[ad_1]

Tezos (XTZ), the cryptocurrency that powers the Tezos layer-1 blockchain protocol, has pumped over 11% on Monday.

XTZ was last trading around $0.72 per token, having rallied as high as $0.746 earlier in the session to test its 100-day Moving Average, after enjoying a strong bounce from support in the mid-$0.60s on Sunday.

Tezos markets itself as a blockchain that is designed to address key barriers facing the adoption of blockchains for the trading of assets and use of decentralized applications.

There doesn’t appear to have been any one fundamental catalyst behind Monday’s upside.

Rather, technicals could explain the move.

XTZ appeared to break an important trendline dating all the way back to late 2021 on Monday, which could have potentially triggered some technical buying.

When an asset breaks out of a long-standing downtrend like this, its often a sign its long bear market has come to an end, although it doesn’t necessarily mean the start of an aggressive new bull market.

Price Prediction – Where Next For Tezos (XTZ)?

Before the bulls declare victory and that XTZ has found a near-term bottom, XTZ needs to also break above its 100DMA and clear the way for a retest of its 200DMA at $0.85.

A break above the 200DMA would then be required for the bulls to really become confident that the bear market is over.

If XTZ can achieve this, a quick retest of the psychologically important $1 level could be on the cards, which would mark a rally of around 40% from current levels.

However, bulls should remain cautious, as near-term upside is far from a guarantee.

Firstly, macro headwinds remain strong – markets were gripped by risk-off on Monday thanks to geopolitical concerns amid the escalating Israel/Palestine conflict, but the main headwind is that the US economy continues to outperform expectations, pushing back the potential date for the start of a US interest rate cutting cycle.

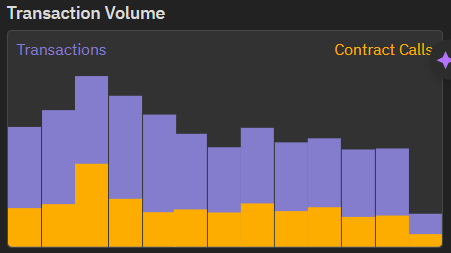

Secondly, the Tezos blockchain doesn’t appear to be thriving – its trade value locked (TVL) in smart contracts has stagnated now for months, as per DeFi Llama, and its monthly transaction numbers continue to deteriorate, as per TZStats.

Tezos (XTZ) Alternatives to Consider

XTZ could well pump in the near future, but its outlook is marred by downside risks.

For those looking for a better probability of near-term gains, an alternative high-risk-high-reward investment strategy to consider is getting involved in crypto presales.

This is where investors buy the tokens of up-start crypto projects to help fund their development.

These tokens are nearly always sold cheaply, and there is a long history of presales delivering huge exponential gains to early investors.

Many of these projects have fantastic teams behind them and a great vision to deliver a revolutionary crypto application/platform.

If an investor can identify such projects, the risk/reward of their presale investment is very good.

The team at Cryptonews spends a lot of time combing through presale projects to help investors out.

Here is a list of 15 of what the project deems as the best crypto presales of 2023.

See the 15 Cryptocurrencies

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

[ad_2]

cryptonews.com