[ad_1]

Bitcoin and Ethereum, two paramount forces in the cryptocurrency realm, are currently experiencing minimal fluctuations of around 1%. They are trading near $26,500 and $1,600, respectively, with an intriguing neutrality, potentially influenced by a tempered trading volume.

Bitcoin and Ethereum, two paramount forces in the cryptocurrency realm, are currently experiencing minimal fluctuations of around 1%. They are trading near $26,500 and $1,600, respectively, with an intriguing neutrality, potentially influenced by a tempered trading volume.

Such a tight trading range can often serve as a harbinger for a breakout, and as investors eagerly scrutinize each shift, it becomes paramount to understand the underlying sentiments.

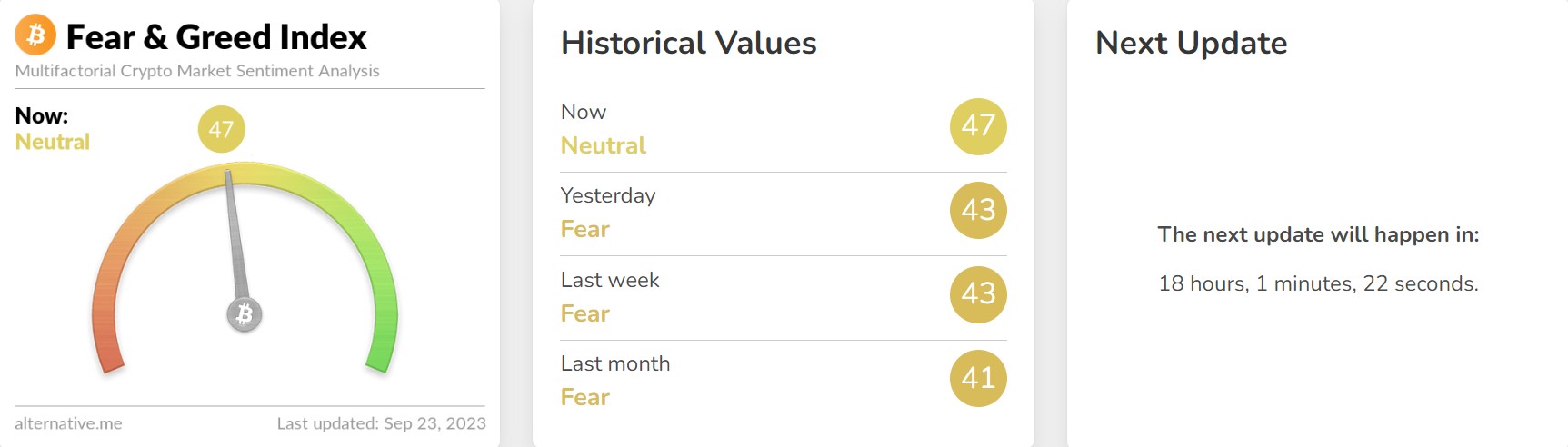

At the same time, the Fear & Greed Index remains neutral, suggesting indecision among investors. This could be one of the reasons behind the neutral trading bias in the cryptocurrency market.

Let’s now dive into the technical aspects of the BTC/USD and ETH/USD pairs.

Bitcoin Price

As of the latest update, Bitcoin is priced at $26,557, boasting a 24-hour trading volume of $10 billion. Reflecting a modest decline, the digital asset has depreciated by 0.31% over the past day.

It retains its premier position on CoinMarketCap, supported by a live market capitalization of approximately $517.69 billion.

The available circulating supply registers at 19,493,312 BTC coins, approaching its predefined maximum of 21,000,000 BTC coins

Bitcoin Price Prediction

From a technical perspective, Bitcoin demonstrates increased market sensitivity, recently surpassing the critical support level pegged at $26,600.

This benchmark previously acted as a resistance point. However, consistent confirmations, most notably on the 4-hour chart, have elevated its significance as a robust support zone for the cryptocurrency.

Following its descent below the $26,650 mark, Bitcoin seems to gravitate towards an immediate support level of $26,300.

As evidenced on the 4-hour chart, the cryptocurrency now positions itself beneath the 50-day exponential moving average and has deviated from its prior ascending trajectory.

Should this downward trend continue, Bitcoin’s next target could potentially be the $25,511 mark.

Conversely, overcoming the $27,000 threshold might set Bitcoin on a trajectory towards $27,500.

This $27,000 juncture, underscored by the 50-day average, is a decisive pivot point dictating Bitcoin’s forthcoming market direction.

Ethereum Price

Ethereum is currently trading for $1,593, accompanied by a 24-hour trading volume of $3 billion. The cryptocurrency has seen a marginal appreciation of just under 0.10% over the preceding 24 hours.

Ethereum maintains its position as the second-ranked asset on CoinMarketCap, boasting a live market capitalization of $191 million.

There’s a circulating supply of 120,227,075 ETH coins, with its maximum supply data undisclosed.

Ethereum Price Prediction

The ETH/USD pair exhibits a turbulent trading pattern, encountering immediate resistance at $1,600 and support near the $1,575 mark.

A breakout from this defined range could catalyse subsequent price movements.

Should ETH successfully breach the $1,600 threshold, ensuing resistance may be anticipated around $1,625, with a more formidable barrier emerging near the double-top pattern of approximately $1,660.

Conversely, if there’s a bearish descent beyond the $1,575 point, the trajectory might steer Ethereum’s price towards the $1,535 mark.

Concurrently, the 50-day EMA, RSI, and MACD indicators all lean towards a bearish inclination, as is evident in the accompanying chart.

Investors would do well to monitor the $1,575 juncture, as a downward shift past this could unveil further selling prospects.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

[ad_2]

cryptonews.com