[ad_1]

Circle, the US-based payments company that issues the stablecoin USD coin (USDC), alleged that major crypto exchange Binance did not fully back some of its own stablecoin proxies – and on Monday, blockchain infrastructure platform Paxos was ordered to cut its connection with Binance in regard to the Binance USD (BUSD) stablecoin.

Circle alerted the watchdog that it found some issues in blockchain data that allegedly showed that Binance did not store enough crypto in reserve to support the number of tokens it had issued, Bloomberg reported, citing a person familiar with the matter.

Then yesterday, the New York State Department of Financial Services (DFS) issued a statement saying that Paxos is under its supervision and that,

“DFS has ordered Paxos to cease minting Paxos-issued BUSD as a result of several unresolved issues related to Paxos’ oversight of its relationship with Binance in regard to Paxos-issued BUSD.”

It further said that the DFS authorized Paxos to issue BUSD on the Ethereum blockchain, but that,

“The Department has not authorized Binance-Peg BUSD on any blockchain, and Binance-Peg BUSD is not issued by Paxos. There is currently no restriction on the listing or exchange in New York of existing Paxos-issued BUSD by DFS-licensed entities.”

Per Bloomberg, citing an NYDFS spokesperson, Paxos was unable to operate BUSD “in a safe and sound manner,” and it “failed to address key deficiencies, requiring further Department action, ordering Paxos to cease minting Paxos-issued BUSD.”

Cutting the Binance line

Subsequently, on February 13, Paxos announced its plans to end its relationship with Binance for BUSD. On February 21, Paxos will stop issuing new BUSD tokens as “directed by and working in close coordination” with the NYDFS, it said. A Circle spokesperson declined to comment.

“Paxos Trust […] will continue to manage BUSD dollar reserves,” Paxos stated.

It added that BUSD would remain fully supported and redeemable to onboarded customers through at least February 2024, while Paxos customers will be able to redeem their funds in USD or convert BUSD to Pax Dollar (USDP).

The DFS said that it is closely monitoring Paxos to verify that the company can “facilitate redemptions in an orderly fashion.”

Last September, Binance started automatically converting USDC deposits on the exchange, among other stablecoins, into BUSD, which resulted in a decrease in Circle’s share of the stablecoin market.

Per a Binance spokesperson, the exchange will stop minting new Binance-peg BUSD due to the Paxos change, but will not change the above-mentioned auto-conversion policy. Binance-peg tokens, aka B-Tokens, have always been 100% backed, they stressed, adding that reserves were not always visible due to not being stored “in a single, dedicated wallet in real time.”

Following the Paxos announcement, Binance CEO Changpeng Zhao (CZ) also tweeted that “funds are SAFU”. The exchange will continue supporting BUSD for “the foreseeable future” and will make adjustments over time as necessary, such as potentially moving away from using BUSD as the main pair for trading, CZ said.

‘BUSD is not a security’

Meanwhile, according to another statement by Paxos issued on Monday, the US Securities and Exchange Commission (SEC) intends to sue Paxos, alleging that BUSD is unregistered security.

CZ argued that, should BUSD be ruled a security, the decision would “have profound impacts on how the crypto industry will develop” in these jurisdictions, and Paxos stated that,

“Paxos categorically disagrees with the SEC staff because BUSD is not a security under the federal securities laws. […] We will engage with the SEC staff on this issue and are prepared to vigorously litigate if necessary.”

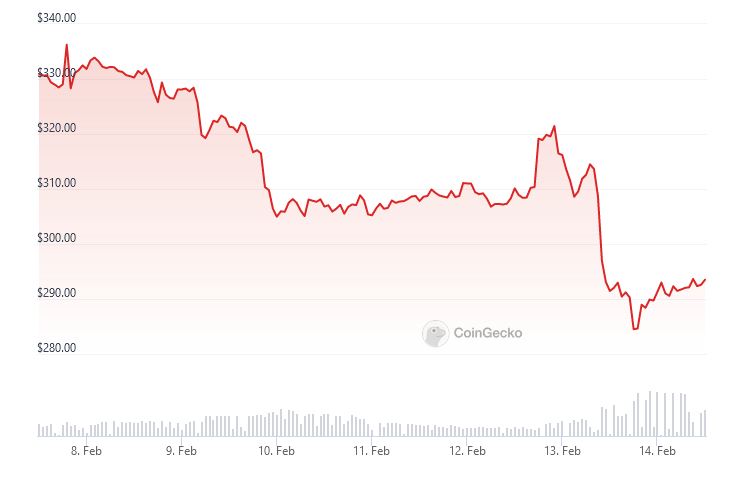

Following all this, Binance’s BNB coin dropped from $314 on Monday morning (UTC) to $284 on Monday evening. Since then, by Tuesday morning, it has recovered to nearly $294. Overall, it’s up 0.6% in a day and down 9.6% in a week.

BNB 7-day price chart:

Meanwhile, in late January, Binance admitted that it had kept collateral for some of the crypto assets it had issued in the same wallet as customer funds, claiming that it had happened by mistake. The report it issued at the time showed that reserves for nearly 50% of the B-Tokens, the 94 Binance-minted tokens, had been stored in a single wallet, with data suggesting that collateral was being mixed with customers’ funds instead of being stored separately.

“Binance is aware of this mistake and is in the process of transferring these assets to dedicated collateral wallets,” a spokesperson said at the time.

____

Learn more:

– Binance Stablecoin BUSD Loses $2 Billion in Market Cap in a Month – What’s Going On?

– Binance Banking Partner Restricts Crypto Transactions to $100,000 and Above – Here’s Why

– SEC Threatens Lawsuit Against Binance BUSD Stablecoin-Issuer Paxos – What’s Going On?

– Crypto Exchange Kraken in Hot Water with SEC Over Alleged Securities Violation – Here’s What You Need to Know

– Binance Shocks Crypto World with Temporary Halt on US Bank Transfers – Here’s What’s Going On

– Billionaire Mike Novogratz’s Surprising Reason for Endorsing Binance, Urges Success for CEO CZ – Here’s What You Need to Know

[ad_2]

cryptonews.com