[ad_1]

Sentiment across major coins in the crypto market continued to improve over the past week, after also seeing a strengthening last week, according to data from the market sentiment analysis service Omenics.

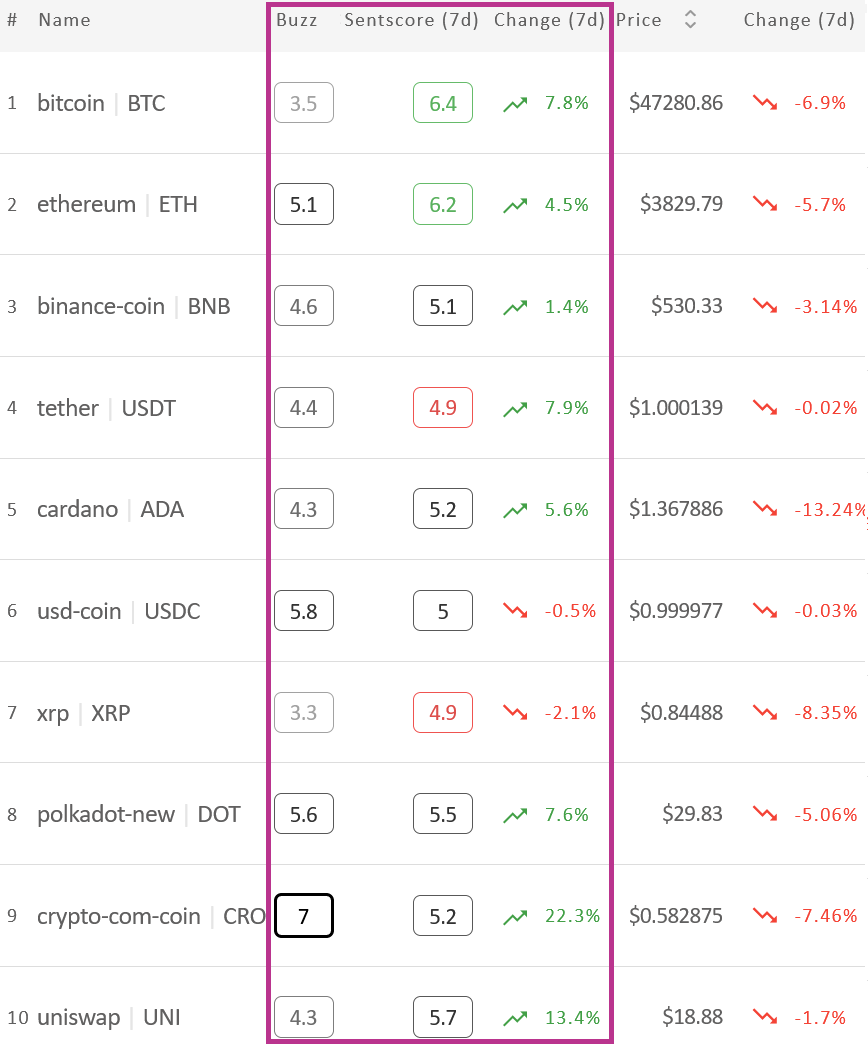

The 7-day moving average of the sentscore for ten major cryptoassets tracked by Omenics for the past week stood at 5.41, up from 5.16 last Monday and 4.85 the week before that. The increase this week comes as a result of a stronger 7-day average sentscore for nearly all of the top 10 coins tracked by Omenics, with bitcoin (BTC) and ethereum (ETH) rising by 0.3 and 0.2 points, respectively, compared with last week.

With a 7-day average sentscore of 6.4 for BTC and 6.2 for ETH, both of these coins are now within the zone that Omenics calls “somewhat positive.”

The only coin in the top 10 list that saw a lower 7-day average sentscore this week was XRP, which dropped from a score of 5.1 last week to 4.9 today.

Sentiment change among the 10 major coins*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive zone

Taking a more focused look at the action over the past 24 hours reveals that sentiment for the two largest cryptoassets has soured somewhat in the short term. On a 24-hour basis, BTC has a sentscore of 6, while ETH has a sentscore of 5.8, the data from Omenics showed.

At the same time, some coins showed a stronger sentiment on this shorter time-frame. Among these, the stablecoin USD coin (USDC) was among the most notable, with a 24-hour sentscore of 5.6 for the day compared to 5 for the week, which could indicate that traders are seeking safety in the stablecoin as crypto prices are falling.

Other than USDC, Uniswap’s governance token UNI also saw stronger sentiment surrounding it over the past 24 hours compared to over the week as a whole. At the time of writing, UNI’s 24-hour sentscore stood at 5.8, the data showed.

Zooming out to cover all of the 35 coins tracked by Omenics on a 7-day average basis, it’s clear that sentiment at the moment favors the two largest cryptoassets. However, there are exceptions to this, with for instance cosmos (ATOM) seeing a sentscore of 6.1. Other than the three mentioned above, no other coins had a sentscore in the area that is considered positive.

Looking at the opposite side of the spectrum, QTUM, nem (XEM) and OMG saw the worst 7-day average sentscores among all coins tracked, with scores of 3.8, 3.9 and 4, respectively. The low scores placed QTUM and XEM in the zone that Omenics defines as “somewhat negative,” while OMG barely managed to stay in the “neutral” zone.

____

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 35 cryptoassets.

[ad_2]

cryptonews.com