[ad_1]

The 14-Day Exponential Moving Average (EMA) of the number of transactions taking place on the Bitcoin network hit its highest level since April 2021 earlier this month, according to data from crypto analytics firm Glassnode. The 14-Day EMA of transactions recently surpassed 300,000, with analysts and cryptocurrency market commentators citing the recently deployed Bitcoin NFT protocol called Ordinals.

According to crypto derivatives firm BitMEX, as of the 7th of February, over 13,000 Ordinal NFTs had been minted directly onto the Bitcoin blockchain, taking up 526MB of block space and associated with a spend of 6.77 BTC (worth around $150,000 at current prices).

The deployment of Ordinal NFTs directly onto the Bitcoin blockchain has been controversial, with some claiming its goes against pseudonymous Bitcoin creator Satoshi Nakamoto’s original vision of the Bitcoin blockchain only being used for financial purposes. Whether you agree with the existence of Bitcoin-based NFTs or not, they are making a mark on the network.

So can Ordinals result in a wider uptick in network activity that benefits the Bitcoin price?

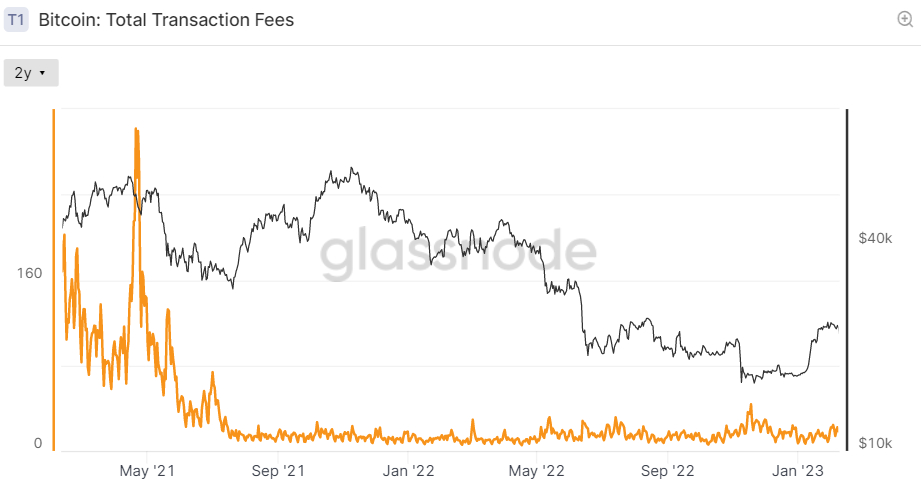

Bitcoin Network Fees Not Impacted Yet

Some analysts and commentators have expressed concerns that the existence of the Ordinal NFTs, which have resulted in numerous Bitcoin blocks hitting the 4MB limit, might put upwards pressure on network fees. However, according to Glassnode data, there has been no notable uptick in network fees as of yet.

Some have argued that if the Ordinal NFTs were to lead to a rise in the Bitcoin network fees, this could be good for miners, thus representing a long-term positive for the Bitcoin network’s security. However, given that fees have yet to pick up, Bitcoin miner revenue relative to its recent history remains supressed. Glassnode’s 4-year Z-Score of Miner Revenue from Fees remains close to its lows that it has remained stuck around since July 2021.

How the Ordinal NFTs Bitcoin Network Activity Might Impact the BTC Price

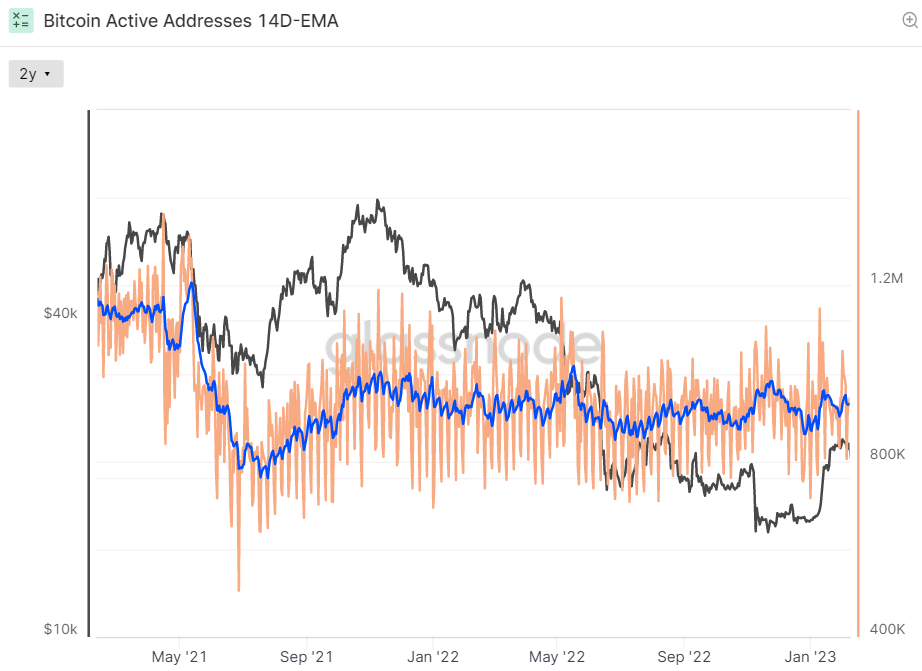

With the Ordinal NFTs having had minimal impact on network fees thus far, it can probably be assumed that the new, controversial protocol’s impact on the BTC price has so far been minimal. Meanwhile, though it has increased transaction traffic, Ordinals doesn’t seem to have had any impact on the number of unique daily users of the Bitcoin blockchain.

Glassnode’s 14-Day EMA of Active Addresses, which the firm defines as “the number of unique addresses that were either a sender or receiver that day”, was around 940,000 as of the 8th of February, close to the range that it has remained within for over a year and a half.

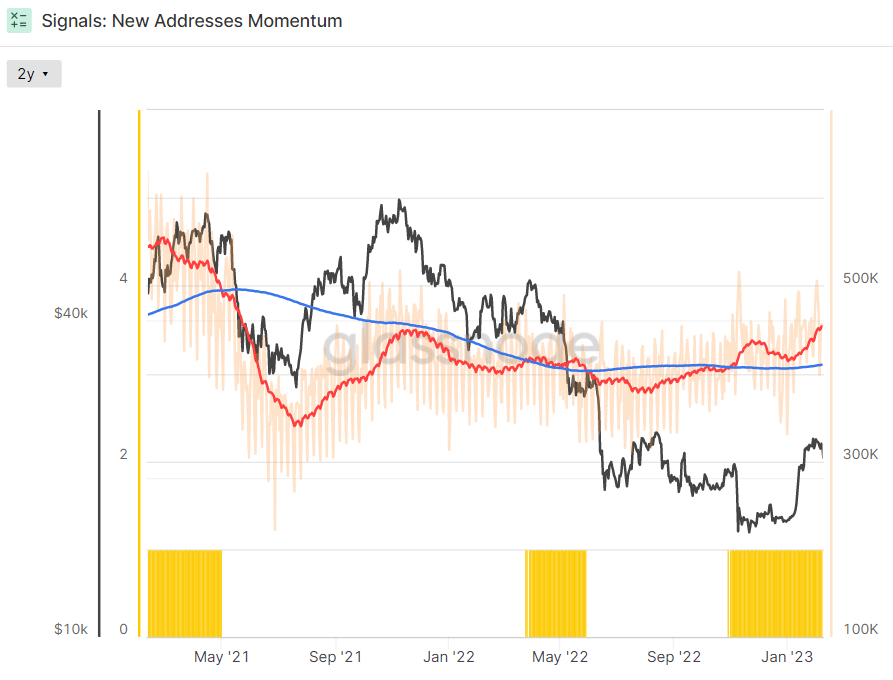

Another indicator of network activity tracked by analysts at Glassnode, New Addresses Momentum, has been sending positive signs as of late. But this positive trend began back in Q4 2022 when the collapse of FTX triggered a drop to fresh annual lows in the Bitcoin price, which 1) encouraged users to take custody of their crypto from exchanges for the first time (meaning lots of new wallet creation) and 2) attracted new users who wanted to buy the dip.

The 30-Day Simple Moving Average (SMA) of new addresses rose above the 365-Day SMA of new addresses in early November, and has been above it ever since.

So it seems as though the arrival of Bitcoin NFTs via the Ordinals protocol has yet to have enough of an impact on Bitcoin network activity and adoption to impact the cryptocurrency’s price. But this is a brand-new technology and its eventual impact on the Bitcoin network is yet to be seen. Bitcoin investors, regardless of their feelings towards Bitcoin-based NFTs, should watch this space.

[ad_2]

cryptonews.com