say the group was active between October 2021 and October 2022.

They added that the 44-year-old Libyan worked as a “broker” of sorts for clients in his native country. His clients allegedly hoped he would help speed up remittances and help them spend less on fees.

South Korean prosecutors, police officers, and customs officials have attempted to wage war on kimchi premium trading in recent years. They believe traders have used a sophisticated network of shell companies in a bid to throw investigators off their trail.

Last month, prosecution officials said they were hoping to convict 20 people for allegedly conducting $3.2 billion worth of kimchi premium transactions.

[ad_2]

cryptonews.com