[ad_1]

Seven out of eight key on-chain and technical indicators tracked by crypto analytics firm Glassnode’s “Recovering from a Bitcoin Bear” are now signaling that the next Bitcoin bull market might be here. Glassnode analysts utilize the dashboard to gauge whether Bitcoin might be in the process of transitioning from a bear market into a longer-term bull market.

The dashboard analyses whether Bitcoin is trading above key pricing models, whether or not network utilization momentum is increasing, whether market profitability is returning and whether the balance of USD-denominated Bitcoin wealth is in favor of the long-term HODLers.

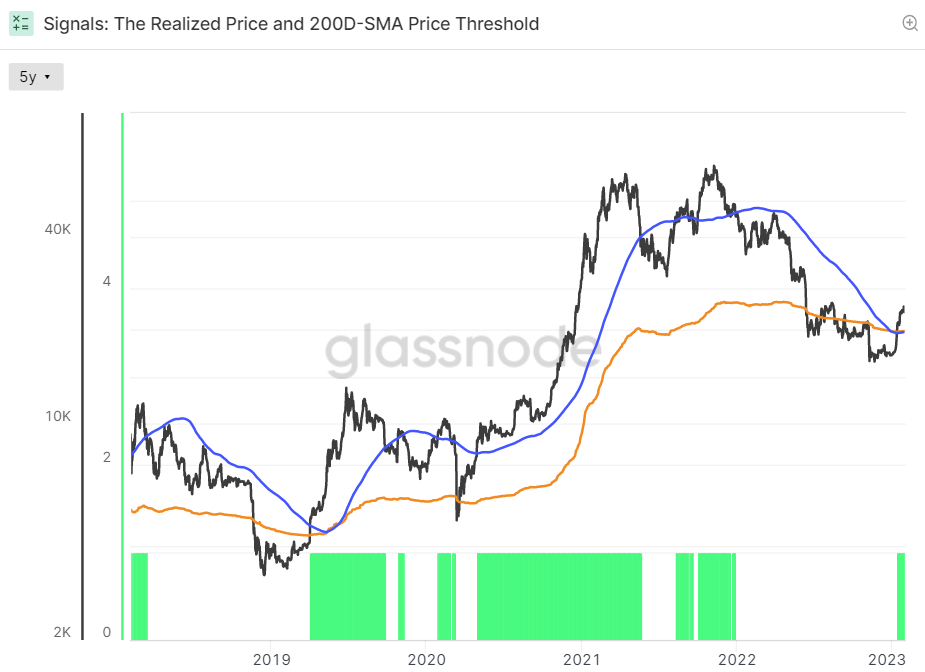

Signals 1 and 2 – Bitcoin Above its 200DMA and Realized Price

Bitcoin’s recent rally has seen it break to the north of its 200-Day Simple Moving Average (SMA) and Realized Price, the average price at the time when each Bitcoin last moved. Both are viewed as technical levels with key long-term significance. A break above them is viewed by many as an indicator that near-term price momentum is shifting in a positive direction.

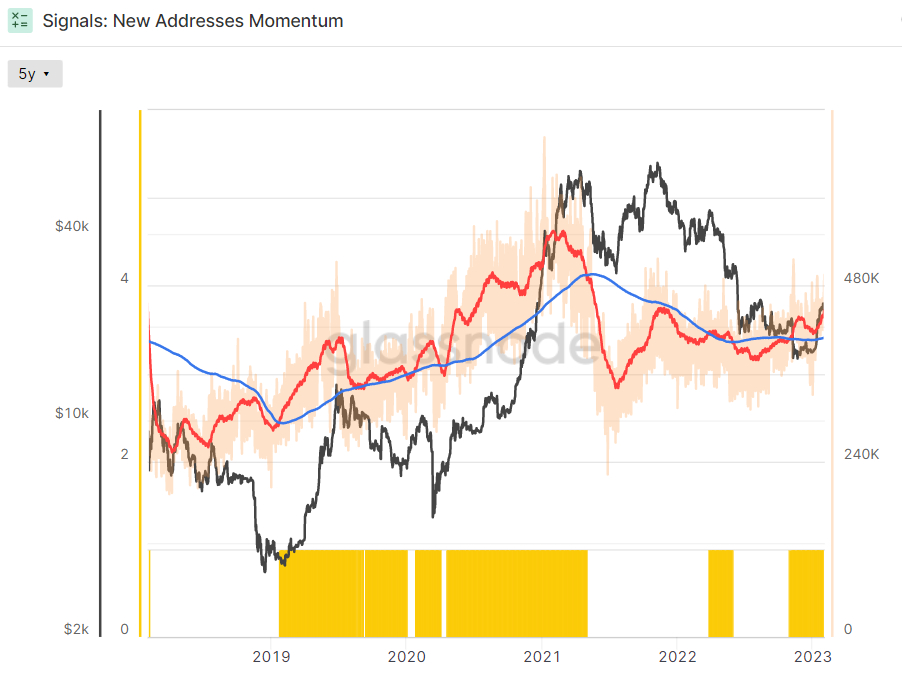

Signal 3 and 4 – New Address and Fee Revenue Momentum Are Positive

The 30-Day SMA of new Bitcoin address creation moved above its 365-Day SMA a few weeks ago, a sign that the rate at which new Bitcoin wallets are being created is accelerating. This has historically occurred at the start of bull markets.

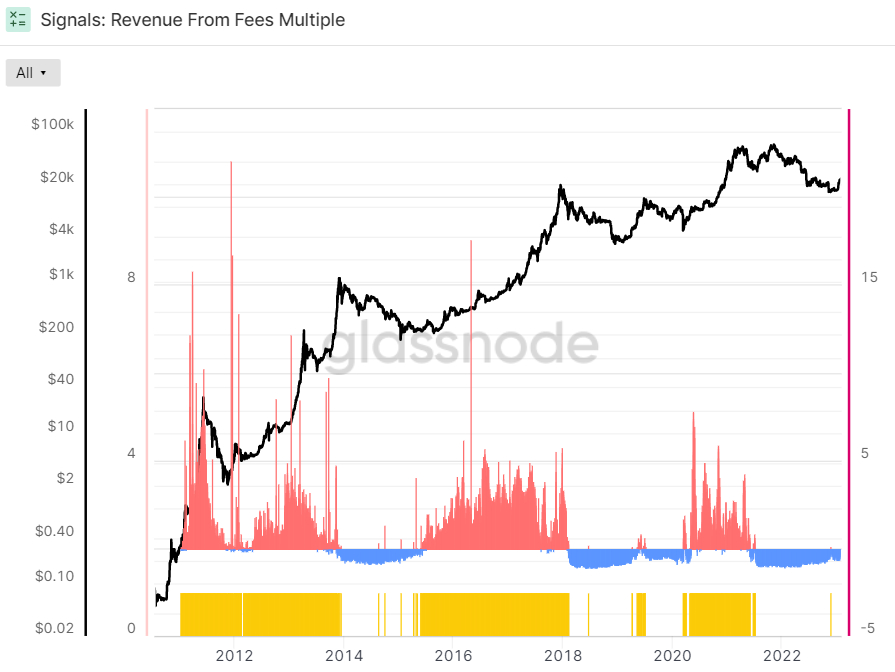

However, the Revenue From Fees Multiple still has a negative 2-year Z-score of around -0.33. The Z-score is the number of standard deviations above or below the mean of a data sample. In this instance, Glassnode’s Z-score is the number of standard deviations above or below the mean Bitcoin Fee Revenue of the last 2-years.

This is the only of Glassnode’s eight dashboard indicators that isn’t yet flashing a buy signal. However, as history shows, this can change very quickly.

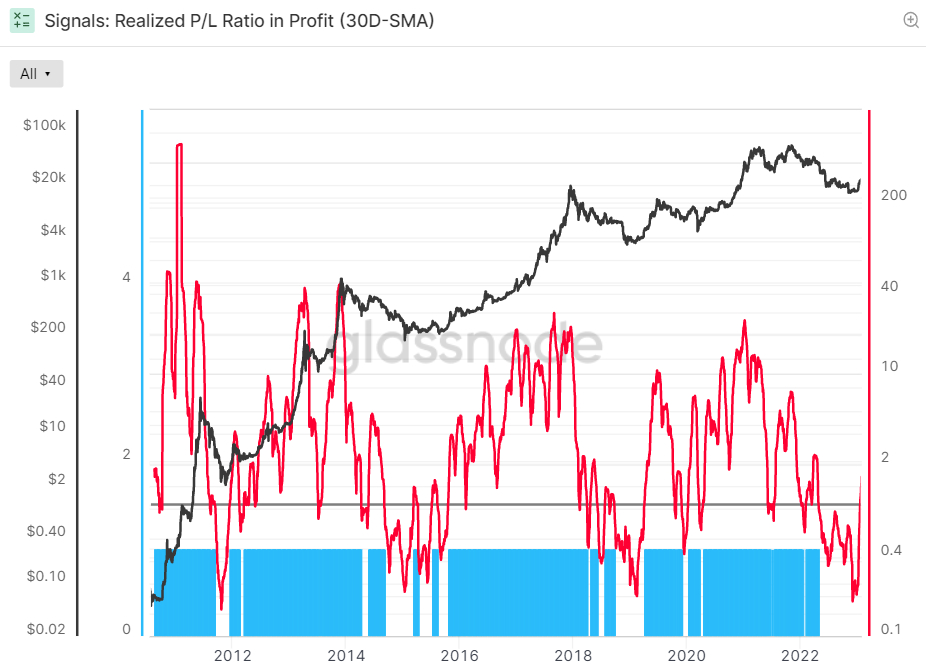

Signals 5 and 6: Market Profitability is Returning

The 30-Day Simple Moving Average (SMA) of the Bitcoin Realized Profit-Loss Ratio (RPLR) indicator recently moved above one for the first time last April. That means that the Bitcoin market is realizing a greater proportion of profits (denominated in USD) than losses.

According to Glassnode, “this generally signifies that sellers with unrealized losses have been exhausted, and a healthier inflow of demand exists to absorb profit taking”. Hence, this indicator is sending a bullish sign.

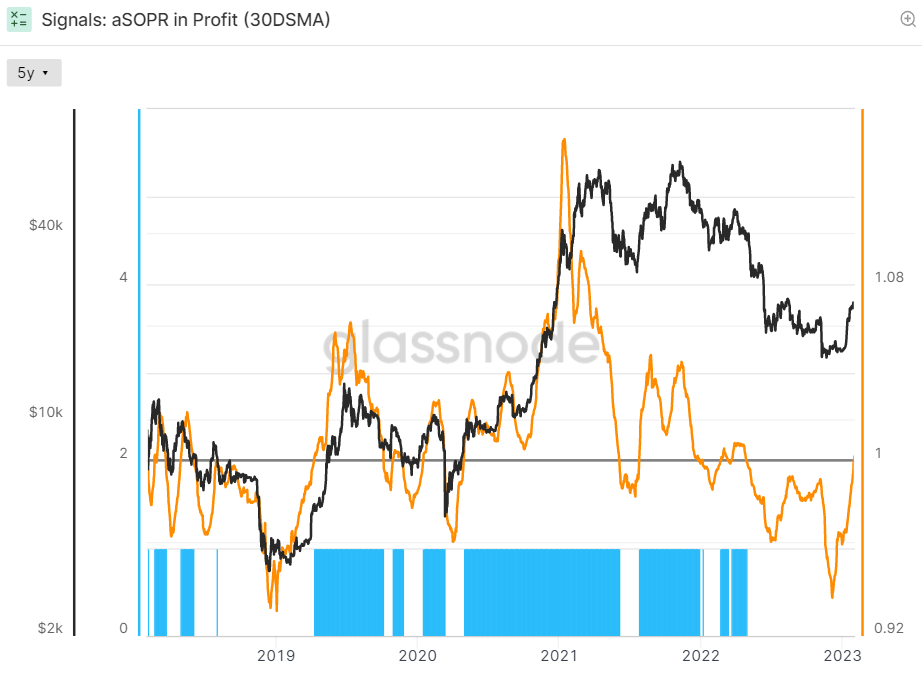

Meanwhile, though the Adjusted Spent Output Profit Ration (aSOPR), an indicator that reflects the degree of realized profit and loss for all coins moved on-chain, recently surpassed 1, indicating the market is in profit. Looking back over the last eight years of Bitcoin history, the aSOPR rising above 1 after a prolonged spell below it has been a fantastic buy signal.

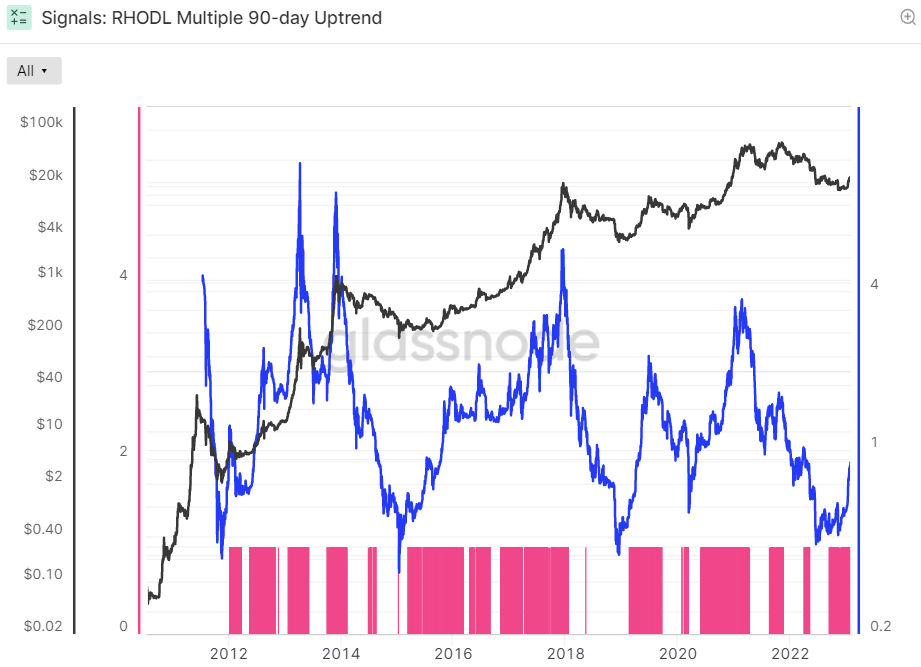

Signals 7 and 8: BTC Balance Has Moved In Favor of The HODLers

The Bitcoin Realized HODL Multiple has been in an uptrend over the last 90 days, a bullish sign according to Glassnode. The crypto analytics firm states that “when the RHODL Multiple transitions into an uptrend over a 90-day window, it indicates that USD-denominated wealth is starting to shift back towards new demand inflows”. It “indicates profits are being taken, the market is capable of absorbing them… (and) that longer-term holders are starting to spend coins” Glassnode states.

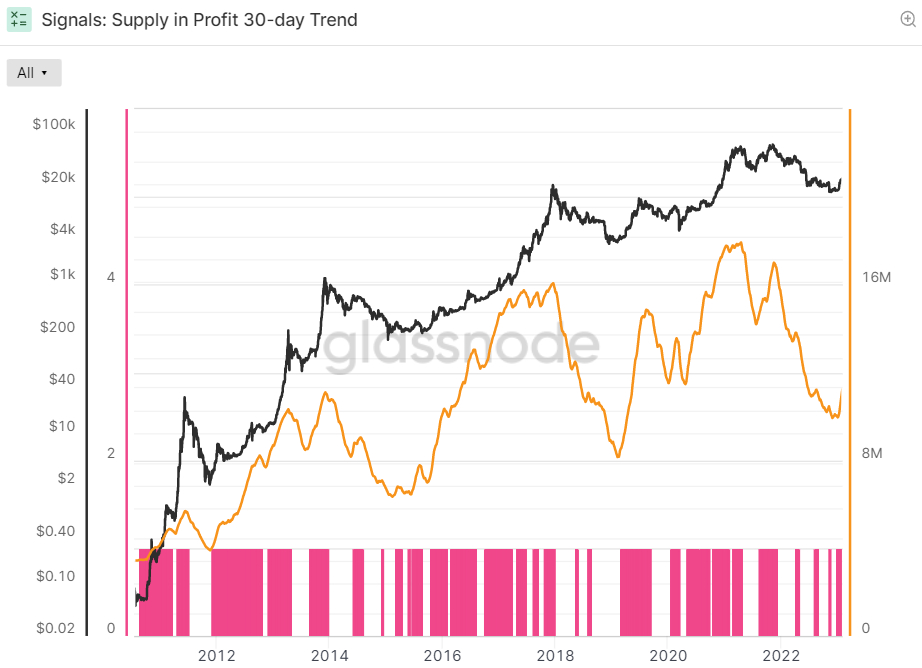

Glassnode’s final indicator in its Recovering from a Bitcoin Bear dashboard is whether or not the 90-day Exponential Moving Average (EMA) of Bitcoin Supply in Profit has been in an uptrend over the last 30 days or not. Supply in Profit is the number of Bitcoins that last moved when USD-denominated prices were lower than they are right now, implying they were bought for a lower price and the wallet is holding onto a paper profit. This indicator is also flashing green.

Where Next for BTC If the Bull Market Really is Here?

Bitcoin shorts have been getting obliterated in 2023 and there is a growing sense that, given expectations for an easing of monetary tightening from the US Federal Reserve in 2023, this year is going to be a much friendlier one for crypto than 2022. Indeed, Bitcoin surpassed $24,000 briefly on Thursday for the first time since August, amid ongoing tailwinds from Wednesday’s not as hawkish as feared Fed policy meeting. Its gains on the year currently stand north of 40%.

There are those who argue that the increasing likelihood of a US recession later this year may weigh on Bitcoin. But historically, the world’s largest cryptocurrency by market capitalization has responded more to changes in financial conditions rather than in the performance of the broader economy – and a US recession would only encourage a faster easing of financial conditions, as markets bet on Fed rate cuts.

Given the above-noted on-chain and technical metrics, there is a growing sense that this latest rally isn’t just a “bear trap”, but the start of a longer-lasting recovery. Analysis of Bitcoin’s historic market cycles suggests a similar story.

Assuming that Bitcoin is thus destined to continue gaining ground in the next few weeks, the next key area of resistance to watch is around $25,500. A break above here would open the door to a swift move higher towards the 23.6% Fibonacci retracement level back from Bitcoin’s 2022 low around $15,500 to its 2021 record high around $69,000, and then on to the $30,000 level.

[ad_2]

cryptonews.com