[ad_1]

The Litecoin price has gained by 1.4% in the past 24 hours, climbing to $91.34 as the cryptocurrency market continues to weather the effects of the SEC taking enforcement action against Paxos and its BUSD stablecoin. Its current price marks a 5% loss in a week, although the coin remains up by 4% in the last 30 days.

This appreciation in the past month has been helped by the Litecoin Foundation’s announcement that its Mastercard-powered Litecoin Card will be launching in Europe. And with LTC’s 24-hour trading volume rising above $600 million, the token could have further gains in store in the coming days.

Litecoin Price Prediction as $600 Million Trading Volume Comes In – Can LTC Reach $1,000 in 2023?

LTC’s indicators continue to suggest that, in the short term, it may be due a fall. Its relative strength index (purple) has dropped down to 50 in the past few days, and may continue to fall along with the coin’s price.

In addition, LTC’s 30-day moving average (red) has likely peaked in relation to its 200-day (blue). It may therefore start coming down soon, helped by imminent losses.

Indeed, the arrival of greater trading volume could be an indicator of traders preparing to sell, rather than the reverse. As such, holders may need to brace themselves for further movements.

In this respect, the key support level to consider here is $90. If LTC falls below this level — which has held since the beginning of February — it could end up seeing returns to $85, which is where it was at the beginning of the year.

However, Litecoin’s fundamentals arguably make it one of the best altcoins in the market. As mentioned above, the Litecoin Foundation recently expanded its partnership with Unbanked and Mastercard into Europe, building on the success Litecoin Card has had since launching in the United States some two years ago.

With the launch of the Litecoin Card in the UK and Europe, millions of people can now spend their LTC holdings to pay for goods and services at thousands of retailers. This launch testifies to the popularity of LTC as a means of payment, with the cryptocurrency standing as a slightly more scalable and spendable fork of Bitcoin.

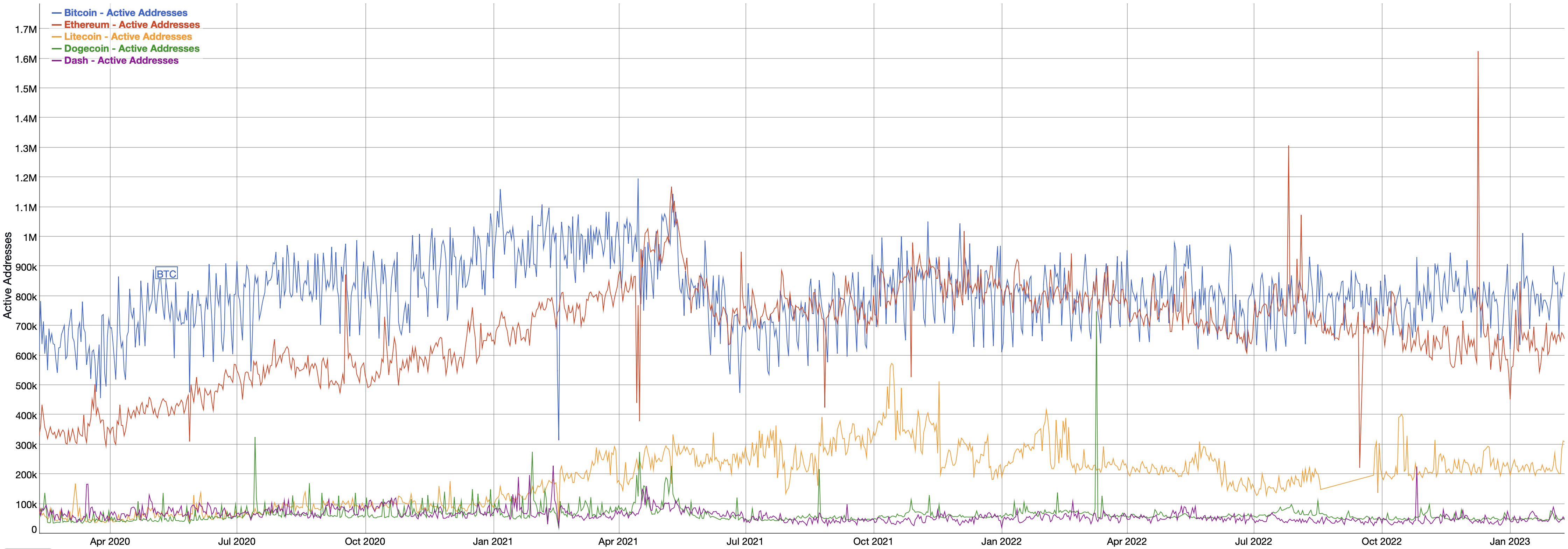

That LTC remains popular is supported by its data, with figures from BitInfoCharts revealing that it boasts just over 250,000 active addresses in the past 24 hours, putting it ahead of Dogecoin and Dash. It has also witnessed more than 110,000 transactions in the past 24 hours, compared to 300,000 for the more established Bitcoin.

Such data reveals that, despite a lack of media hype, Litecoin continues to attract usage. By extension, it’s arguable that LTC is currently undervalued to a significant degree, implying price gains in the not-too distant future.

While $100 hasn’t been reachable for the altcoin in the past week, LTC will almost certainly meet this target later in the year, as market conditions become more favorable. And as the year draws to a close, it could even reach $200 or higher, assuming more bullish sentiment.

In fact, some supporters believe it could reach $1,000 by the start of 2024. Such a rise could be helped by Litecoin’s next halving (reducing its block reward), which is due in August.

Buy Litecoin Now

Litecoin Alternatives

Despite its potential, it’s likely that LTC won’t enjoy a major rally until the market as a whole picks up. That said, there are some high-potential tokens that could rally in the nearer future. As such, we’ve reviewed them in a list of the top 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

[ad_2]

cryptonews.com