[ad_1]

Shiba Inu (SHIB) is on a make-or-break collision course with the 200-Day MA. Will SHIB burst or bounce ahead of the Shibarium launch?

Markets are on edge as Shiba Inu (SHIB) begins a make-or-break test of steadfast 200-day MA. Could the launch of Shibarium save SHIB’s fledging rally?

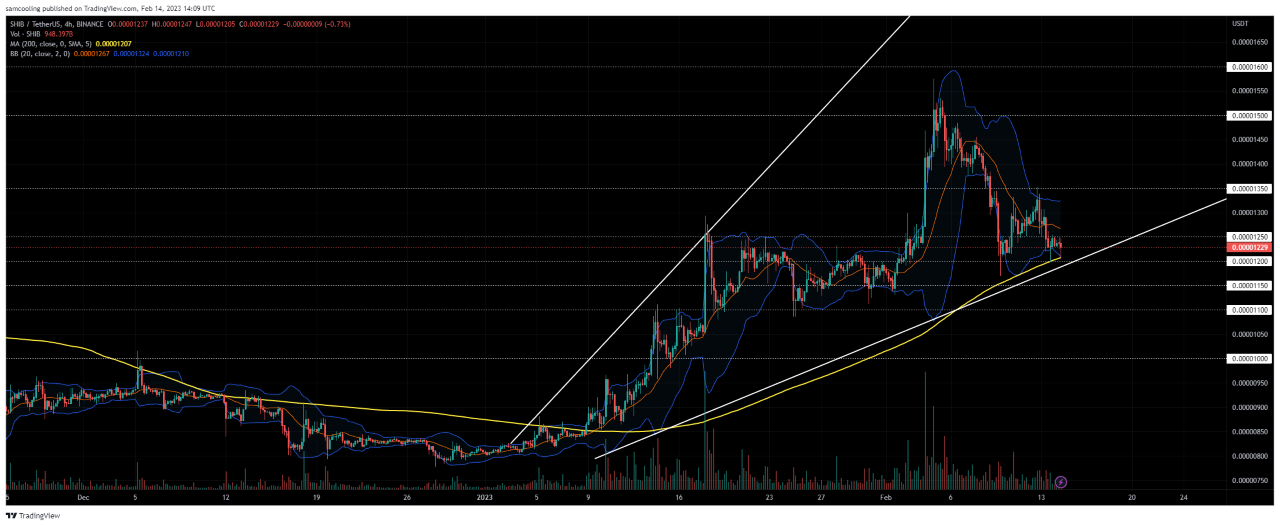

Yesterday’s analysis focused on the critical collision course between price levels and the rising 200-day MA. This follows a retracement pattern predicted last week following rejection at $0.00001500.

I can confirm the vital test of the 200-day MA is currently taking place. A bounce here could see Shibarium drive SHIB to new heights. With bull confidence boosted by the highly anticipated burn mechanism.

This is now the ninth day of localized retracement, with prices currently trading astride the 200-day MA at $0.00001220.

That marks a daily change of -2.17% as bulls continue to fight for support around $0.00001250.

Attempted consolidation at this level over the weekend has found legs from the rising 200-day MA – highlighting the importance of this test.

Price levels are still sat above more obvious local support at $0.00001150 – $0.00001200.

Shiba Inu (SHIB) On-Chain: Could Shiba Inu sell pressure be over?

Price action remains poised as traders sit waiting for a decisive signal from the make-or-break test.

Looking at SHIB’s indicators signals are more clouded today.

The RSI 14 shows increasing bullish divergence at 38.5 – as SHIB continues to move into oversold territory. Notably, the RSI hasn’t topped out since February 4 – marking a 9-day cooldown on the RSI.

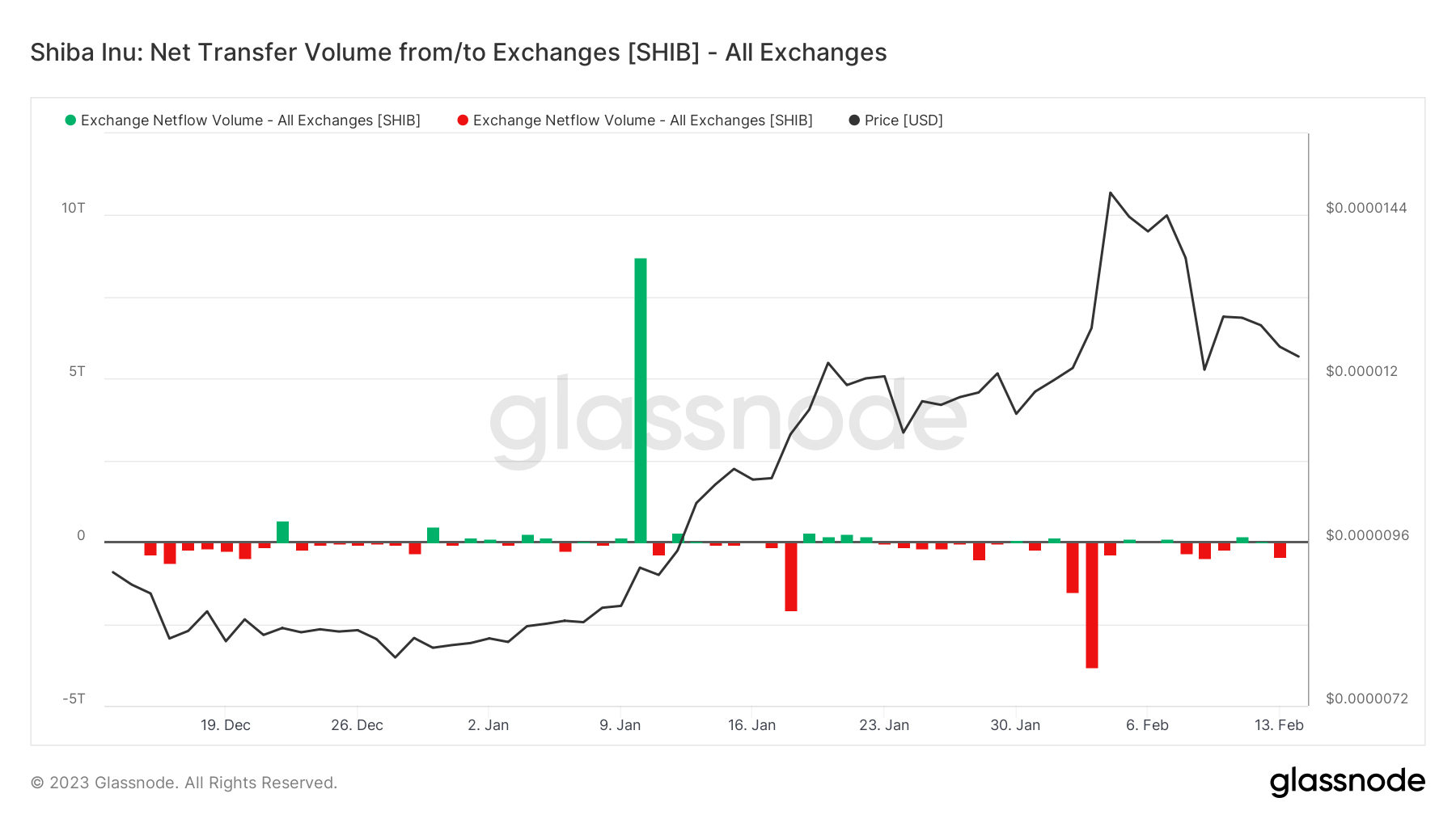

This paints an interesting on-chain picture – illuminating the flow of SHIB off exchanges.

Net Transfer Volume has steadily decreased throughout February.

This follows a huge spike on January 9, which saw coins rushing onto exchanges ready to sell as prices rose. The sell-off likely occurred in the last week of January when prices met resistance at $0.00001500.

Most likely this was profit taking by long-term holders after a difficult crypto winter. Suggesting the worst of ongoing sell-pressure has passed – meaning a bounce off the 200 Day MA could see skyrocket velocity upwards.

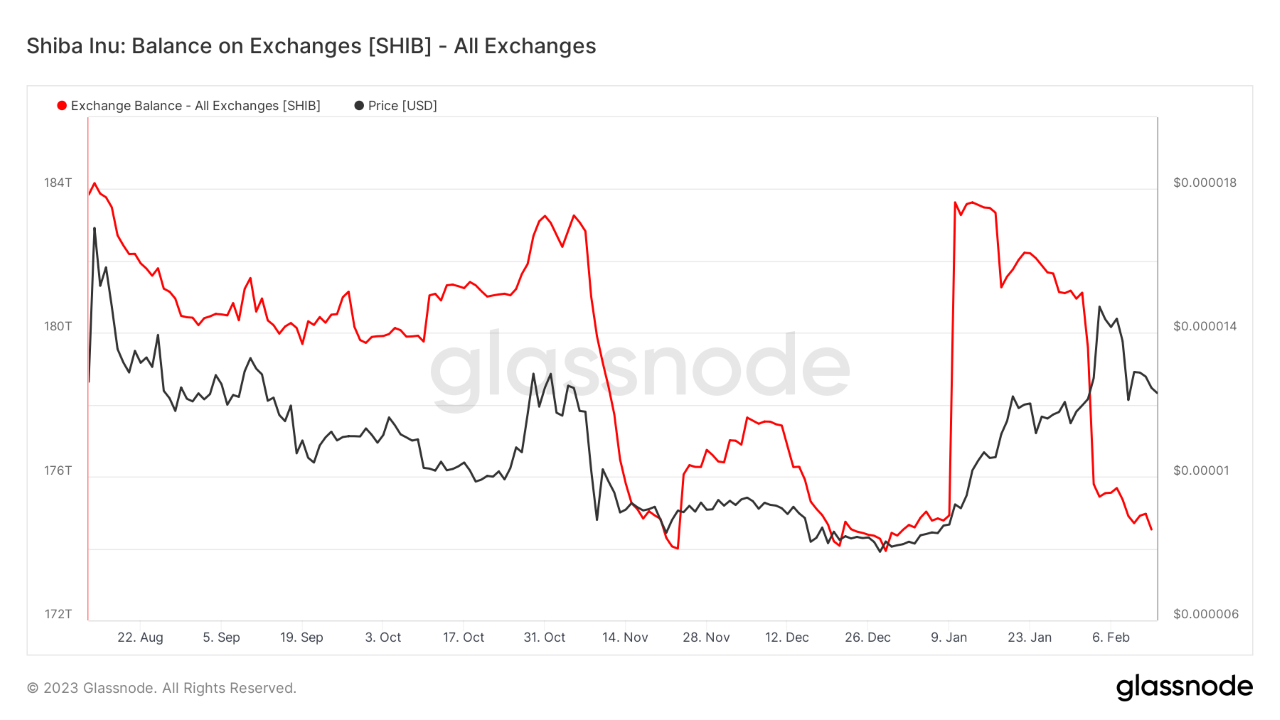

Bullish on-chain sentiment is reinforce when we look at Balance on Exchanges. February has seen a -5.4% reduction in on-exchange balances of SHIB.

This signals that supply is being accumulated and removed from exchanges, likely ahead of the Shibarium launch this week.

A glance at the MACD shows -0.00000002 – the most mild bearish divergence. This is negligible, and reflects the support test astride the 200-Day MA.

How high could Shiba Inu (SHIB) go?

Our current upside potential is a conservative $0.00001500 (+22.25%). Upside potential seems poised to go beyond this level if prices do bounce. This is because of reduced sell-pressure on exchanges and the Shibarium news.

The downside risk of breakdown here is limited, with likely drops to previous support at $0.00001150 (-6.28%).

SHIB’s current Risk: Reward ratio is 3.55 – a very attractive entry – characterized by limited downside risk.

But why is Shiba Inu (SHIB) rallying?

In yesterday’s Shiba Inu price analysis, it was highlighted that Shiba Inu’s burnrate has surged 1,000% in hours.

The huge uptick in burn rate has led some analysts to suggest there is a big comeback in the market inbound.

With deflationary pressure only set to increase with the launch of Shibarium (tipped to launch this week) – things could be on the up soon. Shibarium will result in billions of extra SHIB burned, increasing the scarcity of supply, and theoretically driving price up.

Buy Shiba Inu (SHIB) Now

What is happening with the CPI today?

Check out in-house crypto journalist James Bury’s analysis of today’s CPI figures and what it could mean for your portfolio.

Buy Shiba Inu (SHIB) Now

Shiba Inu (SHIB) Alternative

While SHIB may not rally massively in the near future, there other high-potential crypto projects that are worth investing in alongside SHIB. Accordingly, we’ve reviewed the top 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

[ad_2]

cryptonews.com