[ad_1]

Investors are more bullish on Bitcoin than they are on Ether (ETH) over the next few months, according to various option market gauges of sentiment provided by crypto analytics website The Block. That could mean downside for the ETH/BTC exchange rate over the next few weeks and months.

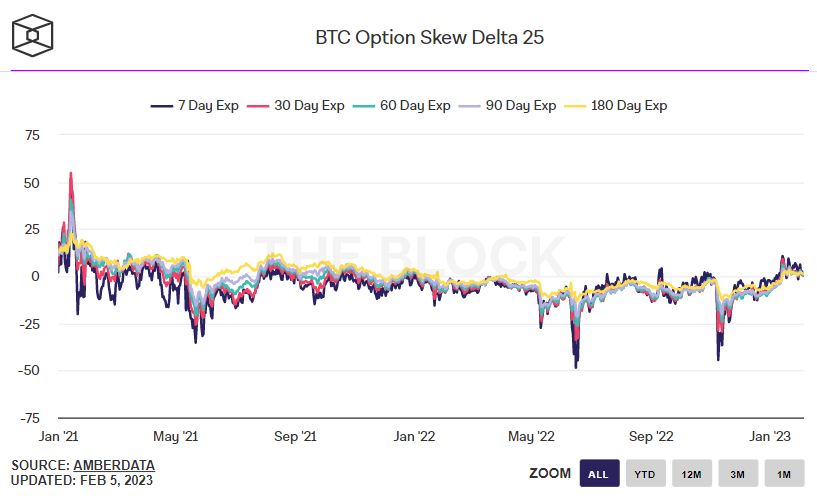

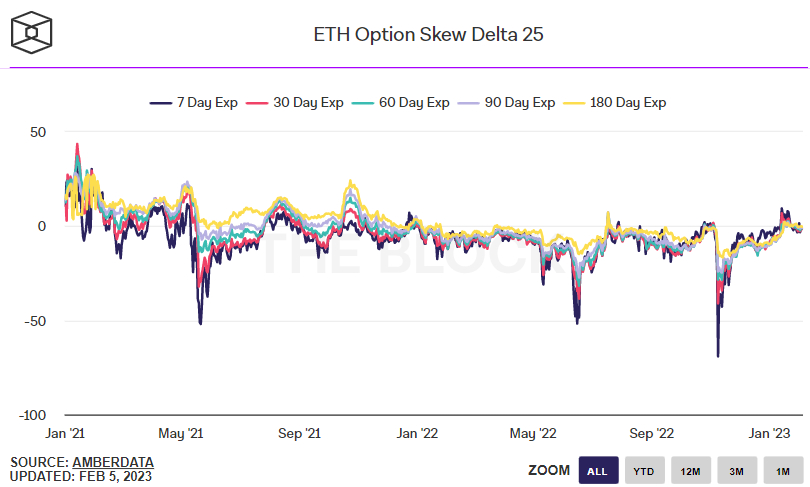

According to a chart provided by The Block, the widely followed 25% delta skew of Bitcoin options expiring in 180 days remained was 1.32 on the 5th of February, not too far below recent one-year highs hit last month in the 3.3 area. The 25% delta skew of Bitcoin options expiring in 7, 30, 60, 90 days were all a little lower, but still above zero, hence indicating that the market has a modestly positive bias.

The 25% delta options skew is a popularly monitored proxy for the degree to which trading desks are over or undercharging for upside or downside protection via the put and call options they are selling to investors. Put options give an investor the right but not the obligation to sell an asset at a predetermined price, while a call option gives an investor the right but not the obligation to buy an asset at a predetermined price.

A 25% delta options skew above 0 suggests that desks are charging more for equivalent call options versus puts. This implies there is higher demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

The 25% delta skew of Ether options expiring in 180 days, meanwhile, was -0.3 on the 5th of February, while the 25% delta skew of Ether options expiring in 7, 30, 60, 90 days were all a little lower at between -0.8 and -1.5. Options markets thus indicate that investors currently have a modestly negative bias on ETH.

Put/Call Ratio Also Concerning For Ethereum Bulls

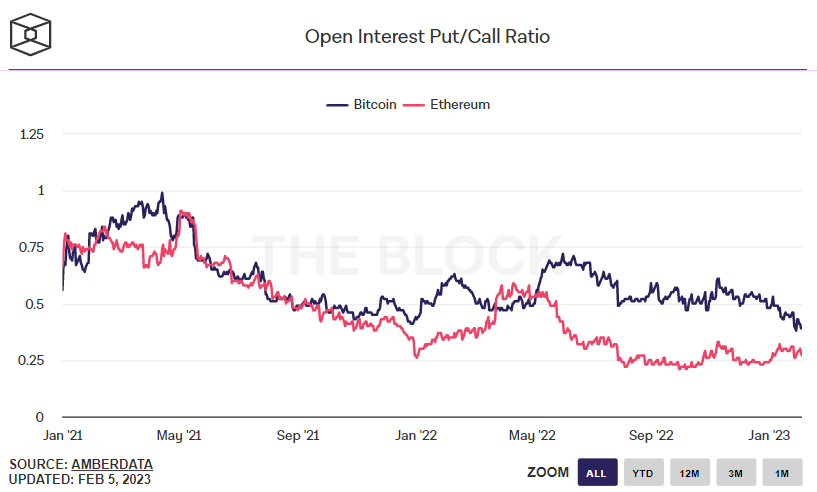

The ratio between the open interest of Bitcoin put and call options was 0.39 on the 4th of February, close to its lowest in over two years. A ratio below 1 means that investors favor owning call options (bets on the price rising) over put options (bets on the price dropping).

While the Ethereum Open Interest Put/Call ratio was last lower at 0.27, it remains substantially above its recent lows hit at the beginning of last October around 0.2. Ether bulls will thus be disappointed to see how, while the Bitcoin Open Interest Put/Call ratio has dropped substantially in 2023 as prices have risen, the same cannot be said for the Ether Open Interest Put/Call ratio.

Options markets are sending a clear signal that, despite this year’s impressive price performance (ETH is up nearly 40%), investors are yet to warm to ETH as much as they have been to Bitcoin as of late. Further signs of this apparently better sentiment towards Bitcoin was evident in CoinShare’s latest weekly fund flows report, which showed Bitcoin once again dominating inflows.

Some Ether investors are perplexed. The Ethereum blockchain will undergo a major upgrade in just under two months – the so-called Shanghai hard fork will free up staked ETH withdrawals for the first time, which is expected to entice significant investment into the Ethereum ecosystem in the long-run.

Meanwhile, Ether is currently experiencing deflation, with the cryptocurrency’s annualized burn rate (thanks to Ethereum Improvement Proposal 1559) currently outstripping the cryptocurrency’s issuance rate. When an asset it deflationary, that typically means higher prices over time.

ETH/BTC to Break Lower?

Options markets are thus sending a signal that ETH/BTC may continue to head lower, with the pair down around 1% this year at 0.0715 and over 16% versus last year’s highs in the 0.085 area. ETH/BTC did recently fund support in the 0.068 area, largely thanks to a long-term uptrend that has been providing support since late 2020. But technicians are warning that if this uptrend is to break, that could open the door to a longer-term move lower in ETH/BTC towards the 2022 lows under 0.05.

[ad_2]

cryptonews.com