[ad_1]

Crypto-exchange OKX has released its third monthly proof-of-reserves (PoR) report, confirming that all its reserves are held in bitcoin, ethereum and USDT. This also means that none are held in its native token OKB, with OKX claiming that it has the largest ‘clean’ asset reserves of any major exchange, equivalent to around $7.5 billion.

Along with previous reports, OKX latest release may go some way to calming fears of further contagion in the cryptocurrency industry, with the collapse of FTX in November having a knock-on effect on other platforms. However, with DCG-owned Genesis declaring bankruptcy yesterday, it’s clear that the industry hasn’t weathered the storm just yet, and that it may take more than monthly PoR attestations to restore investor confidence.

OKX Publishes 3rd Proof of Reserves Report, Shows it Holds None of its Native Token as Collateral

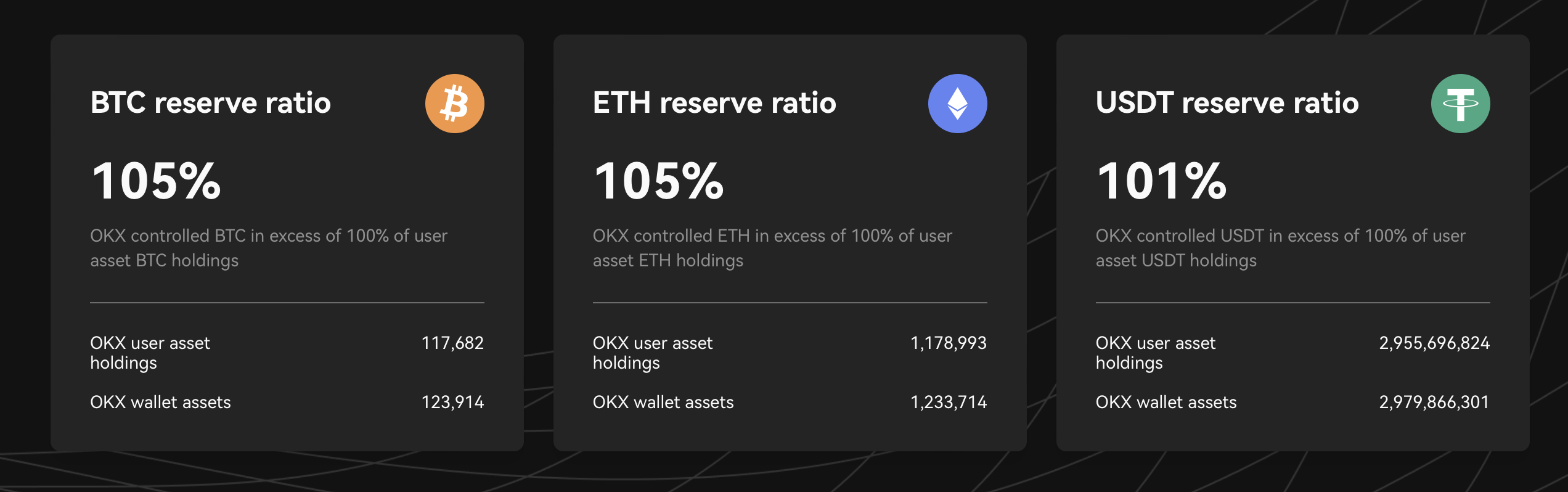

According to OKX latest PoR report, its reserves are actually over-collateralized. This means that it holds more bitcoin, ethereum and USDT in reserve than its customers have deposited with it.

The lack of OKB in OKX’s reserves is significant insofar as a heavy reliance on FTT was one of the major causes of FTX’s demise and ultimate collapse. By not using OKB in its reserves, OKX shows that it’s not vulnerable to a situation where OKB’s price falls dramatically, making its reserves all-but worthless.

According to the exchange, it has published more than 23,000 addresses for its Merkle Tree-based PoR program, with its OKX PoR protocol being open source and available to the public on Github (additional OKX holdings can be viewed on the OKX Nansen Dashboard).

For OKX CMO Haider Rafique, such transparency should provide customers with the assurance that OKX — which is the sixth-biggest exchange in the world in terms of volume (according to CoinGecko) — is one of the more stable exchanges in the industry.

Commenting on the PoR report in a press release, he said, “Security, transparency and trust are core tenets of the OKX business process and customer service philosophy. We’ve already taken a leadership position by publishing our PoR monthly. As industry standards for PoR continue to take shape, we expect that our reserve asset quality will be one of many key differentiating factors for OKX in the market.”

Of course, critics have pointed out that an exchange publishing its reserves is all well and good, but without similar transparency for its liabilities, there’s no reliable way of knowing how secure its financial position is.

Still, in the wake of the catastrophic FTX collapse, proof-of-reserves is at least a positive first step in restoring trust to the industry. It begins a community-wide conversation about how to assure traders and investors of the security of exchanges, and if trading platforms truly are serious about demonstrating their stability, they will consider proof-of-liabilities (and full balance sheets) soon enough.

OKX vs Binance

It’s also worth pointing out that, even without proof of liabilities, OKX’s reports contrast favorably with those of Binance, one of its main rivals. Back in November, it emerged that Binance held only 97% of the bitcoin it owed as customer deposits.

That said, recent data suggests that Binance has enjoyed a substantial inflow into its reserves, potentially filling any gaps in its collateralization ratios.

Nonetheless, doubts probably won’t be eliminated until a majority of major exchanges become publicly traded entities, something which will obligate them to publishing full quarterly financial reports.

However, public listings are probably some way off, if only because the global economic downturn makes IPOs less attractive (insofar as they would raise less money than they would during growth periods).

So for now, the industry and its investors will have to make do with proof-of-reserve reports. Although based on how OKB’s price responded to the latest report, it seems that the market isn’t particularly convinced by proof of reserves.

It was up by a modest 1% in the past 24 hours, reaching $31.03. This represents a 5% gain in a week and a 36% rise in a month. That said, BNB is down by 1% in a day and up by only 14% in a month, so maybe strong proof-of-reserve reports do make a difference.

[ad_2]

cryptonews.com