[ad_1]

The international payment system Swift has reported positive results from a pilot test of transfers between different central bank digital currencies (CBDCs), saying they see “clear potential and value” in it.

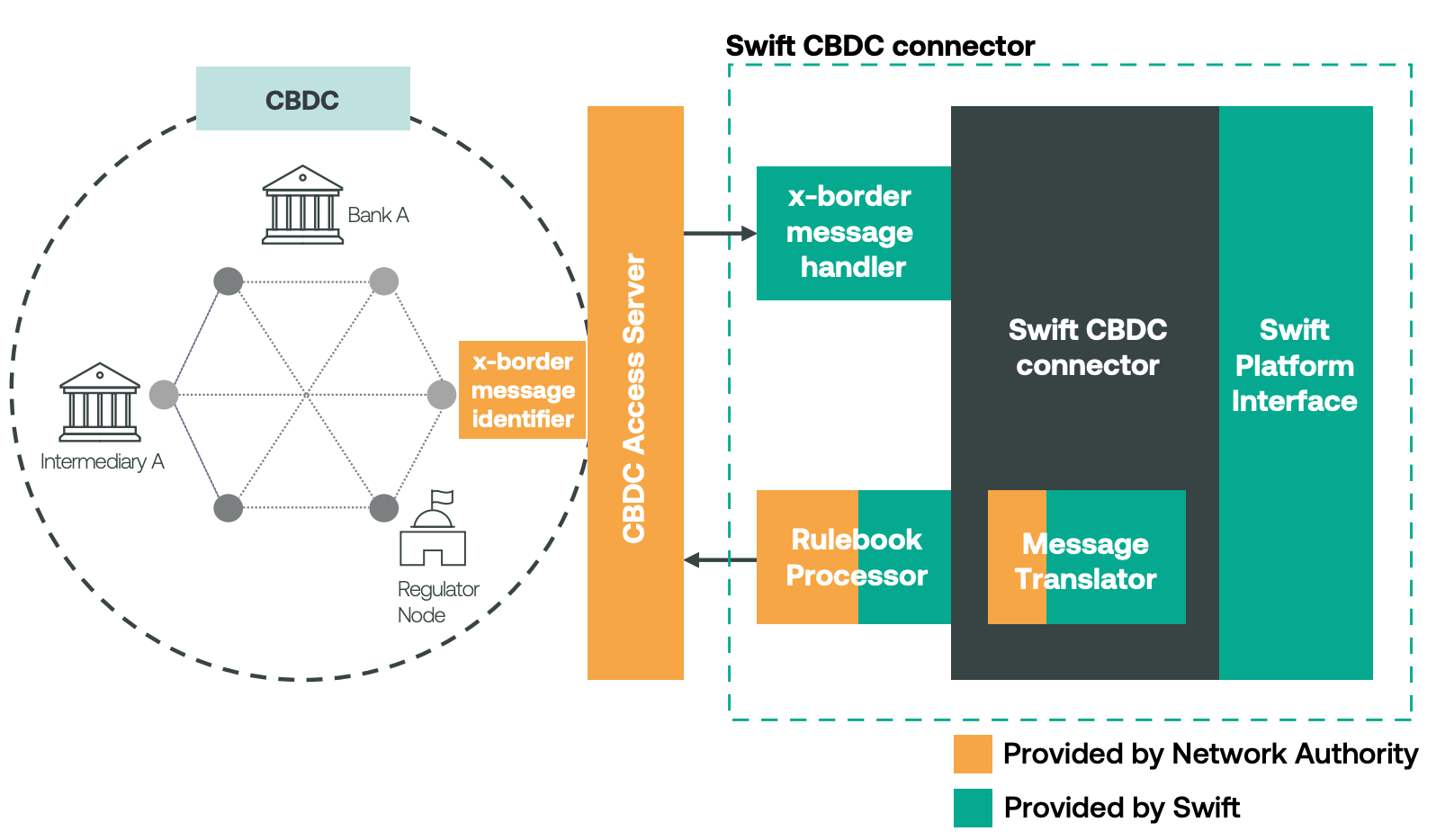

The pilot test specifically looked at how different CBDCs can interoperate through an API-based CBDC connector, using two different blockchain networks and existing fiat-based payment systems.

According to a press release issued by Swift, all participants in the pilot expressed “strong support” for the continued development of the solution. The participants also agreed that the CBDC connector used in the simulations enabled “seamless exchange of CBDCs,” and said this was also true for transfers between CBDCs built on different platforms.

The latter is seen as key, given the risk of fragmentation as central banks around the world all build their own CBDCs.

Following the conclusion of the pilot test, Swift will now develop a beta version of the system for further testing by central banks. After that, a second phase of sandbox testing will be held for participants to explore new use cases, including in securities settlement, trade finance, and conditional payments, Swift said in the press release.

5,000 simulated transactions

18 central and commercial banks participated in the study, which covered 5,000 simulated transactions carried out over a 12-week period. Among the participating banks were large international players like HSBC, Standard Chartered, and NatWest, as well as central banks like the Deutsche Bundesbank and the Monetary Authority of Singapore.

In a comment, Tom Zschach, Swift’s Chief Innovation Officer, said the study has shown that Swift can continue to play a critical role in a financial ecosystem where traditional currencies and CBDCs co-exist.

“Our API-based CBDC connector has been proven to be robust across almost 5,000 transactions between two different blockchain networks and traditional fiat currency, and we’re delighted to have the support of our community in developing it further,” he said.

BIS also reports successful CBDC test

The results of Swift’s study come just days after the Bank for International Settlements (BIS), sometimes called ‘the central bank of central banks’, released the results of its own pilot study for the use of CBDCs in cross-border transactions.

According to the BIS study, it is possible for central banks to have “almost full autonomy” over the design of their own CBDC, while still making the CBDC interoperable with other countries’ CBDCs for cross-border transactions.

[ad_2]

cryptonews.com