[ad_1]

Bitcoin (BTC) bull Michael Saylor’s big bet may be about to backfire for his company MicroStrategy, after the firm on Thursday reported a massive loss for the fourth quarter of last year.

The net loss for MicroStrategy for the fourth quarter ended up at $249.7m, with the number dragged down significantly by a $197.6m loss from the firm’s bitcoin investment strategy, the report revealed.

As of the end of the fourth quarter, MicroStrategy held approximately 132,500 BTC, worth some $1.840bn. The company has recorded a cumulative impairment loss on its BTC holding of $2.153bn since acquisition.

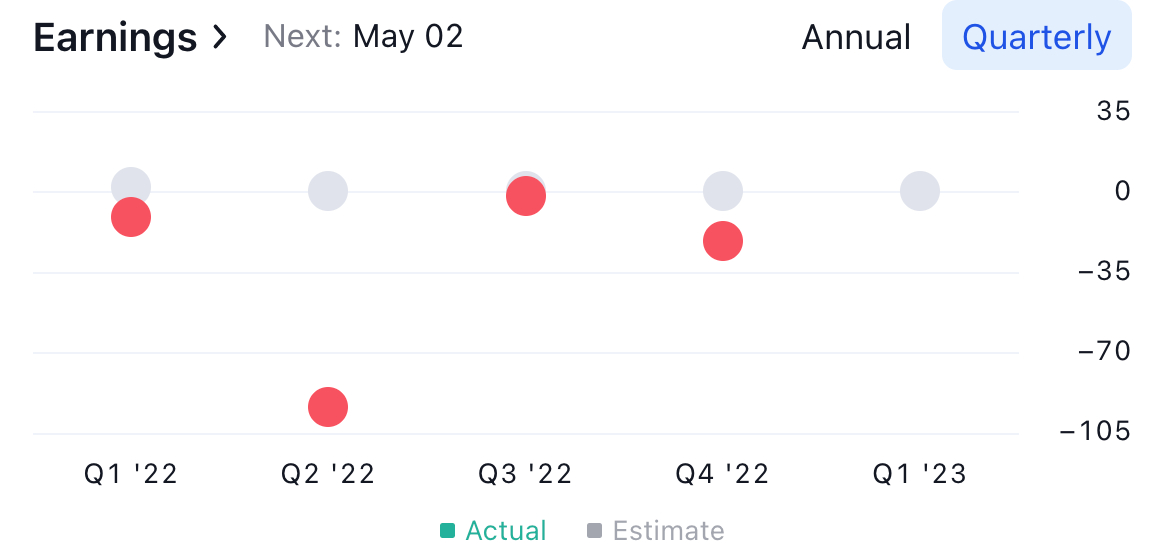

Eighth consecutive quarterly loss

Yesterday’s reported loss marks the eighth consecutive quarterly loss MicroStrategy has reported. Despite this, the company has remained steadfast in his faith in Bitcoin.

“Our corporate strategy and conviction in acquiring, holding, and growing our bitcoin position for the long term remains unchanged,” MicroStrategy’s chief financial officer Andrew Kang was quoted as saying in a press release sent out by the company.

Meanwhile, in an earnings call the same day, MicroStrategy founder and chairman Michael Saylor pointed to the increase in the company’s share price since the bitcoin strategy was announced in August of 2020.

“At that — on the day before, our stock was about $121 to $122 a share. Today, the stock closed at $292 a share. So, of course, we measure our success based upon the creation of shareholder value,” Saylor said.

Stock slipped after-hours

Shares of MicroStrategy, with the ticker MSTR, traded up by a respectable 9% to $292.13 on Thursday, but slipped in after-hours trading to $284 as the loss was reported. Since the beginning of 2022, the stock is now down some 46%.

Since MicroStrategy made its first bitcoin purchase on August 11 of 2020, bitcoin has approximately doubled in price, from around $11,500 to $23,000. The company continued to buy bitcoin throughout the entire 2020-2021 bull market, and has also refrained from selling during the subsequent bear market.

MicroStrategy made its most recent bitcoin purchase in late December last year, when it spent $42.8m to buy 2,395 BTC.

Bitcoin touched a low of $15,476 in November last year, but has since seen a significant recovery. At the time of writing, BTC traded at $23,530, up approximately 50% from the November low.

[ad_2]

cryptonews.com